Frontier Communications 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

20

(Trust Convertible Preferred Securities or EPPICS), representing preferred undivided interests in the assets of the Trust, with

a liquidation preference of $50 per security (for a total liquidation amount of $201.3 million). These securities have an

adjusted conversion price of $11.46 per Citizens common share. The conversion price was reduced from $13.30 to $11.46

during the third quarter of 2004 as a result of the $2.00 per share special, non-recurring dividend. The proceeds from the

issuance of the Trust Convertible Preferred Securities and a Company capital contribution were used to purchase $207.5

million aggregate liquidation amount of 5% Partnership Convertible Preferred Securities due 2036 from another wholly

owned consolidated subsidiary, Citizens Utilities Capital L.P. (the Partnership). The proceeds from the issuance of the

Partnership Convertible Preferred Securities and a Company capital contribution were used to purchase from us $211.8

million aggregate principal amount of 5% Convertible Subordinated Debentures due 2036. The sole assets of the Trust are

the Partnership Convertible Preferred Securities, and our Convertible Subordinated Debentures are substantially all the assets

of the Partnership. Our obligations under the agreements related to the issuances of such securities, taken together, constitute

a full and unconditional guarantee by us of the Trust’s obligations relating to the Trust Convertible Preferred Securities and

the Partnership’s obligations relating to the Partnership Convertible Preferred Securities.

In accordance with the terms of the issuances, we paid the annual 5% interest in quarterly installments on the Convertible

Subordinated Debentures in 2004, 2003 and 2002. Only cash was paid (net of investment returns) to the Partnership in

payment of the interest on the Convertible Subordinated Debentures. The cash was then distributed by the Partnership to the

Trust and then by the Trust to the holders of the EPPICS.

As of December 31, 2004, EPPICS representing a total principal amount of $148.0 million had been converted into 11,622,749

shares of Citizens common stock, and a total of $53.3 million EPPICS remains outstanding.

We have adopted the provisions of FASB Interpretation No. 46R (revised December 2003) (“FIN 46R”), “Consolidation of

Variable Interest Entities,” effective January 1, 2004. We have not restated prior periods.

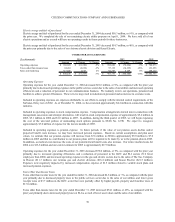

We have included the following description to provide readers a comparative analysis of the accounting impact of this standard.

Both the Trust and the Partnership have been consolidated from the date of their creation through December 31, 2003. As a result

of the new consolidation standards established by FIN 46R, the Company, effective January 1, 2004, deconsolidated the activities

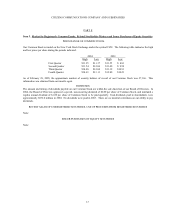

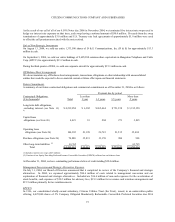

of the Trust and the Partnership. We have highlighted the comparative effect of this change in the following table:

(1) Represents a cash balance on the books of the Partnership that is removed as a result of the deconsolidation.

(2) Represents Citizens’ investments in the Partnership and the Trust. At December 31, 2003, these investments

were eliminated in consolidation against the equity of the Partnership and the Trust.

(3) As a result of the deconsolidation, the Trust and the Partnership balance sheets were removed, leaving debt

issued by Citizens to the Partnership in the amount of $211.8 million. The nominal effect of an increase in

Balance Sheet

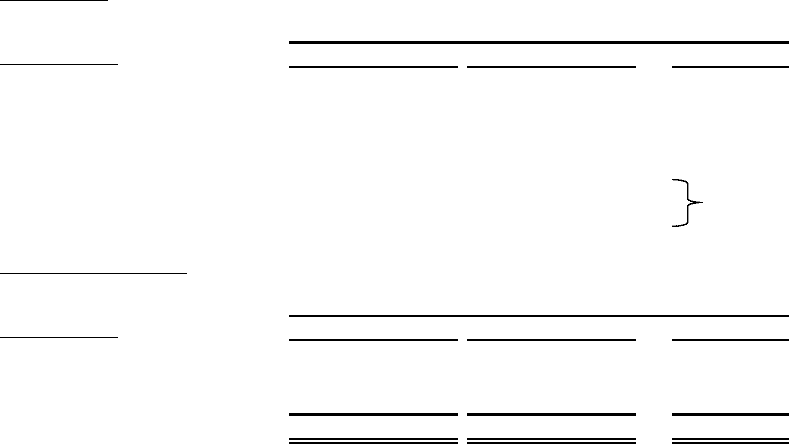

($ in thousands) December 31, 2003 December 31, 2004 Change

Assets:

Cash 2,103$ -$ (2,103)$ (1)

Investments - 12,645 12,645 (2)

Liabilities:

Long-term debt - 63,765 (3)

EPPICS 201,250 - (3)

Statement of Operations

($ in thousands) December 31, 2003 December 31, 2004 Change

Investment income -$ 632$ 632$ (4)

Interest expense - 8,082 8,082 (5)

Dividends on EPPICS (before tax) 10,063 - (10,063) (6)

Net 10,063$ 7,450$ (2,613)$

As of

As reported for the year ended

(137,485) (3)