GE 2015 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

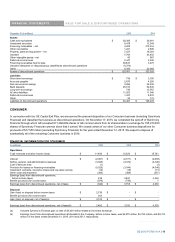

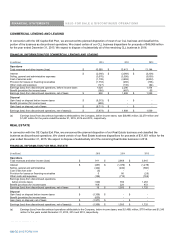

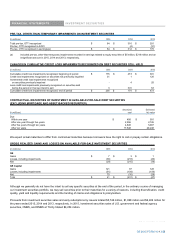

FINANCIAL STATEMENTS ACQUISITIONS & INTANGIBLE ASSETS

GE 2015 FORM 10-K 159

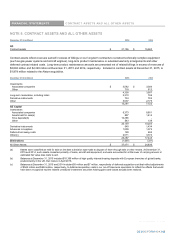

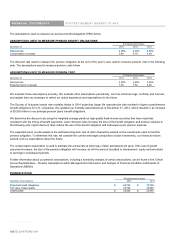

NOTE 8. ACQUISITIONS, GOODWILL AND OTHER INTANGIBLE ASSETS

ACQUISITIONS

On November 2, 2015, we acquired the Thermal, Renewables and Grid businesses from Alstom. The purchase price was ¼9,200

million ($10,135 million), net of cash acquired of approximately ¼1,600 million ($1,765 million). As further discussed below and

elsewhere in this report, the acquired Alstom businesses had a significant impact on our industrial businesses, directly affecting

accounting and reporting related to three of our operating segments, as well as the creation of several new, jointly-owned entities.

Given the timing and complexity of the acquisition, the presentation of these businesses in our financial statements, including the

allocation of the purchase price, is preliminary and likely to change in future reporting periods. We will complete our post-closing

procedures and purchase price allocation no later than the fourth quarter of 2016.

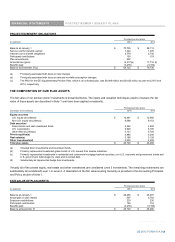

As noted above, we formed three consolidated joint ventures with Alstom in grid technology, renewable energy, and global nuclear and

French steam power. In addition, GE contributed its Digital Energy business to the grid technology joint venture.

Alstom holds redemption rights with respect to its interest in each joint venture, which, if exercised, would require us to purchase all of

their interest during September 2018 or September 2019 for the grid technology and renewable energy joint ventures. Alstom also

holds similar redemption rights for the global nuclear and French steam power joint venture, that are exercisable during the first full

calendar quarter immediately following the fifth or sixth anniversary of the acquisition date. The redemption price would generally be

equal to $OVWRP¶V initial investment plus annual accretion of 3% for the grid technology and renewable energy joint ventures and plus

annual accretion of 2% for the nuclear and French steam power joint venture, with potential upside sharing based on an EBITDA

multiple. Alstom also holds additional redemption rights in other limited circumstances as well as a call option to require GE to sell all of

its interests in the renewable energy joint venture at the higher of fair value or AlVWRP¶V initial investment plus annual accretion of 3%

during the month of May in the years 2016 through 2019 and also upon a decision to IPO the joint venture.

GE holds a call option on $OVWRP¶V interest in the global nuclear and French steam power joint venture at the same amount as $OVWRP¶V

redemption price in the event that Alstom exercises its put option in the grid technology or renewable energy joint ventures. GE also

has call options on $OVWRP¶V interest in the three joint ventures in other limited circumstances. In addition, the French Government holds

a preferred interest in the global nuclear and French steam power joint venture, giving it certain protective rights.

The acquisition and alliances with Alstom affected our Power, Energy Management and Renewable Energy segments. The financial

impact of acquired businesses on individual segments will be affected by a number of variables, including operating performance,

purchase accounting effects and expected synergies. In addition, due to the amount of time that elapsed between signing and closing,

the commercial operations of the businesses were negatively affected primarily as a result of uncertainty among Alstom customers

regarding the execution of the transaction. This affected the overall valuation of the acquired businesses at the time of close and,

accordingly, is reflected in the amounts assigned to the assets and liabilities recorded in purchase accounting. The fair value of the

acquired businesses, including a preliminary valuation of non-controlling interest, at the time of close was approximately $13,700

million, net of cash acquired. The preliminary purchase price allocation resulted in approximately $13,500 million of goodwill and $4,065

million of amortizable intangible assets. The preliminary fair value of the associated non-controlling interest is approximately $3,600

million, which consists of approximately $2,900 million for $OVWRP¶V redeemable non-controlling interest in the three joint ventures

(presented separately from total equity in the consolidated balance sheet) and $700 million for all other non-controlling interest.

In order to obtain approval by the European Commission and the Department of Justice, GE pledged to sell certain of $OVWRP¶V gas-

turbine assets and its Power Systems Manufacturing subsidiary to Ansaldo Energia SpA (Ansaldo) after the close of the transaction for

approximately ¼ million. The purchase price will be paid by Ansaldo over a period of five years. The transaction closed on February

25, 2016.

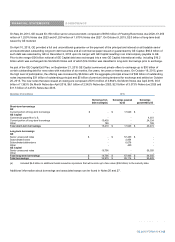

On January 30, 2015, we acquired Milestone Aviation Group (Milestone Aviation), a helicopter leasing business, for approximately

$1,750 million, which is included in our Capital segment. The purchase price allocation resulted in goodwill of approximately $730

million and amortizable intangible assets of approximately $345 million.

GE 2015 FORM 10-K 159