GE 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

How We Are Performing

Revenues Earnings from

Continuing Operations

Attributable to GE

Common Shareowners

Industrial Operating +

Verticals Earnings1

Industrial Operating

Profit Margins1, 3

GE CFOA

Backlog

Segment Gross

Margins2

Consolidated

Industrial

1. Non-GAAP Financial Measure. See Financial Measures That

Supplement U.S. Generally Accepted Accounting Principles (Non-GAAP

Financial Measures) on page 95.

2. Excluding Alstom.

3. Including Corporate, excluding Alstom, restructuring and other & gains.

$249B $266B $315B

$14.3B $15.2B $16.4B

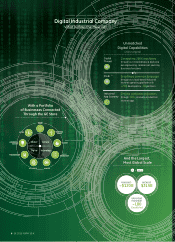

Connected Multi-Business Portfolio

as a Competitive Advantage

Great infrastructure

businesses built upon

technical & market

leadership critical scale

to take advantage of global

demographic trends

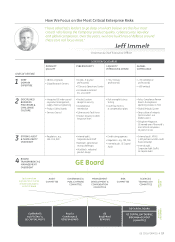

Year Event

Businesses

Impacted

Businesses

Mitigating

Impact

GE

Response Outcome

2001 9/11

attacks

Invested

in next-gen

aircraft

engines

GE 90, GEnx,

next-gen CFM

2004 U.S. gas

turbine cycle

bottom

Most other

businesses saw

double-digit

growth

Invested

to diversify

energy

businesses

Stronger, more

diversified

energy

businesses

2009 Financial

crisis

Industrial

businesses

generated ~$17B

of cash flow

(as originally

reported)

Supported

GE Capital with

cash infusions

Smaller GE

Capital that

is stronger &

more focused

2015 Oil price

drop

Restructured

Oil & Gas and

acquired Alstom

energy businesses

at attractive price

Diversity provides

strength through

disruptive events &

commodity cycles

Each business contributes

to GE by providing unique

expertise to the GE Store &

leverages the GE Store to

compete more effectively

Financing infrastructure investments through

Energy Financial Services, GE Capital Aviation

Services & Industrial Finance, including

Healthcare Equipment Finance

HOW CAPITAL VERTICALS CONNECT TO INDUSTRIAL

v

estments t

h

roug

h

G

E Ca

p

ital Aviation

c

e, inc

l

u

d

ing

nc

e

A

L

C

AL

S

CO

NN

EC

T

TO

I

ND

US

TR

IA

A

$113.2B

2013 2014 2015

0%

$117.4B

3%

$117.2B

$7.6B

25%

$9.5B

83%

$1.7B

2013 2014 2015

$10.3B

9%

$11.3B

16%

$13.1B

2013 2014 2015

27.4%

80bps

27.4%

80bps

26.6%

2013 2014 20151

12.6%

110bps

15.3%

160bps

14.2%

2013 2014 2015

$12.1B

$4.3B

2015

$12.2B

$3.0B

2014

$6.0B

$8.3B

2013

$71B

$195B

2014 2015

$226B

$89B

$64B

$185B

2013

S ervices

Equipment

GE Capital

Dividend

Industrial CFOA1

10 GE 2015 FORM 10-K