GE 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MD&A CRITICAL ACCOUNTING ESTIMATES

90 GE 2015 FORM 10-K

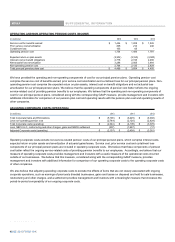

To determine the expected long-term rate of return on pension plan assets, we consider current and target asset allocations, as well as

historical and expected returns on various categories of plan assets. In developing future long-term return expectations for our principal

EHQHILWSODQV¶DVVHWVZHIRUPXODWHYLHZVRQWKHIXWXUHHFRQRPLFHQYLURQPHQWERWKLQWKH86DQGDEURDG We evaluate general

market trends and historical relationships among a number of key variables that impact asset class returns such as expected earnings

growth, inflation, valuations, yields and spreads, using both internal and external sources. We also take into account expected volatility

by asset class and diversification across classes to determine expected overall portfolio results given current and target allocations.

Assets in our principal pension plans earned 0.6% in 2015, and had average annual returns of 6.4%, 5.0%, and 8.5% per year in the 5-,

10- and 25-year periods ended December 31, 2015, respectively. The average historical 10- and 25- year returns were significantly

affected by investment losses in 2008. Based on our analysis of future expectations of asset performance, past return results, and our

current and target asset allocations, we have assumed a 7.5% long-term expected return on those assets for cost recognition in 2016

compared to 7.5% in 2015 and 2014 and 8.0% in 2013.

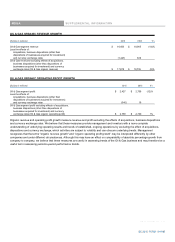

Changes in key assumptions for our principal pension plans would have the following effects.

x Discount rate ± A 25 basis point increase in discount rate would decrease pension cost in the following year by $0.2 billion and

would decrease the pension benefit obligation at year-end by about $2.2 billion.

x Expected return on assets ± A 50 basis point decrease in the expected return on assets would increase pension cost in the

following year by $0.2 billion.

Further information on our pension plans is provided in the Other Consolidated Information ± Postretirement Benefit Plans section

within the MD&A and in Note 12 and 27 to the consolidated financial statements.

INCOME TAXES

Our annual tax rate is based on our income, statutory tax rates and tax planning opportunities available to us in the various jurisdictions

in which we operate. Tax laws are complex and subject to different interpretations by the taxpayer and respective governmental taxing

authorities. Significant judgment is required in determining our tax expense and in evaluating our tax positions, including evaluating

uncertainties. We review our tax positions quarterly and adjust the balances as new information becomes available. Our income tax

rate is significantly affected by the tax rate on our global operations. In addition to local country tax laws and regulations, this rate

depends on the extent earnings are indefinitely reinvested outside the United States. Indefinite reinvestment is determined by

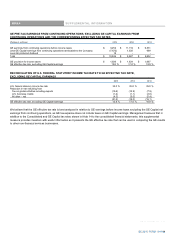

PDQDJHPHQW¶VMXGJPHQWDERXWDQGLQWHQWLRQVFRQFHUQLQJWKHfuture operations of the Company. At December 31, 2015 and 2014,

approximately $104 billion and $119 billion of earnings, respectively, have been indefinitely reinvested outside the United States. Most

of these earnings have been reinvested in active non-U.S. business operations, and we do not intend to repatriate these earnings to

fund U.S. operations. Because of the availability of U.S. foreign tax credits, it is not practicable to determine the U.S. federal income tax

liability that would be payable if such earnings were not reinvested indefinitely.

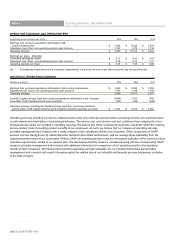

Deferred income tax assets represent amounts available to reduce income taxes payable on taxable income in future years. Such

assets arise because of temporary differences between the financial reporting and tax bases of assets and liabilities, as well as from

net operating loss and tax credit carryforwards. We evaluate the recoverability of these future tax deductions and credits by assessing

the adequacy of future expected taxable income from all sources, including reversal of taxable temporary differences, forecasted

operating earnings and available tax planning strategies. These sources of income rely heavily on estimates. We use our historical

experience and our short- and long-range business forecasts to provide insight. Further, our global and diversified business portfolio

gives us the opportunity to employ various prudent and feasible tax planning strategies to facilitate the recoverability of future

deductions. Amounts recorded for deferred tax assets related to non-U.S. net operating losses, net of valuation allowances, were $5.1

billion and $5.5 billion at December 31, 2015 and 2014, including $0.8 billion and $1.7 billion at December 31, 2015 and 2014,

respectively, of deferred tax assets, net of valuation allowances, associated with losses reported in discontinued operations, primarily

related to our Real Estate and Consumer businesses and our loss on the sale of GE Money Japan. Such year-end 2015 amounts are

expected to be fully recoverable within the applicable statutory expiration periods. To the extent we do not consider it more likely than

not that a deferred tax asset will be recovered, a valuation allowance is established.

Further information on income taxes is provided in the Other Consolidated Information ± Income Taxes section within the MD&A and in

Note 14 to the consolidated financial statements.

90 GE 2015 FORM 10-K