GE 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

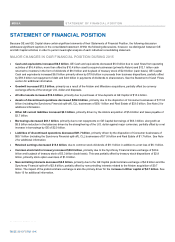

MD&A FINANCIAL RESOURCES AND LIQUIDITY

80 GE 2015 FORM 10-K

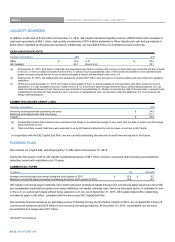

LIQUIDITY SOURCES

In addition to GE cash of $10.4 billion at December 31, 2015, GE Capital maintained liquidity sources of $90.9 billion that consisted of

cash and equivalents of $60.1 billion, high-quality investments of $10.4 billion presented in Other Assets and cash and equivalents of

$20.4 billion classified as discontinued operations. Additionally, we have $45.6 billion of committed unused credit lines.

CASH AND EQUIVALENTS

December 31 (In billions) 2015 2015

GE(a) $ 10.4 U.S. $ 20.4

GE Capital(b) 60.1 Non-U.S.(c) 50.1

(a) At December 31, 2015, $2.8 billion of GE cash and equivalents was held in countries with currency controls that may restrict the transfer of funds

to the U.S. or limit our ability to transfer funds to the U.S. without incurring substantial costs. These funds are available to fund operations and

growth in these countries and we do not currently anticipate a need to transfer these funds to the U.S.

(b) At December 31, 2015, GE Capital cash and equivalents of about $0.7 billion were primarily in insurance entities and were subject to regulatory

restrictions.

(c) Of this amount at December 31, 2015, $3.5 billion is held outside of the U.S. and is available to fund operations and other growth of non-U.S.

subsidiaries; it is also available to fund our needs in the U.S. on a short-term basis through short-term loans, without being subject to U.S. tax.

Under the Internal Revenue Code, these loans are permitted to be outstanding for 30 days or less and the total of all such loans is required to be

outstanding for less than 60 days during the year. If we were to repatriate this cash, we would be subject to additional U.S. income taxes and

foreign withholding taxes.

COMMITTED UNUSED CREDIT LINES

December 31 (In billions) 2015

Revolving credit agreements (exceeding one year) $ 24.5

Revolving credit agreements (364-day line)(a) 21.1

Total(b) $ 45.6

(a) Included $20.9 billion that contains a term-out feature that allows us to extend borrowings for two years from the date on which such borrowings

would otherwise be due.

(b) Total committed unused credit lines were extended to us by 48 financial institutions but can be drawn on and lent to GE Capital.

In conjunction with the GE Capital Exit Plan, we are currently evaluating the amount of credit lines we require in the future.

FUNDING PLAN

We reduced our Capital ENI, excluding liquidity*, to $82 billion at December 31, 2015.

During the first quarter of 2015, GE Capital completed issuances of $8.1 billion of senior unsecured debt (excluding securitizations

described below) with maturities up to 10 years.

COMMERCIAL PAPER

(In billions) GE GE Capital

A

verage commercial paper borrowings during the fourth quarter of 2015 $ 13.8 $ 9.2

Maximum commercial paper borrowings outstanding during the fourth quarter of 2015 16.8 12.7

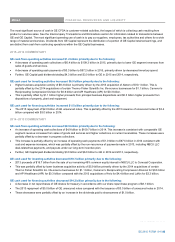

GE Capital commercial paper maturities have historically been funded principally through new commercial paper issuances and at GE

are substantially repaid before quarter-end using indefinitely reinvested overseas cash, which as discussed above, is available for use

in the U.S. on a short-term basis without being subject to U.S. tax. As of December 31, 2015, GE Capital reduced the outstanding

commercial paper to $5 billion, consistent with the announced GE Capital Exit Plan.

We securitize financial assets as an alternative source of funding. During the first twelve months of 2015, we completed $2.1 billion of

non-recourse issuances and $3.4 billion of non-recourse borrowings matured. At December 31, 2015, consolidated non-recourse

securitization borrowings were $3.1 billion.

*Non-GAAP Financial Measure

80 GE 2015 FORM 10-K