GE 2015 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

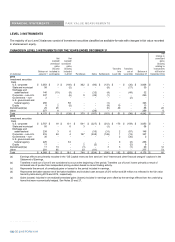

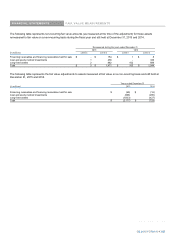

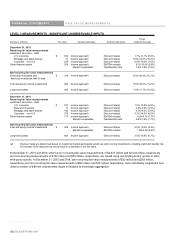

FINANCIAL STATEMENTS FAIR VALUE MEASUREMENTS

GE 2015 FORM 10-K 185

NOTE 19. FAIR VALUE MEASUREMENTS

RECURRING FAIR VALUE MEASUREMENTS

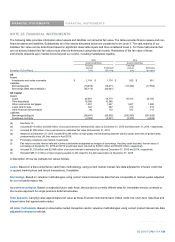

Our assets and liabilities measured at fair value on a recurring basis include investment securities primarily supporting obligations to

annuitants and policyholders in our run-off insurance operations and derivatives.

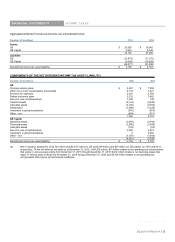

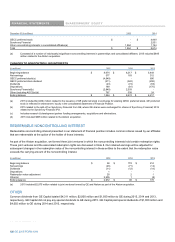

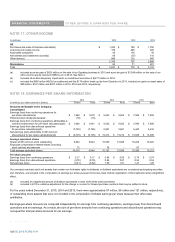

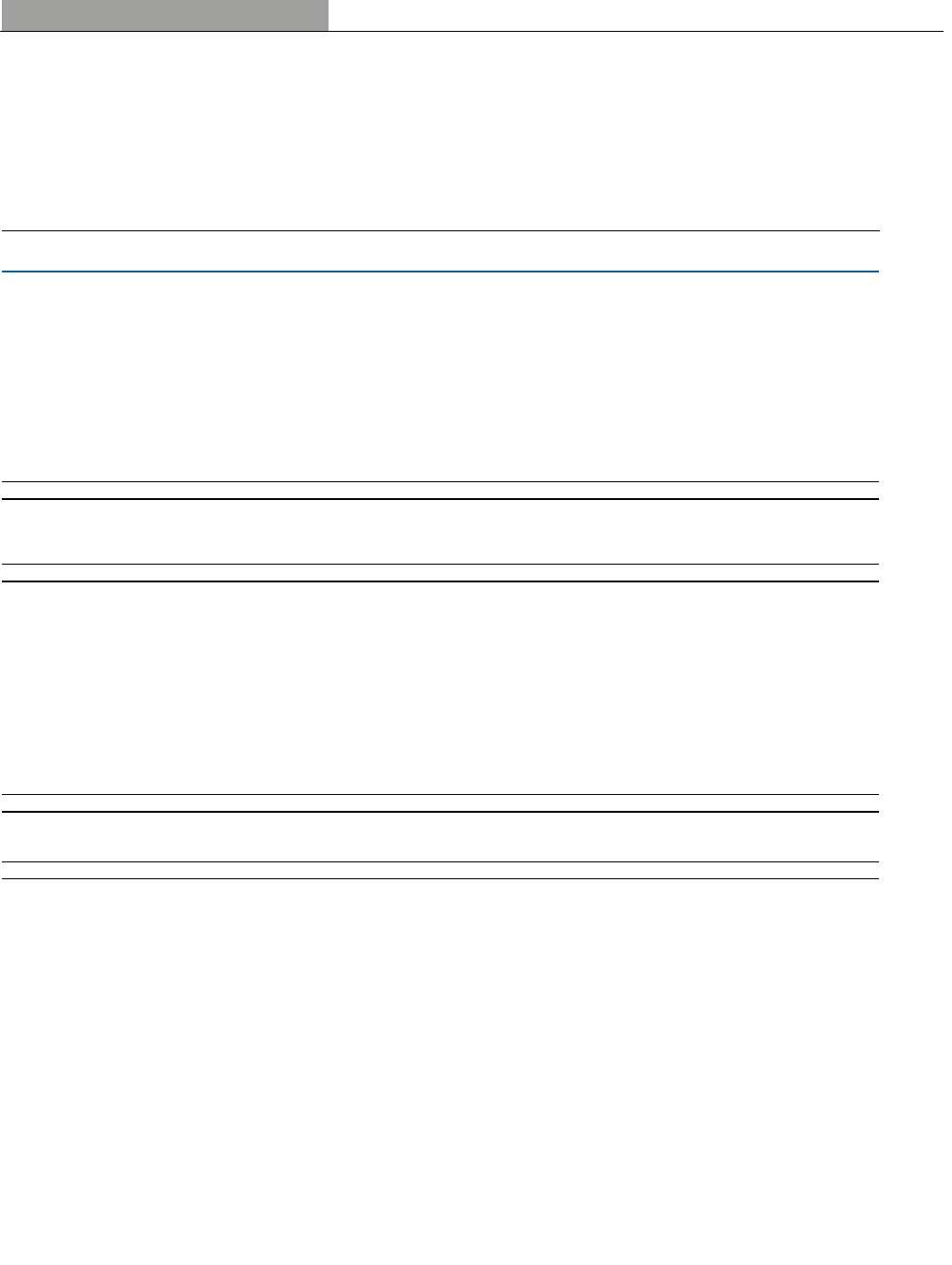

ASSETS AND LIABILITIES MEASURED AT FAIR VALUE ON A RECURRING BASIS

Nettin

g

(

In millions

)

Level 1

(

a

)

Level 2

(

a

)

Level 3 ad

j

ustment

(

b

)

Net balance

December 31, 2015

Assets

Investment securities

Debt

U.S. corporate $ - $ 19,351 $ 3,006 $ - $ 22,358

State and municipal - 4,215 30 - 4,245

Mortgage and asset-backed - 3,084 32 - 3,116

Corporate ± non-U.S. 12 544 290 - 847

Government ± non-U.S. 5 410 - - 415

U.S. government and federal agency 49 404 323 - 776

Equity 194 9 13 - 216

Derivatives(c) - 7,312 79 (6,110) 1,281

Other(d) - - 259 - 259

Total $ 260 $ 35,331 $ 4,033 $ (6,110) $ 33,512

Liabilities

Derivatives $ - $ 5,677 $ 4 $ (4,968) $ 713

Other(e) - 1,182 - - 1,182

Total $ - $ 6,860 $ 4 $ (4,968) $ 1,895

December 31, 2014

Assets

Investment securities

Debt

U.S. corporate $ - $ 20,651 $ 3,053 $ - $ 23,704

State and municipal - 4,560 58 - 4,618

Mortgage and asset-backed - 4,632 146 - 4,777

Corporate ± non-U.S. - 615 337 - 953

Government ± non-U.S. - 489 2 - 491

U.S. government and federal agency - 496 266 - 761

Equity 176 16 9 - 201

Derivatives(c) - 9,881 30 (7,570) 2,341

Other(d) - - 277 - 277

Total $ 176 $ 41,340 $ 4,177 $ (7,570) $ 38,122

Liabilities

Derivatives $ - $ 4,840 $ 11 $ (4,337) $ 514

Other(e) - 1,179 - - 1,179

Total $ - $ 6,018 $ 11 $ (4,337) $ 1,692

(a) There were no securities transferred between Level 1 and Level 2 for the years ended December 31, 2015 and 2014.

(b) The netting of derivative receivables and payables (including the effects of any collateral posted or received) is permitted when a legally

enforceable master netting agreement exists.

(c) The fair value of derivatives includes an adjustment for non-performance risk. At December 31, 2015 and 2014, the cumulative adjustment for

non-performance risk was insignificant and $16 million, respectively. See Notes 20 and 27 for additional information on the composition of our

derivative portfolio.

(d) Includes private equity investments.

(e) Primarily represented the liability associated with certain of our deferred incentive compensation plans.

GE 2015 FORM 10-K 185