Frontier Communications 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-39

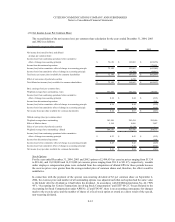

Pension Plan

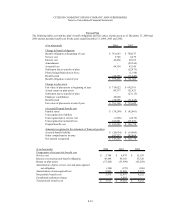

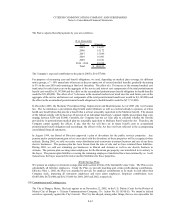

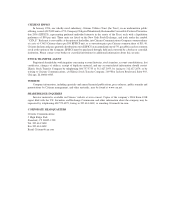

The following tables set forth the plan’s benefit obligations and fair values of plan assets as of December 31, 2004 and

2003 and net periodic benefit cost for the years ended December 31, 2004, 2003 and 2002.

($ in thousands) 2004 2003

Change in benefit obligation

Benefit obligation at beginning of year 761,683$ 780,237$

Service cost 5,748 6,479

Interest cost 46,468 49,103

Amendments - (22,164)

Actuarial loss 44,350 43,146

Settlement due to transfer of plan - (22,475)

Plant closings/Reduction in force - (1,198)

Benefits paid (58,791) (71,445)

Benefit obligation at end of yea

r

799,458$ 761,683$

Change in plan assets

Fair value of plan assets at beginning of year 719,622$ 692,361$

Actual return on plan assets 80,337 121,821

Settlement due to transfer of plan - (23,115)

Employer contribution 20,000 -

Benefits paid (58,791) (71,445)

Fair value of plan assets at end of yea

r

761,168$ 719,622$

(Accrued)/Prepaid benefit cost

Funded status (38,290)$ (42,061)$

Unrecognized net liability - -

Unrecognized prior service cost (1,988) (2,232)

Unrecognized net actuarial loss 183,481 171,071

Prepaid benefit cos

t

143,203$ 126,778$

Amounts recognized in the statement of financial position

Accrued benefit liability (20,034)$ (19,086)$

Other comprehensive income 163,237 145,864

Net amount recognized 143,203$ 126,778$

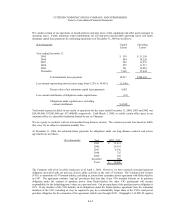

($ in thousands) 2004 2003 2002

Components of net periodic benefit cost

Service cost 5,748$ 6,479$ 12,159$

Interest cost on projected benefit obligation 46,468 49,103 53,320

Return on plan assets (57,203) (53,999) (63,258)

Amortization of prior service cost and unrecognized

net obligation (244) (172) (106)

Amortization of unrecognized loss 8,806 11,026 2,137

Net periodic benefit cost 3,575 12,437 4,252

Curtailment/settlement charge - 6,585 -

Total periodic benefit cos

t

3,575$ 19,022$ 4,252$