GE 2015 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL STATEMENTS PROPERTY, PLANT AND EQUIPMENT

158 GE 2015 FORM 10-K

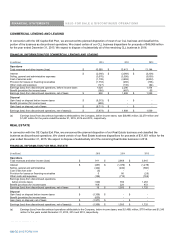

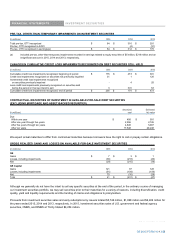

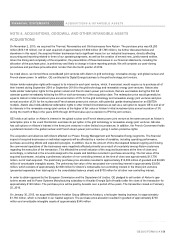

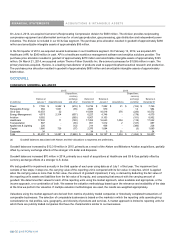

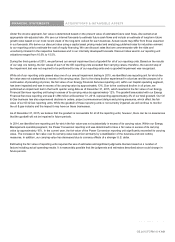

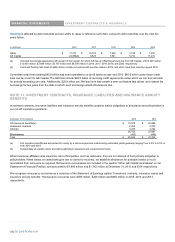

We manage our financing receivable portfolios using delinquency and nonaccrual data as key performance indicators. Substantially all

of our financing receivables are secured at December 31, 2015 and 2014.

At December 31, 2015, $622 million (2.5%), $201 million (0.8%) and $256 million (1.0%) of financing receivables were over 30 days

past due, over 90 days past due and on nonaccrual, respectively. At December 31, 2014, $610 million (2.4%), $131 million (0.5%) and

$512 million (2.0%) of financing receivables were over 30 days past due, over 90 days past due and on nonaccrual, respectively. The

vast majority of nonaccrual loans at December 31, 2015 and 2014, which are primarily at GECAS, are currently paying in accordance

with their contractual terms.

The recorded investment in impaired loans at December 31, 2015 and 2014 was $175 million and $412 million, respectively, primarily in

GECAS, and included $2 million and $20 million of impaired loans with specific allowances of $1 and $16 million, respectively, primarily

at EFS. The method used to measure impairment for these loans is primarily based on collateral value. At December 31, 2015, troubled

debt restructurings included in impaired loans were $116 million, the vast majority at GECAS.

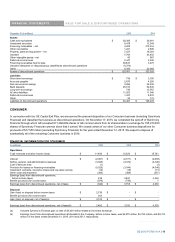

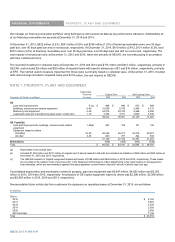

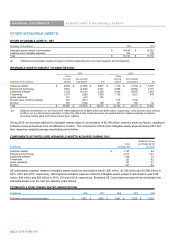

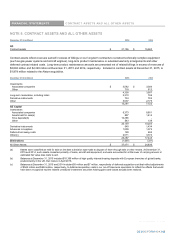

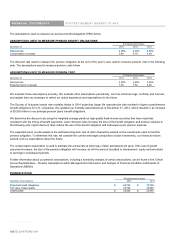

NOTE 7. PROPERTY, PLANT AND EQUIPMENT

Depreciable

lives-ne

w

Original Cost Net Carrying Value

December 31 (Dollars in millions) (in years) 2015 2014 2015 201

4

GE

Land and improvements 8 (a) $ 888 $ 690 $ 870 $ 698

Buildings, structures and related equipment 8-40 10,050 8,740 5,440 4,131

Machinery and equipment 4-20 24,515 23,370 9,986 9,040

Leasehold costs and manufacturing plant under construction 1-10 4,359 3,751 3,849 3,338

39,812 36,551 20,145 17,207

GE Capital(b)

Land and improvements, buildings, structures and related

equipment

1-35(a) 267 318 101 142

Equipment leased to others

Aircraft(c) 15-20 50,339 46,017 34,316 30,573

All other 3-35 543 767 364 539

51,149 47,102 34,781 31,253

Eliminations (939) (462) (831) (390)

Total $ 90,022 $ 83,191 $ 54,095 $ 48,070

(a) Depreciable lives exclude land.

(b) Included $1,024 million and $731 million of original cost of assets leased to GE with accumulated amortization of $83 million and $60 million at

December 31, 2015 and 2014, respectively.

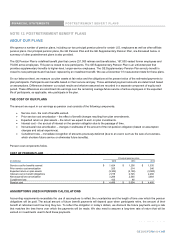

(c) The GECAS business of Capital recognized impairment losses of $168 million and $445 million in 2015 and 2014, respectively. These losses

are recorded in the caption ³Cost of services sold´ in the Statement of Earnings to reflect adjustments to fair value based on PDQDJHPHQW¶V

best estimates, which are benchmarked against third-party appraiser current market values for aircraft of similar type and age.

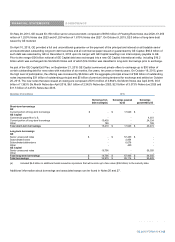

Consolidated depreciation and amortization related to property, plant and equipment was $4,847 million, $4,953 million and $5,202

million in 2015, 2014 and 2013, respectively. Amortization of GE Capital equipment leased to others was $2,266 million, $2,386 million

and $2,693 million in 2015, 2014 and 2013, respectively.

Noncancellable future rentals due from customers for equipment on operating leases at December 31, 2015, are as follows:

(In millions)

Due in

2016 $ 4,162

2017 3,876

2018 3,378

2019 2,920

2020 2,455

2021 and later 7,128

Total $ 23,919

158 GE 2015 FORM 10-K