Frontier Communications 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

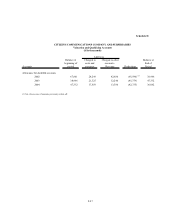

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-37

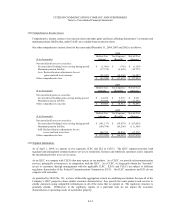

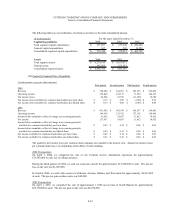

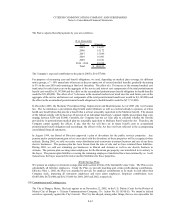

On April 4, 2003, we completed the sale of our wireless partnership interest in Wisconsin for approximately

$7,500,000 in cash. The pre-tax gain on the sale was $2,173,000.

On August 8, 2003, we completed the sale of The Gas Company in Hawaii division for $119,290,000 in cash and

assumed liabilities. The initial pre-tax loss on the sale was $18,480,000 recognized in the third quarter of 2003. We

recognized an additional loss on the sale of $700,000 in the fourth quarter of 2003 due to customary sale price

adjustments.

On August 11, 2003, we completed the sale of our Arizona gas and electric divisions for $224,100,000 in cash. The

initial pre-tax loss on the sale was $12,791,000 recognized in the third quarter of 2003. We recognized an additional

loss on the sale of $5,700,000 in the fourth quarter of 2003 due to customary sale price adjustments.

In the third quarter 2003, we recognized a non-cash pre-tax impairment loss of $4,000,000 related to the electric

sector assets held for sale, in accordance with the provisions of SFAS No. 144.

In the fourth quarter 2003, we recognized an additional non-cash pre-tax impairment loss of $11,300,000 related to

the electric sector assets held for sale, in accordance with the provisions of SFAS No. 144.

On December 2, 2003, we completed the sale of substantially all of our Vermont electric division’s transmission assets

for $7,344,000 in cash (less $1,837,000 in refunds to customers per an order by the Vermont Public Service Board).

In the fourth quarter 2003, we reduced our reserve for telecommunications bankruptcies by approximately

$6,600,000 as a result of a settlement with WorldCom/MCI.

Restructuring and other expenses in 2003 primarily consist of severance expenses related to reductions in personnel at

our telecommunications operations and the write-off of software no longer useful.

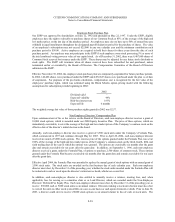

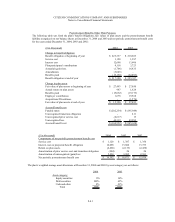

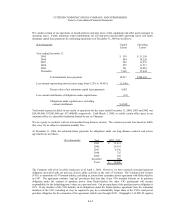

(25) Retirement Plans:

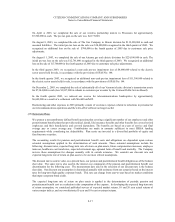

We sponsor a noncontributory defined benefit pension plan covering a significant number of our employees and other

postretirement benefit plans that provide medical, dental, life insurance benefits and other benefits for covered retired

employees and their beneficiaries and covered dependents. The benefits are based on years of service and final

average pay or career average pay. Contributions are made in amounts sufficient to meet ERISA funding

requirements while considering tax deductibility. Plan assets are invested in a diversified portfolio of equity and

fixed-income securities.

The accounting results for pension and postretirement benefit costs and obligations are dependent upon various

actuarial assumptions applied in the determination of such amounts. These actuarial assumptions include the

following: discount rates, expected long-term rate of return on plan assets, future compensation increases, employee

turnover, healthcare cost trend rates, expected retirement age, optional form of benefit and mortality. The Company

reviews these assumptions for changes annually with its outside actuaries. We consider our discount rate and

expected long-term rate of return on plan assets to be our most critical assumptions.

The discount rate is used to value, on a present basis, our pension and postretirement benefit obligation as of the balance

sheet date. The same rate is also used in the interest cost component of the pension and postretirement benefit cost

determination for the following year. The measurement date used in the selection of our discount rate is the balance

sheet date. Our discount rate assumption is determined annually with assistance from our actuaries based on the interest

rates for long-term high quality corporate bonds. This rate can change from year-to-year based on market conditions

that impact corporate bond yields.

The expected long-term rate of return on plan assets is applied in the determination of periodic pension and

postretirement benefit cost as a reduction in the computation of the expense. In developing the expected long-term rate

of return assumption, we considered published surveys of expected market returns, 10 and 20 year actual returns of

various major indices, and our own historical 5-year and 10-year investment returns.