Frontier Communications 2004 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SHAREHOLDER INFORMATION

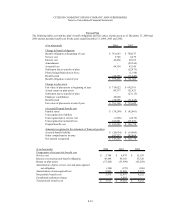

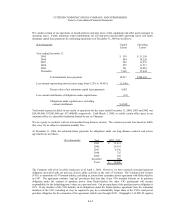

STOCK MARKET INFORMATION

On February 24, 1992, Citizens Utilities commenced trading on the New York Stock Exchange (NYSE) under

the symbols CZNA and CZNB for Series A and Series B Common Stock, respectively. Effective August 25, 1997,

Citizens Common Stock Series A and Citizens Common Stock Series B were combined into a single series common

stock trading on the NYSE under the symbol CZN. Citizens Equity Providing Preferred Income Convertible Securities

(EPPICS) trade on the NYSE under the symbol CZN_P.

On May 18, 2000, the shareholders of the company approved a name change from Citizens Utilities Company

to Citizens Communications Company. The approval does not affect certificates issued by or on behalf of Citizens

Utilities.

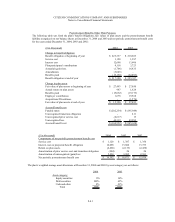

COMMON STOCK

Historical information

Citizens declared and issued quarterly stock dividends on its common stock based on the number of whole shares

owned on the record date for that dividend. Under current statutes and regulations, stock dividends are not taxable

when received and are treated as capital transactions for federal income tax purposes, when sold. Gain or loss is based

on the difference between sales price and adjusted basis per share.

Effective with the first quarter of 1999, Citizens discontinued paying stock dividends on its common stock. As

a result, the Stock Dividend Sale Plan is inactive.

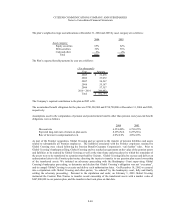

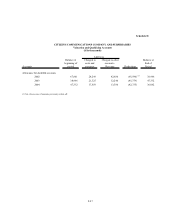

Cash dividends

In July 2004, Citizens Communications announced that it would begin to pay a cash dividend of 25 cents per

quarter per share of common stock held by a shareholder as of the record date. In 2004, a special dividend of $2 per

common share, and a quarterly dividend of 25 cents per common share, were paid on September 2, 2004 to shareholders

of record on August 18, 2004. On December 31, 2004, a dividend of 25 cents per share was paid to shareholders of

record on December 10, 2004. The company believes that all dividends paid in 2004 were ordinary dividends for federal

income tax purposes.

Book Entry

Book entry provides registered shareholders of Citizens Common Stock with statements reflecting the number

of shares credited to their accounts as a result of stock dividends and purchases. A shareholder may receive certificates

representing his or her stock dividends and/or purchases by completing the reverse side of the quarterly statement and

mailing it, or a written request, to the company’s stock transfer agent, Illinois Stock Transfer Company.

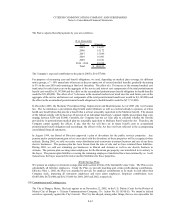

Direct Stock Purchase and Sale Plan

Registered shareholders may enroll in Citizens’ Direct Stock Purchase and Sale Plan. Street name shareholders

may participate in the Plan if their brokers or custodial institutions establish procedures permitting them to do so. The

Plan provides shareholders with a convenient method for purchasing additional shares of Citizens Common Stock by

making optional cash payments.

Under the Plan, the price shareholders pay for Citizens Common Stock is based on an average market price during

the purchase period and includes a commission of two cents per share if the shares are purchased on the open market.

There is currently a $6 transaction fee to purchase stock through the Plan. The Plan also provides shareholders with

a way to sell shares of Citizens stock. There is a fee of $15 and a two cents per share commission for each sales

transaction. For information and/or an enrollment form for this Plan, please contact Illinois Stock Transfer Company.

Stock Safekeeping Program

The Stock Safekeeping Program is voluntary and allows shareholders to mail their stock certificates to Citizens’

transfer agent, Illinois Stock Transfer Company. Upon receipt, Illinois Stock Transfer Company credits the

shareholder’s account with the appropriate number of book entry shares, cancels the actual certificates, and issues a

statement reflecting the transaction. A shareholder requiring certificates for sale or pledge may request them in writing

(by mail or fax) at any time from the transfer agent. For more information about this program, please contact Illinois

Stock Transfer Company.