GE 2015 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

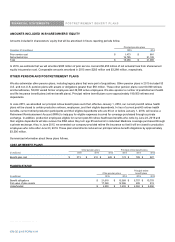

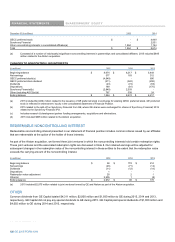

FINANCIAL STATEMENTS 6+$5(2:1(56¶ EQUITY

176 GE 2015 FORM 10-K

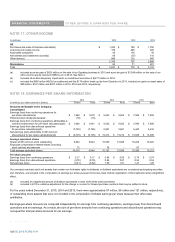

NOTE 15. 6+$5(2:1(56¶ EQUITY

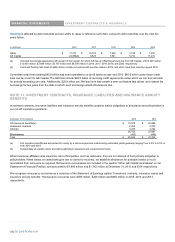

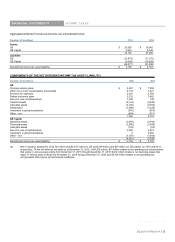

(In millions) 2015 201

4

2013

Preferred stock issued $ 6 $ - $ -

Common stock issued $ 702 $ 702 $ 702

Accumulated other comprehensive income

Balance at January 1 $ (18,172) $ (9,119) $ (20,229)

Other comprehensive income before reclassifications (3,312) (12,088) 8,844

Reclassifications from other comprehensive income 4,956 3,035 2,265

Other comprehensive income, net, attributable to GE 1,644 (9,053) 11,109

Balance at December 31 $ (16,529) $

(18,172) $ (9,119)

Other capital

Balance at January 1 $ 32,889 $ 32,494 $ 33,070

Gains (losses) on treasury stock dispositions and other(a)(b) 4,724 396 (576)

Balance at December 31 $ 37,613 $ 32,889 $ 32,494

Retained earnings

Balance at January 1 $ 155,333 $

149,051 $ 144,055

Net earnings (loss) attributable to the Company (6,126) 15,233 13,057

Dividends and other transactions with shareowners (9,161) (8,948) (8,060)

Redemption value adjustment on redeemable noncontrolling interests (25) (2) (1)

Balance at December 31 $ 140,020 $

155,333 $ 149,051

Common stock held in treasury

Balance at January 1 $ (42,593) $

(42,561) $ (34,571)

Purchases(c) (23,762) (1,950) (10,466)

Dispositions 2,816 1,917 2,477

Balance at December 31 $ (63,539) $

(42,593) $ (42,561)

Total equity

GE shareowners' equity balance at December 31 $ 98,274 $

128,159 $ 130,566

Noncontrolling interests balance at December 31 1,864 8,674 6,217

Total equity balance at December 31 $ 100,138 $

136,833 $ 136,783

(a) 2014 included $440 million related to the excess of the net proceeds from the Synchrony Financial IPO over the carrying value of the interest

sold.

(b) 2015 included $4,949 million related to issuance of new preferred stock in exchange for existing GE Capital preferred stock.

(c) 2015 included $(20,383) million related to the split-off of Synchrony Financial from GE, where GE shares were exchanged for shares of

Synchrony Financial.

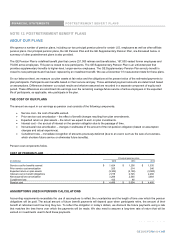

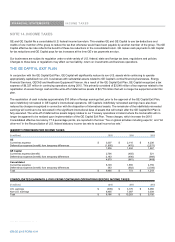

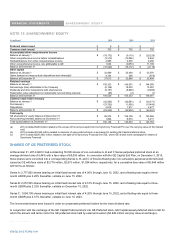

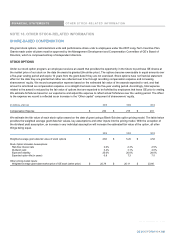

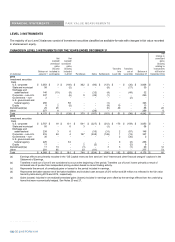

SHARES OF GE PREFERRED STOCK

At December 31, 2014 GECC had outstanding 50,000 shares of non-cumulative A, B and C Series perpetual preferred stock at an

average dividend rate of 6.44% with a face value of $5,000 million. In connection with the GE Capital Exit Plan, on December 3, 2015,

these shares were converted into a corresponding Series A, B, and C of fixed-to-floating rate non-cumulative perpetual preferred stock

issued by GE with face value of $2,778 million, $2,073 million, $1,094 million, respectively, for a cumulative face value of $5,944 million

with terms as follows:

Series A: 2,777,625 shares bearing an initial fixed interest rate of 4.00% through June 15, 2022, and a floating rate equal to three-

month LIBOR plus 2.28% thereafter, callable on June 15, 2022.

Series B: 2,072,525 shares bearing an initial fixed interest rate of 4.10% through June 15, 2022, and a floating rate equal to three-

month LIBOR plus 2.32% thereafter, callable on December 15, 2022.

Series C: 1,094,100 shares bearing an initial fixed interest rate of 4.20% through June 15, 2022, and a floating rate equal to three-

month LIBOR plus 2.37% thereafter, callable on June 15, 2023.

The incremental shares were issued in order to compensate preferred holders for the lower dividend rate.

In conjunction with the exchange of the GE Capital Preferred stock into GE Preferred stock, GE Capital issued preferred stock to GE for

which the amount and terms mirror the GE preferred stock held by external investors ($4,949 million carrying value at exchange).

176 GE 2015 FORM 10-K