Frontier Communications 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

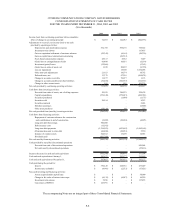

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-18

(8) Discontinued Operations and Net Assets Held for Sale:

On August 24, 1999, our Board of Directors approved a plan of divestiture for our public utilities services businesses,

which included our water, gas and electric businesses. All of these properties have been sold.

Water and Wastewater

On January 15, 2002, we completed the sale of our water and wastewater operations for $859,100,000 in cash

and $122,500,000 of assumed debt and other liabilities. The pre-tax gain on the disposal of the water segment

was $316,700,000.

Discontinued operations in the consolidated statements of operations reflect the results of operations of the

water/wastewater properties sold in January 2002 including allocated interest expense for the periods presented.

Interest expense was allocated to the discontinued operations based on the outstanding debt specifically identified

with these businesses.

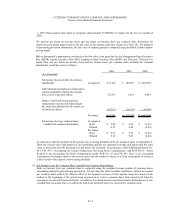

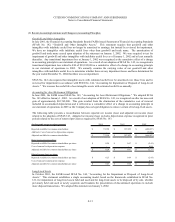

Summarized financial information for the water/wastewater operations (discontinued operations) is set forth below:

Electric and Gas

On April 1, 2004, we completed the sale of our Vermont electric distribution operations for approximately

$13,992,000 in cash, net of selling expenses.

On December 2, 2003, we completed the sale of substantially all of our Vermont electric division’s transmission

assets for $7,344,000 in cash (less $1,837,000 in refunds to customers as ordered by the Vermont Public Service

Board). Losses on the sales of our Vermont properties were included in the impairment charges recorded during

2003.

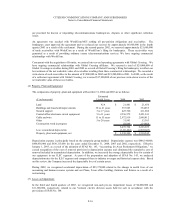

Pre-tax gains/(losses) in connection with the following transactions were included in Other income (loss), net:

On August 8, 2003, we completed the sale of The Gas Company in Hawaii division for $119,290,000 in cash and

assumed liabilities. The pre-tax loss on the sale recognized in 2003 was $19,180,000.

On August 11, 2003, we completed the sale of our Arizona gas and electric divisions for $224,100,000 in cash. The

pre-tax loss on the sale recognized in 2003 was $18,491,000.

On November 1, 2002, we completed the sale of our Kauai electric division for $215,000,000 in cash.

On July 2, 2001, we completed the sale of our Louisiana Gas operations for $363,436,000 in cash.

On November 30, 2001, we sold our Colorado Gas division for approximately $8,900,000 in cash after purchase

price adjustments.

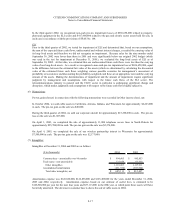

( $ in thousands) For the year ended

December 31, 2002

Revenue 4,650$

Operating loss (415)$

Income tax benefit (554)$

Net loss (1,478)$

Gain on disposal of water segment, net of tax 181,369$