Frontier Communications 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-23

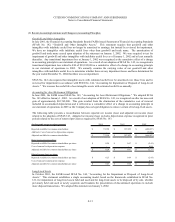

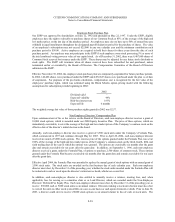

The interest rate swap contracts are reflected at fair value in our consolidated balance sheet and the related portion of

fixed-rate debt being hedged is reflected at an amount equal to the sum of its book value and an amount representing

the change in fair value of the debt obligations attributable to the interest rate risk being hedged. Changes in the fair

value of interest rate swap contracts, and the offsetting changes in the adjusted carrying value of the related portion of

the fixed-rate debt being hedged, are recognized in the consolidated statements of operations in interest expense. The

notional amounts of fixed-rate indebtedness hedged as of December 31, 2004 and December 31, 2003 was

$300,000,000 and $400,000,000, respectively. Such contracts require us to pay variable rates of interest (average pay

rate of approximately 6.12% as of December 31, 2004) and receive fixed rates of interest (average receive rate of

8.44% as of December 31, 2004). The fair value of these derivatives is reflected in other assets as of December 31,

2004, in the amount of $4,466,000 and the related underlying debt has been increased by a like amount. The amounts

received during the year ended December 31, 2004 as a result of these contracts amounted to $9,363,000 and are

included as a reduction of interest expense.

As the result of our call of all of our 8.50% Notes due 2006 in November 2004, we terminated five interest rate swaps

involving an aggregate $250,000,000 notional amount of indebtedness. Proceeds from the swap terminations of

approximately $3,026,000 and U.S. Treasury rate lock agreements of approximately $971,000 were applied against the

cost to retire the debt, resulting in a net premium of approximately $46,277,000 recorded in other income (loss), net.

We do not anticipate any nonperformance by counter parties to our derivative contracts as all counter parties have

investment grade credit ratings.

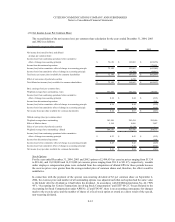

(13) Management Succession and Strategic Alternatives Expenses:

On July 11, 2004, our Board of Directors announced that it had completed its review of the Company’s financial and

strategic alternatives and on September 2, 2004 the Company paid a special, non-recurring dividend of $2 per

common share and a quarterly dividend of $0.25 per common share to shareholders of record on August 18, 2004.

Concurrently, Leonard Tow decided to step down from his position as chief executive officer, effective immediately,

and resigned his position as Chairman of the board on September 27, 2004. The Board of Directors named Mary

Agnes Wilderotter president and chief executive officer, and Rudy J. Graf was elected Chairman of the board, on

September 30, 2004.

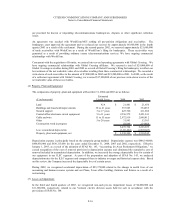

In 2004, we expensed approximately $90,632,000 of costs related to management succession and our exploration of

financial and strategic alternatives. Included are $36,618,000 of non-cash expenses for the acceleration of stock

benefits, cash expenses of $19,229,000 for advisory fees, $19,339,000 for severance and retention arrangements and

$15,446,000 primarily for tax reimbursements.

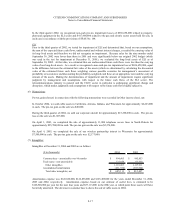

(14) Shareholder Rights Plan:

On March 6, 2002, our Board of Directors adopted a Shareholder Rights Plan. The purpose of the Shareholder

Rights Plan is to deter coercive takeover tactics and to encourage third parties interested in acquiring us to negotiate

with our Board of Directors. It is intended to strengthen the ability of our Board of Directors to fulfill its fiduciary

duties to take actions, which are in the best interest of our shareholders. The rights were distributed to shareholders as

a dividend at the rate of one right for each share of our common stock held by shareholders of record as of the close

of business on March 26, 2002. Initially, the rights generally were exercisable only if a person or group acquired

beneficial ownership of 15 percent or more of our common stock (the “Acquiror”) without the consent of our

independent directors. On January 21, 2003, our Board of Directors amended the terms of our Rights agreement

increasing the level at which these rights will become exercisable to 20 percent of our common stock. Each right not

owned by an Acquiror becomes the right to purchase our common stock at a 50 percent discount.