Frontier Communications 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

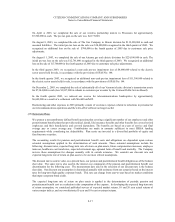

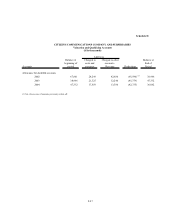

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-42

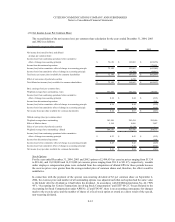

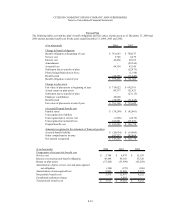

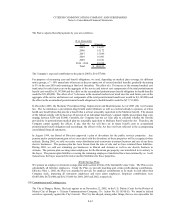

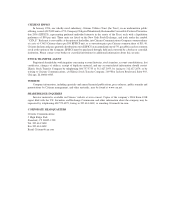

The Plan’s expected benefit payments by year are as follows:

The Company’s expected contribution to the plan in 2005 is $14,477,000.

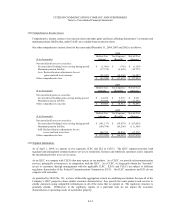

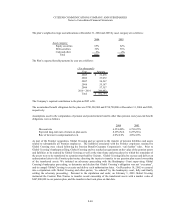

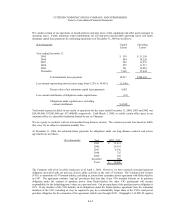

For purposes of measuring year-end benefit obligations, we used, depending on medical plan coverage for different

retiree groups, a 7 - 10% annual rate of increase in the per-capita cost of covered medical benefits, gradually decreasing

to 5% in the year 2010 and remaining at that level thereafter. The effect of a 1% increase in the assumed medical cost

trend rates for each future year on the aggregate of the service and interest cost components of the total postretirement

benefit cost would be $1,397,000 and the effect on the accumulated postretirement benefit obligation for health benefits

would be $21,428,000. The effect of a 1% decrease in the assumed medical cost trend rates for each future year on the

aggregate of the service and interest cost components of the total postretirement benefit cost would be $(1,145,000) and

the effect on the accumulated postretirement benefit obligation for health benefits would be $(17,711,000).

In December 2003, the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (the Act) became

law. The Act introduces a prescription drug benefit under Medicare as well as a federal subsidy to sponsors of retiree

health care benefit plans that provide a benefit that is at least actuarially equivalent to the Medicare benefit. The amount

of the federal subsidy will be based on 28 percent of an individual beneficiary’s annual eligible prescription drug costs

ranging between $250 and $5,000. Currently, the Company has not yet been able to conclude whether the benefits

provided by its postretirement medical plan are actuarially equivalent to Medicare Part D under the Act. Therefore, the

Company cannot quantify the effects, if any, that the Act will have on its future benefit costs or accumulated

postretirement benefit obligation and accordingly, the effects of the Act have not been reflected in the accompanying

consolidated financial statements.

In August 1999, our Board of Directors approved a plan of divestiture for the public services properties. Any

pension and/or postretirement gain or loss associated with the divestiture of these properties will be recognized when

realized. During 2002, we sold our entire water distribution and wastewater treatment business and one of our three

electric businesses. The pension plan has been frozen from the date of sale and we have retained those liabilities.

During 2003, we sold our remaining gas businesses in Hawaii and Arizona as well as our electric business in

Arizona. The pension plan covering union employees for the Hawaiian gas property was transferred in its entirety to

the buyer. The pension plan liabilities covering the remaining employees transferred have been retained by us. In all

transactions, the buyer assumed the retiree medical liabilities for those properties.

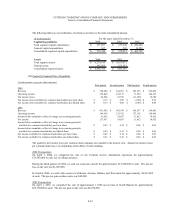

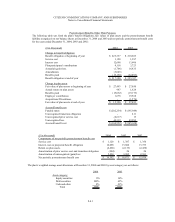

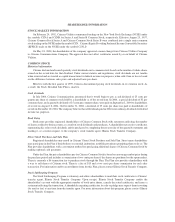

401(k) Savings Plans

We sponsor an employee retirement savings plan under section 401(k) of the Internal Revenue Code. The Plan covers

substantially all full-time employees. Under the Plan, we provide matching and certain profit-sharing contributions.

Effective May 1, 2002, the Plan was amended to provide for employer contributions to be made in cash rather than

Company stock, impacting all non-union employees and most union employees. Employer contributions were

$8,403,000, $9,724,000 and $10,331,000 for 2004, 2003 and 2002, respectively.

(26) Commitments and Contingencies:

The City of Bangor, Maine, filed suit against us on November 22, 2002, in the U.S. District Court for the District of

Maine (City of Bangor v. Citizens Communications Company, Civ. Action No. 02-183-B-S). We intend to defend

ourselves vigorously against the City's lawsuit. The City has alleged, among other things, that we are responsible for

($ in thousands)

Year Amount

2005 14,477$

2006 15,172

2007 15,846

2008 16,401

2009 16,921

2010 - 2014 89,998

Total 168,815$