GE 2015 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL STATEMENTS INCOME TAXES

172 GE 2015 FORM 10-K

NOTE 14. INCOME TAXES

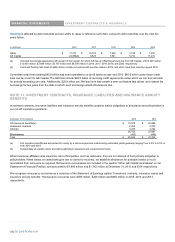

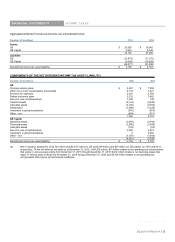

GE and GE Capital file a consolidated U.S. federal income tax return. This enables GE and GE Capital to use tax deductions and

credits of one member of the group to reduce the tax that otherwise would have been payable by another member of the group. The GE

Capital effective tax rate reflects the benefit of these tax reductions in the consolidated return. GE makes cash payments to GE Capital

for tax reductions and GE Capital pays for tax increases at the time *(¶V tax payments are due.

Our businesses are subject to regulation under a wide variety of U.S. federal, state and foreign tax laws, regulations and policies.

Changes to these laws or regulations may affect our tax liability, return on investments and business operations.

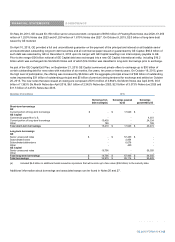

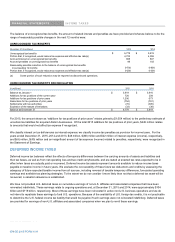

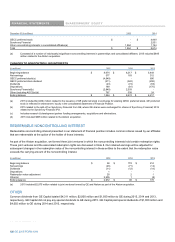

THE GE CAPITAL EXIT PLAN

In conjunction with the GE Capital Exit Plan, GE Capital will significantly reduce its non-U.S. assets while continuing to operate

appropriately capitalized non-U.S. businesses with substantial assets related to GE &DSLWDO¶V vertical financing businesses, Energy

Financial Services, GECAS and Healthcare Equipment Finance. As a result of the GE Capital Exit Plan, GE Capital recognized a tax

expense of $6,327 million in continuing operations during 2015. This primarily consisted of $3,548 million of tax expense related to the

repatriation of excess foreign cash and the write-off of deferred tax assets of $2,779 million that will no longer be supported under this

plan.

The repatriation of cash includes approximately $10 billion of foreign earnings that, prior to the approval of the GE Capital Exit Plan,

were indefinitely reinvested in GE &DSLWDO¶V international operations. GE &DSLWDO¶V indefinitely reinvested earnings have also been

reduced by charges recognized in connection with the disposition of international assets. The remainder of the indefinitely reinvested

earnings will continue to be reinvested in the significant international base of assets that will remain after the GE Capital Exit Plan is

fully executed. The write-off of deferred tax assets largely relates to our Treasury operations in Ireland where the tax benefits will no

longer be apparent to be realized upon implementation of the GE Capital Exit Plan. These charges, which increase the 2015

Consolidated effective tax rate by 77.3 percentage points, are reported in the lines ³7D[ on global activities including H[SRUWV´ and ³$OO

other-QHW´ in the Reconciliation of U.S. federal statutory income tax rate to actual income tax rDWH´

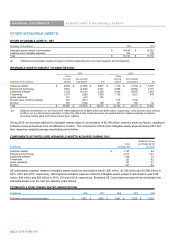

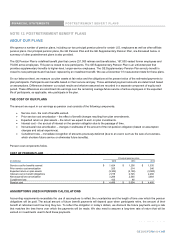

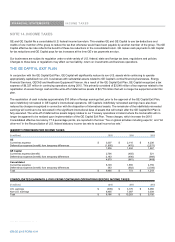

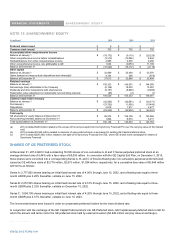

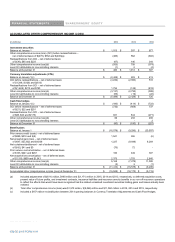

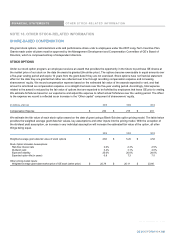

(BENEFIT) PROVISION FOR INCOME TAXES

(In millions) 2015 2014 2013

GE

Current tax expense $ 3,307 $ 2,110 $ 4,238

Deferred tax expense (benefit) from temporary differences (1,800) (476) (2,571)

1,506 1,634 1,667

GE Capital

Current tax expense (benefit) 2,796 (455) 521

Deferred tax expense (benefit) from temporary differences 2,183 (406) (969)

4,979 (861) (448)

Consolidated

Current tax expense 6,103 1,655 4,759

Deferred tax expense (benefit) from temporary differences 383 (882) (3,540)

Total $ 6,485 $ 773 $ 1,219

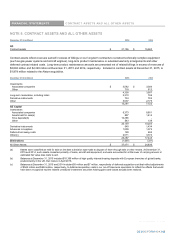

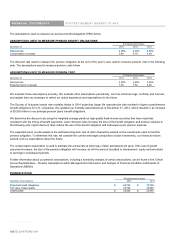

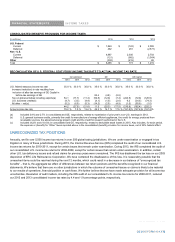

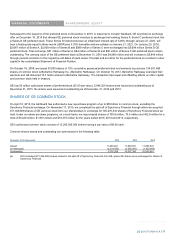

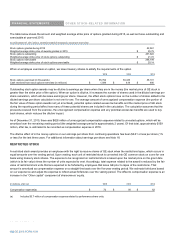

CONSOLIDATED EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES

(In millions) 2015 2014 2013

U.S. earnings $ (309) $ 3,176 $ 6,066

Non-U.S. earnings 8,495 7,087 3,034

Total $ 8,186 $ 10,263 $ 9,100

172 GE 2015 FORM 10-K