Frontier Communications 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-25

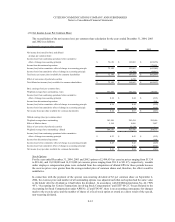

We have included the following description to provide readers a comparative analysis of the accounting impact of this

standard. Both the Trust and the Partnership have been consolidated from the date of their creation through December

31, 2003. As a result of the new consolidation standards established by FIN 46R, the Company, effective January 1,

2004, deconsolidated the activities of the Trust and the Partnership. We have highlighted the comparative effect of this

change in the following table:

(1) Represents a cash balance on the books of the Partnership that is removed as a result of the deconsolidation.

(2) Represents Citizens’ investments in the Partnership and the Trust. At December 31, 2003, these investments were

eliminated in consolidation against the equity of the Partnership and the Trust.

(3) As a result of the deconsolidation, the Trust and the Partnership balance sheets were removed, leaving debt issued

by Citizens to the Partnership in the amount of $211,756,000. The nominal effect of an increase in debt of

$10,506,000 is debt that is “intercompany.” As of December 31, 2004, Citizens has $53,259,000 ($63,765,000 less

$10,506,000 of intercompany debt) of debt outstanding to third parties and will continue to pay interest on that

amount at 5%.

(4) Represents interest income to be paid by the Partnership and the Trust to Citizens for its investments noted in (2)

above. The Partnership and the Trust have no source of cash except as provided by Citizens. Interest is payable at

the rate of 5% per annum.

(5) Represents interest expense on the convertible debentures issued by Citizens to the Partnership. Interest is payable

at the rate of 5% per annum.

(6) As a result of the deconsolidation of the Trust, previously reported dividends on the convertible preferred securities

issued to the public by the Trust are removed and replaced by the interest accruing on the debt issued by Citizens to

the Partnership. Citizens remains the guarantor of the EPPICS debt and continues to be the sole source of cash for

the Trust to pay dividends.

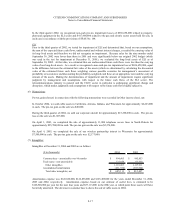

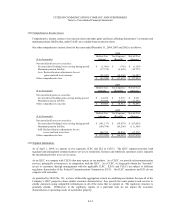

(17) Capital Stock:

We are authorized to issue up to 600,000,000 shares of Common Stock. The amount and timing of dividends payable

on Common Stock are within the sole discretion of our Board of Directors.

(18) Stock Plans:

At December 31, 2004, we have five stock based compensation plans, which are described below. We apply APB

Opinion No. 25 and related interpretations in accounting for the employee stock plans resulting in the use of the intrinsic

value to value the stock option. Compensation cost has not generally been recognized in the financial statements for

options issued pursuant to the Management Equity Incentive Plan (MEIP), the 1996 Equity Incentive Plan (1996 EIP) or

the Amended and Restated 2000 Equity Incentive Plan (2000 EIP), as the exercise price for such options was equal to

the market price of the stock at the time of grant. However, during 2002 the expiration date of approximately 79,000

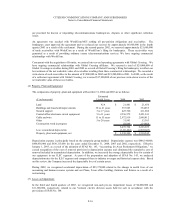

Balance Sheet

($ in thousands) December 31, 2003 December 31, 2004 Change

Assets:

Cash 2,103$ -$ (2,103)$ (1)

Investments - 12,645 12,645 (2)

Liabilities:

Long-term debt - 63,765 (3)

EPPICS 201,250 - (3)

Statement of Operations

($ in thousands) December 31, 2003 December 31, 2004 Change

Investment income -$ 632$ 632$ (4)

Interest expense - 8,082 8,082 (5)

Dividends on EPPICS (before tax) 10,063 - (10,063) (6)

Net 10,063$ 7,450$ (2,613)$

As of

As reported for the year ended

(137,485) (3)