GE 2015 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

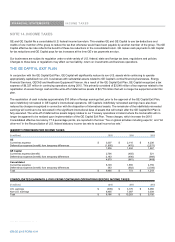

FINANCIAL STATEMENTS INCOME TAXES

GE 2015 FORM 10-K 173

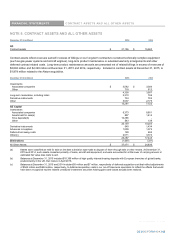

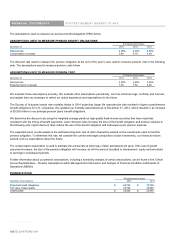

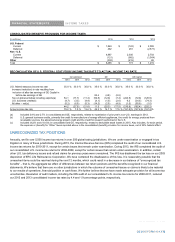

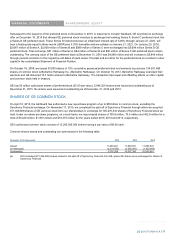

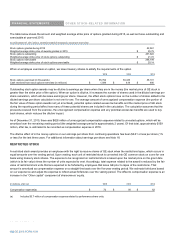

CONSOLIDATED (BENEFIT) PROVISION FOR INCOME TAXES

(In millions) 2015 2014 2013

U.S. Federal

Current $ 1,549 $ (122) $ 2,005

Deferred 492 261 (2,571)

Non - U.S.

Current 4,867 2,035 2,703

Deferred (121) (982) (1,004)

Other (302) (419) 86

Total $ 6,485 $ 773 $ 1,219

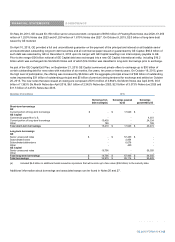

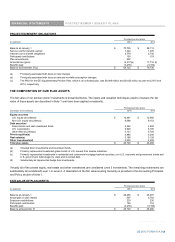

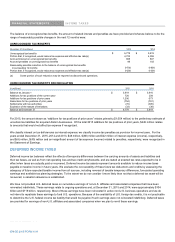

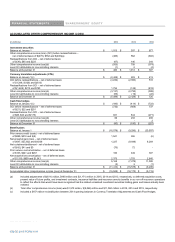

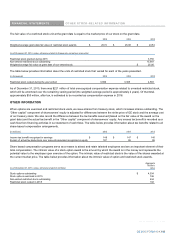

RECONCILIATION OF U.S. FEDERAL STATUTORY INCOME TAX RATE TO ACTUAL INCOME TAX RATE

Consolidated GE GE Capital

2015 2014 2013 2015 201

4

2013 2015 201

4

2013

U.S. federal statutory income tax rate 35.0 % 35.0 % 35.0 % 35.0 % 35.0 % 35.0 % 35.0 % 35.0 % 35.0 %

Increase (reduction) in rate resulting from

inclusion of after-tax earnings of GE Capital in

before-tax earnings of GE - - - 82.4 (4.8) (2.6) - - -

Tax on global activities including exports(a) 54.1 (17.7) (11.4) (52.8) (12.0) (7.4) (224.5) (72.0) (126.9)

U.S. business credits(b) (4.7) (3.3) (4.9) (4.1) (1.0) (2.6) 9.2 (34.5) (74.3)

All other ± net(c) (5.2) (6.5) (5.3) (14.2) (2.5) (4.9) (1.5) (55.9) (1.0)

44.2 (27.5) (21.6) 11.3 (20.3) (17.5) (216.8) (162.4) (202.2)

A

ctual income tax rate 79.2 % 7.5 % 13.4 % 46.3 % 14.7 % 17.5 % (181.8)% (127.4)% (167.2)%

(a) Included DQGLQFRQVROLGDWHGDQG*(UHVSHFWLYHO\UHODWHGWRUHSDWULDWLRQRISULRU\HDU¶VQRQ-U.S. earnings in 2013.

(b) U.S. general business credits, primarily the credit for manufacture of energy efficient appliances, the credit for energy produced from

renewable sources, the advanced energy project credit and the credit for research performed in the U.S.

(c) Included (4.2)% and (10.6)% in consolidated and GE, respectively, related to deductible stock losses in 2015. Also includes, for each period,

the H[SHQVHRUEHQHILWIRU³2WKHU´WD[HVUHSRUWHGDERYHLQWKHFRQVROLGDWHGEHQHILWSURYLVLRQIRULQFRPHWD[HVQHWRIIHderal effect.

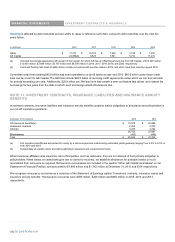

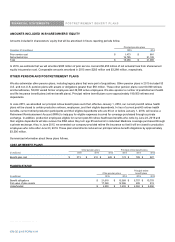

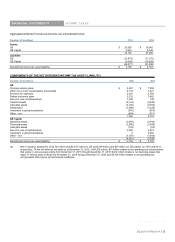

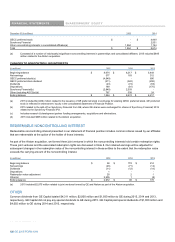

UNRECOGNIZED TAX POSITIONS

Annually, we file over 5,500 income tax returns in over 300 global taxing jurisdictions. We are under examination or engaged in tax

litigation in many of these jurisdictions. During 2015, the Internal Revenue Service (IRS) completed the audit of our consolidated U.S.

income tax returns for 2010-2011, except for certain issues that remain under examination. During 2013, the IRS completed the audit of

our consolidated U.S. income tax returns for 2008-2009, except for certain issues that remain under examination. In addition, certain

other U.S. tax deficiency issues and refund claims for previous years were unresolved. The IRS has disallowed the tax loss on our 2003

disposition of ERC Life Reinsurance Corporation. We have contested the disallowance of this loss. It is reasonably possible that the

unresolved items could be resolved during the next 12 months, which could result in a decrease in our balance of ³XQUHFRJQL]HG tax

EHQHILWV´ ± that is, the aggregate tax effect of differences between tax return positions and the benefits recognized in our financial

statements. We believe that there are no other jurisdictions in which the outcome of unresolved issues or claims is likely to be material

to our results of operations, financial position or cash flows. We further believe that we have made adequate provision for all income tax

uncertainties. Resolution of audit matters, including the IRS audit of our consolidated U.S. income tax returns for 2008-2011, reduced

our 2015 and 2013 consolidated income tax rates by 4.4 and 1.9 percentage points, respectively.

GE 2015 FORM 10-K 173