Frontier Communications 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

21

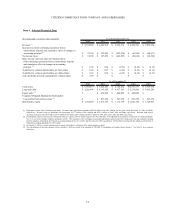

debt of $10.5 million is debt that is “intercompany.” As of December 31, 2004, Citizens has $53.3 million

($63.8 million less $10.5 million of intercompany debt) of debt outstanding to third parties and will continue

to pay interest on that amount at 5%.

(4) Represents interest income to be paid by the Partnership and the Trust to Citizens for its investments noted in

(2) above. The Partnership and the Trust have no source of cash except as provided by Citizens. Interest is

payable at the rate of 5% per annum.

(5) Represents interest expense on the convertible debentures issued by Citizens to the partnership. Interest is

payable at the rate of 5% per annum.

(6) As a result of the deconsolidation of the Trust, previously reported dividends on the convertible preferred

securities issued to the public by the Trust are removed and replaced by the interest accruing on the debt

issued by Citizens to the Partnership. Citizens remains the guarantor of the EPPICS debt and continues to be

the sole source of cash for the Trust to pay dividends.

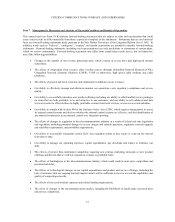

Covenants

The terms and conditions contained in our indentures and credit facilities agreements include the timely and punctual payment

of principal and interest when due, the maintenance of our corporate existence, keeping proper books and records in

accordance with GAAP, restrictions on the allowance of liens on our assets, and restrictions on asset sales and transfers,

mergers and other changes in corporate control. We currently have no restrictions on the payment of dividends either by

contract, rule or regulation.

Our $200.0 million term loan facility with the Rural Telephone Finance Cooperative (RTFC) contains a maximum leverage ratio

covenant. Under the leverage ratio covenant, we are required to maintain a ratio of (i) total indebtedness minus cash and cash

equivalents in excess of $50.0 million to (ii) consolidated adjusted EBITDA (as defined in the agreements) over the last four

quarters no greater than 4.25 to 1 through December 30, 2004, and 4.00 to 1 thereafter.

Our new $250 million credit facility contains a maximum leverage ratio covenant. Under the leverage ratio covenant, we are

required to maintain a ratio of (i) total indebtedness minus cash and cash equivalents in excess of $50.0 million to (ii)

consolidated adjusted EBITDA (as defined in the agreement) over the last four quarters no greater than 4.50 to 1. Although the

new credit facility is unsecured, it will be equally and ratably secured by certain liens and equally and ratably guaranteed by

certain of our subsidiaries if we issue debt that is secured or guaranteed. We are in compliance with all of our debt and credit

facility covenants.

Divestitures

On August 24, 1999, our Board of Directors approved a plan of divestiture for our public utilities services businesses, which

included gas, electric and water and wastewater businesses. As of April 1, 2004, we sold all of these properties. All of the

agreements relating to the sales provide that we will indemnify the buyer against certain liabilities (typically liabilities relating

to events that occurred prior to sale), including environmental liabilities, for claims made by specified dates and that exceed

threshold amounts specified in each agreement.

On January 15, 2002, we sold our water and wastewater services operations for $859.1 million in cash and $122.5 million in

assumed debt and other liabilities.

On October 31, 2002, we completed the sale of approximately 4,000 access lines in North Dakota for approximately $9.7 million

in cash.

On November 1, 2002, we completed the sale of our Kauai electric division for $215.0 million in cash.

On April 1, 2003, we completed the sale of approximately 11,000 access lines in North Dakota for approximately $25.7

million in cash.

On April 4, 2003, we completed the sale of our wireless partnership interest in Wisconsin for approximately $7.5 million in

cash.

On August 8, 2003, we completed the sale of The Gas Company in Hawaii division for $119.3 million in cash and assumed

liabilities.

On August 11, 2003, we completed the sale of our Arizona gas and electric divisions for $224.1 million in cash.