GE 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

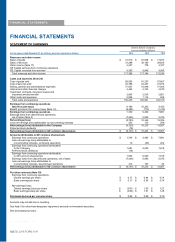

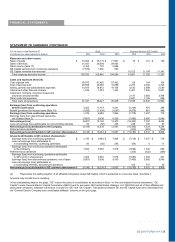

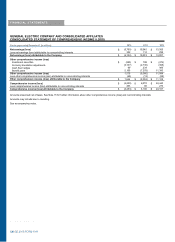

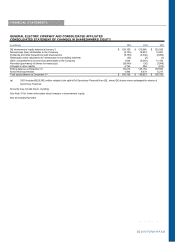

FINANCIAL STATEMENTS PRESENTATION & POLICIES

GE 2015 FORM 10-K 137

Unless otherwise indicated, information in these notes to consolidated financial statements relates to continuing operations. Certain of

our operations have been presented as discontinued. See Note 2.

The effects of translating to U.S. dollars the financial statements of non-U.S. affiliates whose functional currency is the local currency

DUHLQFOXGHGLQVKDUHRZQHUV¶HTXLW\$VVHWDQGOLDELOLW\DFFRXQWVDUHWUDQVODWHGDW\HDU-end exchange rates, while revenues and

expenses are translated at average rates for the respective periods.

Preparing financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires us to make estimates

based on assumptions about current, and for some estimates future, economic and market conditions (for example, unemployment,

market liquidity, the real estate market, etc.), which affect reported amounts and related disclosures in our financial statements.

Although our current estimates contemplate current conditions and how we expect them to change in the future, as appropriate, it is

reasonably possible that in 2016 actual conditions could be worse than anticipated in those estimates, which could materially affect our

results of operations and financial position. Among other effects, such changes could result in future impairments of investment

securities, goodwill, intangibles and long-lived assets, incremental losses on financing receivables, establishment of valuation

allowances on deferred tax assets, incremental fair value marks on businesses and assets held for sale carried at lower of cost or

market, and increased tax liabilities.

THE GE CAPITAL EXIT PLAN

On April 10, 2015, the Company announced its plan (the GE Capital Exit Plan) to reduce the size of its financial services businesses

through the sale of most of the assets of GE Capital over the following 24 months, and to focus on continued investment and growth in

WKH&RPSDQ\¶VLQGXVWULDOEXVLQHVVHV8QGHUWKH*(&DSLWDO([LW3ODQZKLFKZDVDSSURYHGRQ$SULODQGDVSHFWVRIZKLFK were

approved on March 31, 2015, the Company will retain certain GE Capital businesses, principally its vertical financing businesses²GE

Capital Aviation Services (GECAS), Energy Financial Services (EFS) and Healthcare Equipment Finance²that directly relate to the

CoPSDQ\¶VFRUHLQGXVWULDOGRPDLQDQGRWKHURSHUDWLRQVLQFOXGLQJ:RUNLQJ&DSLWDO6ROXWLRQVRXUUXQ-off insurance activities, and

allocated corporate costs (together referred to as GE Capital Verticals or Verticals). The assets planned for disposition include Real

Estate, most of Commercial Lending and Leasing (CLL) and all Consumer platforms (including all U.S. banking assets).

AFTER-TAX CHARGES RELATED TO THE GE CAPITAL EXIT PLAN

In connection with the announcement of the GE Capital Exit Plan, the Company estimated that it would incur approximately $23 billion

in after-tax charges through 2016, approximately $6 billion of which were expected to result in future net cash expenditures. These

charges relate to: business dispositions, including goodwill allocations (approximately $13 billion), tax expense related to expected

repatriation of foreign earnings and write-off of deferred tax assets (approximately $7 billion), and restructuring and other charges

(approximately $3 billion).

During 2015, GE recorded $22,030 million of after-tax charges related to the GE Capital Exit Plan, of which $7,687 million was recorded

in continuing operations and $14,343 million was recorded in discontinued operations. A description of after-tax charges for 2015 is

provided below.

x $9,517 million of net loss primarily related to the completed and planned dispositions of the Real Estate business, the

Consumer business and most of the CLL business, which was recorded in discontinued operations under the caption

³(DUQLQJVORVVIURPGLVFRQWLQXHGRSHUDWLRQVQHWRIWD[HV´LQWKH6WDWHPHQWRI(DUQLQJV

x $6,467 million of tax expense related to expected repatriation of foreign earnings and write-off of deferred tax assets, of which

$6,327 million was recorded in continuing operations DQGUHSRUWHGLQ*(&DSLWDO¶V&RUSRUDWHFRPSRQHQWDQGPLOOLRQZDV

UHFRUGHGLQGLVFRQWLQXHGRSHUDWLRQVLQRXU&RQVXPHUEXVLQHVVXQGHUWKHFDSWLRQ³(DUQLQJVORVVIURPGLVFRQWLQXHG

RSHUDWLRQVQHWRIWD[HV´LQWKH6WDWHPHQWRI(DUQLQJV

x $4,666 million of net asset impairments due to shortened hold periods, of which $3,151 million was recorded in discontinued

operations in our Consumer business and $1,515 million was recorded in discontinued operations in our CLL business, all

XQGHUWKHFDSWLRQ³(DUQLQJVORVVIURPGLVFRQWLQXHGRSHUDWLRQVQHWRIWD[HV´LQWKH6WDWHPHQWRI(DUQLQJV

x $818 million impairment charge of a coal-fired power plant in the U.S. related to a decision in the fourth quarter to exit the

investment over time recorded in continuing operations in *(&DSLWDO¶V &RUSRUDWHFRPSRQHQWXQGHUWKHFDSWLRQ³2WKHUFRVWV

DQGH[SHQVHV´LQWKH6WDWHPHQWRI(DUQLQJV.

GE 2015 FORM 10-K 137