GE 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MD&A FINANCIAL RESOURCES AND LIQUIDITY

GE 2015 FORM 10-K 83

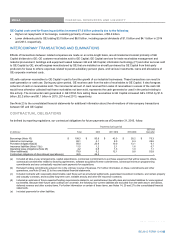

The most significant source of cash in GE CFOA is customer-related activities, the largest of which is collecting cash resulting from

product or services sales. See the Intercompany Transactions and Eliminations section for information related to transactions between

GE and GE Capital. The most significant operating use of cash is to pay our suppliers, employees, tax authorities and others for a wide

range of material and services. Dividends from GE Capital represent the distribution of a portion of GE Capital retained earnings, and

are distinct from cash from continuing operations within the GE Capital businesses.

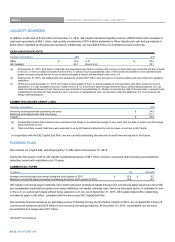

2015±2014 COMMENTARY

GE cash from operating activities increased $1.2 billion primarily due to the following:

x A decrease of operating cash collections of $0.4 billion to $109.3 billion in 2015, primarily due to lower GE segment revenues from

sales of goods and services.

x A decrease of operating cash payments of $0.3 billion to $97.2 billion in 2015, primarily driven by decreased inventory spend.

x Further, GE Capital paid dividends totaling $4.3 billion and $3.0 billion to GE in 2015 and 2014, respectively.

GE cash used for investing activities increased $6.9 billion primarily due to the following:

x Higher business acquisition activity of $8.3 billion is primarily driven by the 2015 acquisition of Alstom of $10.1 billion. This is

partially offset by the 2014 acquisitions of certain Thermo Fisher Scientific Inc. life-VFLHQFHEXVLQHVVHVIRUELOOLRQ&DPHURQ¶V

Reciprocating Compression Division for $0.6 billion and API Healthcare (API) for $0.3 billion.

x This is partially offset by $1.1 billion higher proceeds from principal business dispositions and $0.3 billion higher proceeds from

dispositions of property, plant and equipment.

GE cash used for financing activities increased $1.5 billion primarily due to the following:

x The 2015 repayment of $2.0 billion of GE unsecured notes. This is partially offset by the 2015 issuance of unsecured notes of $3.4

billion compared with $3.0 billion in 2014.

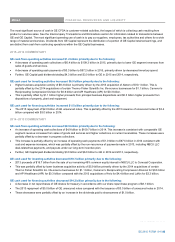

2014±2013 COMMENTARY

GE cash from operating activities increased $0.9 billion primarily due to the following:

x An increase of operating cash collections of $4.9 billion to $109.7 billion in 2014. This increase is consistent with comparable GE

segment revenue increases from sales of goods and services and higher collections on current receivables. These increases were

partially offset by a decrease in progress collections.

x This increase is partially offset by an increase of operating cash payments of $1.0 billion to $97.5 billion in 2014 consistent with

cost and expense increases, which was partially offset by the non-recurrence of payments made in 2013, including NBCU LLC

deal-related tax payments, and payouts under our long-term incentive plan.

x Further, GE Capital paid dividends totaling $3.0 billion and $6.0 billion to GE in 2014 and 2013, respectively.

GE cash used for investing activities decreased $10.7 billion primarily due to the following:

x 2013 proceeds of $16.7 billion from the sale of our remaining 49% common equity interest in NBCU LLC to Comcast Corporation.

x This was partially offset by lower business acquisition activity of $5.9 billion primarily driven by the 2014 acquisitions of certain

Thermo Fisher Scientific Inc. life-VFLHQFHEXVLQHVVHVIRUELOOLRQ&DPHURQ¶V5HFLSURFDWLQJ&RPSUHVVLRQ'LYLVLRQIRUELOOLRQ

and API Healthcare (API) for $0.3 billion compared with the 2013 acquisitions of Avio for $4.4 billion and Lufkin for $3.3 billion.

GE cash used for financing activities decreased $14.2 billion primarily due to the following:

x A decrease in net repurchases of GE shares for treasury in accordance with our share repurchase program of $8.1 billion.

x The 2013 repayment of $5.0 billion of GE unsecured notes compared with the issuance of $3.0 billion of unsecured notes in 2014.

x These decreases were partially offset by an increase in the dividends paid to shareowners of $1.0 billion.

GE 2015 FORM 10-K 83