Frontier Communications 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

32

Restructuring and other expenses for 2003 primarily consist of severance expenses related to reductions in personnel at our

telecommunications operations and the write-off of software no longer used.

During the third and fourth quarters of 2003, we recognized additional pre-tax impairment losses of $4.0 million and $11.3

million related to our Vermont property to write down assets to be sold to our best estimate of their net realizable value upon sale.

In the third quarter of 2002, we recognized non-cash pre-tax impairment losses of $656.7 million related to property, plant and

equipment in the ELI sector and $417.4 million related to the gas and electric sector assets held for sale. Our assessment of

impairment for ELI was a result of continued losses at ELI and continued actual revenue declines in excess of projected revenue

declines. The gas and electric sector impairments were associated with the sale of our Arizona and Hawaii gas and electric

properties at prices that were less than the previous carrying values and the write-down of our remaining utility to our best

estimate of net realizable sales price. Previously, we believed that the net realizable value of these properties was equal to or

above their carrying values. However, as a result of market conditions, and the desire to complete the divestiture process quickly

in order to focus on our core telecommunications operations and raise money to further reduce debt, in the third quarter of 2002

we made a strategic decision to accept proceeds less than carrying values rather than continue to market these properties for

higher prices (See Critical Accounting Policies and Estimates above).

Investment Income

Investment income for the year ended December 31, 2004 increased $23.2 million as compared with the prior year primarily

due to the sale of our investments in D & E and HTCC and higher income from money market balances and short-term

investments.

Investment income for the year ended December 31, 2003 increased $108.8 million as compared to prior year primarily due to

the recognition in 2002 of non-cash pre-tax losses of $95.3 million resulting from an other than temporary decline in the value

of our investment in Adelphia and $16.4 million resulting from an other than temporary decline in the value of our investment

in D & E (see Note 9 to Consolidated Financial Statements), partially offset by lower income in 2003 from money market

balances and short-term investments.

Other Income (Loss)

Other loss, net for the year ended December 31, 2004 increased $97.3 million as compared to prior year primarily due to a pre-

tax loss from the early extinguishment of debt of $66.5 million in 2004, and the recognition in 2003 of $69.5 million in non-

cash pre-tax gains related to a capital lease termination and a capital lease restructuring at ELI, partially offset in 2004 by

$25.3 million in income from the expiration of certain retained liabilities at less than face value, which are associated with

customer advances for construction from our disposed water properties and a net loss on sales of assets in 2004 of $1.9

million, which is primarily attributable to the loss on the sale of our corporate aircraft, compared to a net loss on sales of

assets in 2003 of $20.5 million.

Other income, net for the year ended December 31, 2003 increased $21.5 million, or 95%, as compared to the prior year

primarily due to $69.5 million in non-cash pre-tax gains in 2003 related to capital lease restructurings at ELI, $6.2 million of

income in 2003 from the settlement of certain retained liabilities at less than face value, which are associated with customer

advances for construction from our disposed water properties, a decrease of $20.1 million compared to income of $26.3

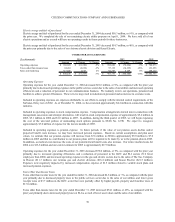

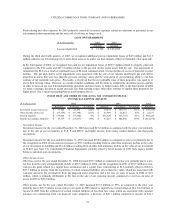

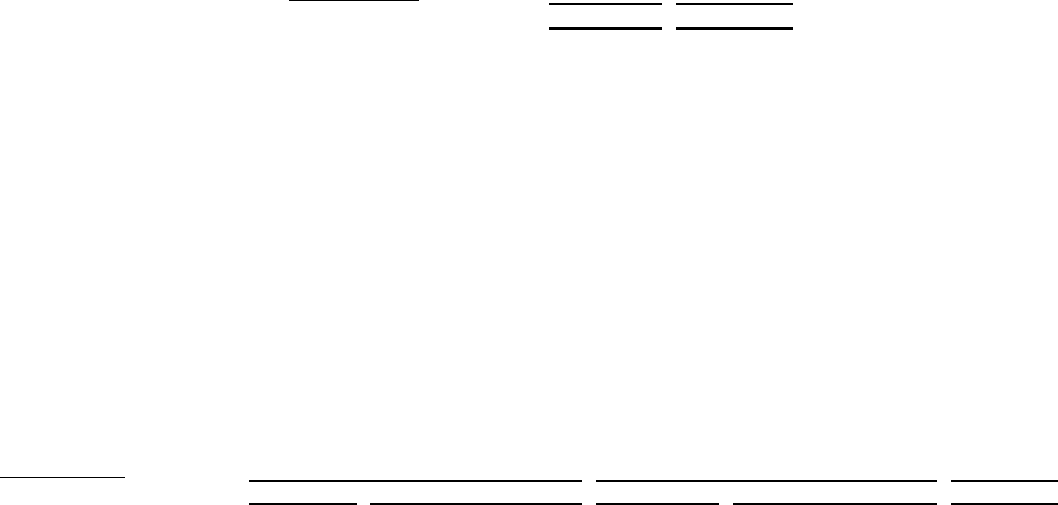

($ in thousands) 2003 2002

Amount Amount

Loss on impairment 15,300$ 1,074,058$

LOSS ON IMPAIRMENT

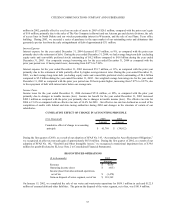

($ in thousands) 2002

Amount $ Change % Change Amount $ Change % Change Amount

Investment income (loss), net 33,626$ 23,194$ 222% 10,432$ 108,791$ 111% (98,359)$

Other income (loss), net (53,359)$ (97,348)$ -221% 43,989$ 21,452$ 95% 22,537$

Interest expense 379,024$ (37,500)$ -9% 416,524$ (51,705)$ -11% 468,229$

Income tax expense (benefit) 13,379$ (53,837)$ -80% 67,216$ 482,090$ 116% (414,874)$

INVESTMENT AND OTHER INCOME (LOSS), NET / INTEREST EXPENSE /

INCOME TAX EXPENSE (BENEFIT)

2004 2003