Frontier Communications 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

33

million in 2002, partially offset by a net loss on sales of assets in 2003 of $20.5 million, compared with the prior year’s gain

of $9.8 million, primarily due to the sales of The Gas Company in Hawaii and our Arizona gas and electric divisions, the sale

of access lines in North Dakota and our wireless partnership interest in Wisconsin, and the sale of our Plano, Texas office

building. During 2003, we executed a series of purchases in the open market of our outstanding notes and debentures that

generated a pre-tax loss from the early extinguishment of debt of approximately $3.1 million.

Interest Expense

Interest expense for the year ended December 31, 2004 decreased $37.5 million, or 9%, as compared with the prior year

primarily due to the retirement of debt. During the year ended December 31, 2004, we had average long-term debt (excluding

equity units and convertible preferred stock) outstanding of $4.2 billion compared to $4.6 billion during the year ended

December 31, 2003. Our composite average borrowing rate for the year ended December 31, 2004 as compared with the

prior year period was 11 basis points lower, decreasing from 8.07% to 7.96%.

Interest expense for the year ended December 31, 2003 decreased $51.7 million, or 11%, as compared with the prior year

primarily due to the retirement of debt partially offset by higher average interest rates. During the year ended December 31,

2003, we had average long-term debt (excluding equity units and convertible preferred stock) outstanding of $4.6 billion

compared to $5.2 billion during the year ended December 31, 2002. Our weighted average borrowing rate for the year ended

December 31, 2003 as compared with the prior year period was 20 basis points higher, increasing from 7.87% to 8.07%, due

to the repayment of debt with interest rates below our average rate.

Income Taxes

Income taxes for the year ended December 31, 2004 decreased $53.8 million, or 80%, as compared with the prior year

primarily due to changes in taxable income (loss). Income tax benefit for the year ended December 31, 2003 increased

$482.1 million as compared with the prior year primarily due to changes in taxable income (loss). The effective tax rate for

2004 is 15.6% as compared with an effective tax rate of 34.4% for 2003. Our effective tax rate has declined as a result of the

completion of audits with federal and state taxing authorities during 2004 and changes in the structure of certain of our

subsidiaries.

During the first quarter of 2003, as a result of our adoption of SFAS No. 143, “Accounting for Asset Retirement Obligations,”

we recognized an after tax non-cash gain of approximately $65.8 million. During the first quarter of 2002, as a result of our

adoption of SFAS No. 142, “Goodwill and Other Intangible Assets,” we recognized a transitional impairment loss of $39.8

million for goodwill related to ELI (see Note 2 to Consolidated Financial Statements).

On January 15, 2002, we completed the sale of our water and wastewater operations for $859.1 million in cash and $122.5

million of assumed debt and other liabilities. The gain on the disposal of the water segment, net of tax, was $181.4 million.

($ in thousands) 2003 2002

Amount Amount

Cumulative effect of change in accounting

principle 65,769$ (39,812)$

CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING PRINCIPLE

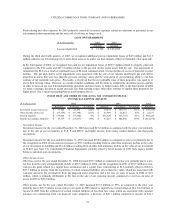

($ in thousands) 2002

Amount

Revenue 4,650$

Operating income (loss) (415)$

Income (loss) from discontinued operations,

net of tax (1,478)$

Gain on disposal of water segment, net of tax 181,369$

DISCONTINUED OPERATIONS