GE 2015 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL STATEMENTS 6+$5(2:1(56¶ EQUITY

GE 2015 FORM 10-K 179

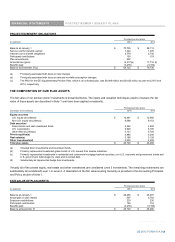

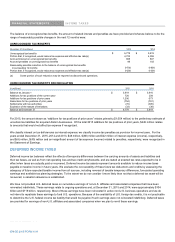

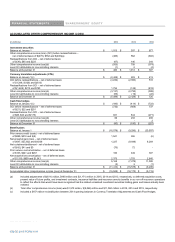

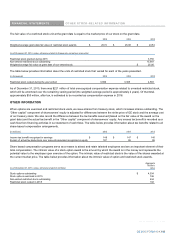

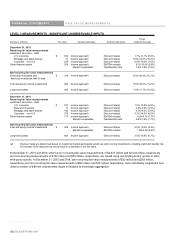

RECLASSIFICATION OUT OF AOCI

(In millions) 2015 201

4

2013 Statement of earnings caption

Available-for-sale securities

Realized gains (losses) on

sale/impairment of securities $ 103 $ (231) $ (541) Total revenue and other income (a)

(36) 85 223 Benefit (provision) for income taxes (b)

$ 67 $ (146) $ (318) Net of tax

Currenc

y

translation ad

j

ustments

Gains (losses) on dispositions $ (305) $ (85) $ 25 Total revenues and other income(c)

(1,489) 213 793 Benefit (provision) for income taxes(d)

$ (1,794) $ 129 $ 818 Net of tax

Cash flow hed

g

es

Gains (losses) on interest rate

derivatives $ (130) $ (234) $ (364) Interest and other financial charges

Foreign exchange contracts (801) (666) 564 (e)

Other 13 22 248 (f)

(918) (878) 447 Total before tax

86 34 (176) Benefit (provision) for income taxes

$ (831) $ (844) $ 271 Net of tax

Benefit

p

lan items

Curtailment gain (loss) $ 118 $ (113) $ - (g)

Amortization of prior service costs (203) (590) (664) (g)

Amortization of actuarial gains (losses) (3,572) (2,612) (3,983) (g)

(3,657) (3,315) (4,647) Total before tax

1,260 1,141 1,610 Benefit (provision) for income taxes

$ (2,397) $ (2,174) $ (3,037) Net of tax

Total reclassification adjustments $ (4,956) $ (3,035) $ (2,266) Net of tax

(a) Included $61 million, an insignificant amount and $(497) million in 2015, 2014 and 2013, respectively, in earnings (loss) from discontinued

operations, net of taxes.

(b) Included $(30) million, $3 million and $204 million in 2015, 2014 and 2013, respectively, in earnings (loss) from discontinued operations, net of

taxes.

(c) Included $(224) million, $(51) million and $62 million in 2015, 2014 and 2013, respectively, in earnings (loss) from discontinued operations, net

of taxes.

(d) Included $(1,506) million, $213 million and $802 million in 2015, 2014 and 2013, respectively, in earnings (loss) from discontinued operations,

net of taxes.

(e) Included $(758) million, $(607) million and $608 million in GE Capital revenues from services and $(43) million, $(59) million and $(44) million in

interest and other financial charges in 2015, 2014 and 2013, respectively.

(f) Primarily recorded in costs and expenses.

(g) Curtailment gain (loss), amortization of prior service costs and actuarial gains and losses reclassified out of AOCI are included in the

computation of net periodic pension costs. See Notes 12 and 27 for further information.

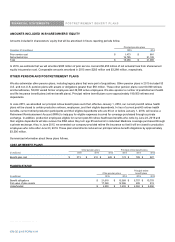

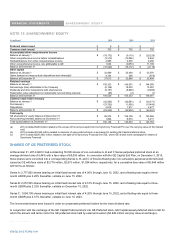

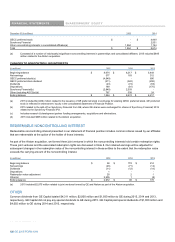

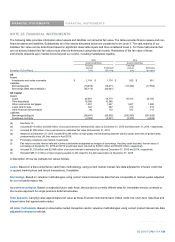

NONCONTROLLING INTERESTS

Noncontrolling interests in equity of consolidated affiliates includes common shares in consolidated affiliates and preferred stock issued

by our affiliates.

Prior to the fourth quarter of 2015, the preferred stock issued by GECC was classified as noncontrolling interests in our consolidated

Statement of Financial Position, with dividends presented as noncontrolling interest in our consolidated Statement of Earnings. As

discussed previously in this note, this preferred stock was converted to a corresponding series of preferred stock issued by GE and on

January 20, 2016 a substantial majority of those shares were exchanged into GE Series D preferred stock. Effective with these

FKDQJHVWKHSUHIHUUHGVWRFNLVVXHGE\*(LVUHIOHFWHGLQRXUVKDUHRZQHUV¶HTXLW\DQGGLYLGHQGVDUHSUHVHQWHGDVDUHGXFWLRQof net

earnings aWWULEXWDEOHWR*(LQWKHVWDWHPHQWRIHDUQLQJVXQGHUWKHFDSWLRQ³3UHIHUUHGVWRFNGLYLGHQGV´IRUWKH\HDUHQGHG'HFHPEHU

31, 2015 and subsequently.

GE 2015 FORM 10-K 179