Frontier Communications 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-24

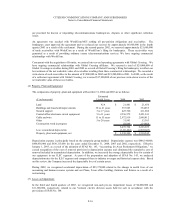

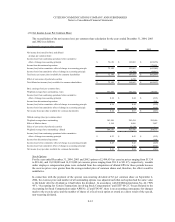

(15) Other Income (Loss), net:

The components of other income (loss), net for the years ended December 31, 2004, 2003 and 2002 are as follows:

During 2004, 2003 and 2002, we recognized income in connection with certain retained liabilities associated with

customer advances for construction from our disposed water properties, as a result of some of these liabilities

terminating. During 2003, we recognized gains in connection with the termination/restructuring of capital leases at ELI.

Gain (loss) on sale of assets in 2004 is primarily attributable to the loss on the sale of our corporate aircraft during the

third quarter. In 2003, the amount represents the sales of The Gas Company in Hawaii and our Arizona gas and electric

divisions, access lines in North Dakota and our wireless partnership interest in Wisconsin, and our Plano, Texas office

building. Other, net for 2002 includes a $12,800,000 loss related to a tender offer completed in 2002 with respect to our

6.80% Debentures due 2026 (puttable at par in 2003) and ELI’s 6.05% Guaranteed Notes due 2004.

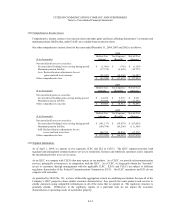

(16) Company Obligated Mandatorily Redeemable Convertible Preferred Securities:

In 1996, our consolidated wholly-owned subsidiary, Citizens Utilities Trust (the Trust), issued, in an underwritten public

offering, 4,025,000 shares of 5% Company Obligated Mandatorily Redeemable Convertible Preferred Securities due

2036 (EPPICS), representing preferred undivided interests in the assets of the Trust, with a liquidation preference of $50

per security (for a total liquidation amount of $201,250,000). These securities have an adjusted conversion price of

$11.46 per Citizens common share. The conversion price was reduced from $13.30 to $11.46 during the third quarter of

2004 as a result of the $2.00 per share special, non-recurring dividend. The proceeds from the issuance of the Trust

Convertible Preferred Securities and a Company capital contribution were used to purchase $207,475,000 aggregate

liquidation amount of 5% Partnership Convertible Preferred Securities due 2036 from another wholly-owned subsidiary,

Citizens Utilities Capital L.P. (the Partnership). The proceeds from the issuance of the Partnership Convertible

Preferred Securities and a Company capital contribution were used to purchase from us $211,756,000 aggregate

principal amount of 5% Convertible Subordinated Debentures due 2036. The sole assets of the Trust are the Partnership

Convertible Preferred Securities, and our Convertible Subordinated Debentures are substantially all the assets of the

Partnership. Our obligations under the agreements related to the issuances of such securities, taken together, constitute a

full and unconditional guarantee by us of the Trust’s obligations relating to the Trust Convertible Preferred Securities

and the Partnership’s obligations relating to the Partnership Convertible Preferred Securities.

In accordance with the terms of the issuances, we paid the annual 5% interest in quarterly installments on the

Convertible Subordinated Debentures in the four quarters of 2004, 2003 and 2002. Only cash was paid (net of

investment returns) to the Partnership in payment of the interest on the Convertible Subordinated Debentures. The cash

was then distributed by the Partnership to the Trust and then by the Trust to the holders of the EPPICS.

As of December 31, 2004, EPPICS representing a total principal amount of $147,991,000 had been converted into

11,622,749 shares of Citizens common stock.

We have adopted the provisions of FIN 46R (revised December 2003) (“FIN 46R”), “Consolidation of Variable Interest

Entities,” effective January 1, 2004. We have not restated prior periods.

($ in thousands) 2004 2003 2002

Gain on capital lease termination/restructuring - 69,512 -

Gain on expiration/settlement of customer advances 25,345 6,165 26,330

(Premium) discount on debt repurchases (66,480) (10,851) 5,550

Gain (loss) on sale of assets (1,945) (20,492) 9,798

Other, net (10,279) (345) (19,141)

Total other income (loss), net (53,359)$ 43,989$ 22,537$