Frontier Communications 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-16

are provided for known or impending telecommunications bankruptcies, disputes or other significant collection

issues.

An agreement was reached with WorldCom/MCI settling all pre-petition obligations and receivables. The

bankruptcy court approved the agreement and we reduced our reserves by approximately $6,600,000 in the fourth

quarter 2003 as a result of the settlement. During the second quarter 2002, we reserved approximately $21,600,000

of trade receivables with WorldCom as a result of WorldCom’s filing for bankruptcy. These receivables were

generated as a result of providing ordinary course telecommunications services. We have ongoing commercial

relationships with WorldCom.

Concurrent with the acquisition of Frontier, we entered into several operating agreements with Global Crossing. We

have ongoing commercial relationships with Global Crossing affiliates. We reserved a total of $29,000,000 of

Global Crossing receivables during 2001 and 2002 as a result of Global Crossing’s filing for bankruptcy to reflect our

best estimate of the net realizable value of receivables resulting from these commercial relationships. We recorded a

write-down of such receivables in the amount of $7,800,000 in 2002 and $21,200,000 in 2001. In 2002, as the result

of a settlement agreement with Global Crossing, we reversed $17,900,000 of our previous write-down reserve of the

net realizable value of these receivables.

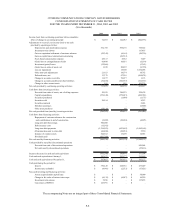

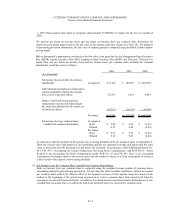

(4) Property, Plant and Equipment:

The components of property, plant and equipment at December 31, 2004 and 2003 are as follows:

Depreciation expense is principally based on the composite group method. Depreciation expense was $446,190,000,

$468,438,000 and $630,113,000 for the years ended December 31, 2004, 2003 and 2002, respectively. Effective

January 1, 2003, as a result of the adoption of SFAS No. 143, “Accounting for Asset Retirement Obligations,” we

ceased recognition of the cost of removal provision in depreciation expense and eliminated the cumulative cost of

removal included in accumulated depreciation. In addition, we increased the average depreciable lives for certain of

our equipment in our ILEC segment. As part of the preparation and adoption of SFAS No. 143, we analyzed

depreciation rates for the ILEC segment and compared them to industry averages and historical expense data. Based

on this review, the Company increased the depreciable lives of certain assets.

During 2002, we recognized accelerated depreciation of $23,379,000 related to the change in useful lives of our

accounting and human resource systems and our Plano, Texas office building, furniture and fixtures as a result of a

restructuring.

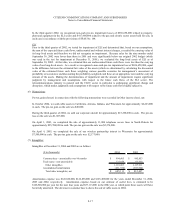

(5) Losses on Impairment:

In the third and fourth quarters of 2003, we recognized non-cash pre-tax impairment losses of $4,000,000 and

$11,300,000, respectively, related to our Vermont electric division assets held for sale in accordance with the

provisions of SFAS No. 144.

Estimated

($ in thousands) Useful Lives 2004 2003

Land N/A 21,481$ 21,650$

Buildings and leasehold improvements 30 to 41 years 357,983 354,855

General support 3 to 17 years 425,720 411,660

Central office/electronic circuit equipment 5 to 11 years 2,536,579 2,421,341

Cable and wire 15 to 55 years 2,972,919 2,848,412

Other 5 to 20 years 31,993 53,303

Construction work in progress 93,049 114,988

6,439,724 6,226,209

Less: accumulated depreciation (3,101,424) (2,695,667)

Property, plant and equipment, ne

t

3,338,300$ 3,530,542$