Frontier Communications 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

19

As the result of our call of all of our 8.50% Notes due 2006 in November 2004, we terminated five interest rate swaps used to

hedge our interest rate exposure on that issue, each swap having a notional amount of $50.0 million. Proceeds from the swap

terminations of approximately $3.0 million and U.S. Treasury rate lock agreements of approximately $1.0 million were used

to offset the call premium associated with the notes retired.

Sale of Non-Strategic Investments

On August 13, 2004, we sold our entire 1,333,500 shares of D & E Communications, Inc. (D & E) for approximately $13.3

million in cash.

On September 3, 2004, we sold our entire holdings of 2,605,908 common share equivalents in Hungarian Telephone and Cable

Corp. (HTCC) for approximately $13.2 million in cash.

During the third quarter of 2004, we sold our corporate aircraft for approximately $15.3 million in cash.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other relationship with unconsolidated

entities that would be expected to have a material current or future effect upon our financial statements.

Future Commitments

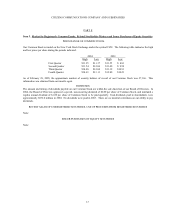

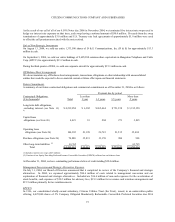

A summary of our future contractual obligations and commercial commitments as of December 31, 2004 is as follows:

Payment due by period

Contractual Obligations: Less than More than

($ in thousands) Total 1 year 1-3 years 3-5 years 5 years

Long-term debt obligations,

excluding interest (see Note 11)

(1)

$ 4,219,054 $ 6,302 $ 265,464 $ 751,938 $ 3,195,350

Capital lease

obligations (see Note 26) 4,421 81 204 271 3,865

Operating lease

obligations (see Note 26) 104,992 21,198 26,765 21,535 35,494

Purchase obligations (see Note 26) 70,880 35,831 33,159 900 990

Other long-term liabilities (2) 63,765 - - - 63,765

Total $ 4,463,112 $ 63,412 $ 325,592 $ 774,644 $ 3,299,464

(1) Includes interest rate swaps ($4.5 million).

(2) Consists of our Equity Providing Preferred Income Convertible Securities (EPPICS) reflected on our balance sheet.

At December 31, 2004, we have outstanding performance letters of credit totaling $22.4 million.

Management Succession and Strategic Alternatives Expenses

On July 11, 2004, our Board of Directors announced that it completed its review of the Company’s financial and strategic

alternatives. In 2004, we expensed approximately $90.6 million of costs related to management succession and our

exploration of financial and strategic alternatives. Included are $36.6 million of non-cash expenses for the acceleration of

stock benefits, cash expenses of $19.2 million for advisory fees, $19.3 million for severance and retention arrangements and

$15.5 million primarily for tax reimbursements.

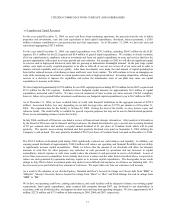

EPPICS

In 1996, our consolidated wholly-owned subsidiary, Citizens Utilities Trust (the Trust), issued, in an underwritten public

offering, 4,025,000 shares of 5% Company Obligated Mandatorily Redeemable Convertible Preferred Securities due 2036