Frontier Communications 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-40

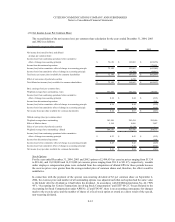

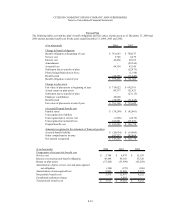

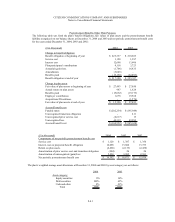

The plan’s weighted average asset allocations at December 31, 2004 and 2003 by asset category are as follows:

2004 2003

Asset category:

Equity securities 65% 62%

Debt securities 32% 36%

Cash and other 3% 2%

Total 100% 100%

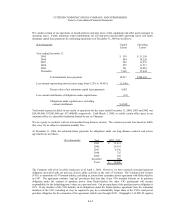

The Plan’s expected benefit payments by year are as follows:

The Company’s required contribution to the plan in 2005 is $0.

The accumulated benefit obligation for the plan was $781,202,000 and $738,709,000 at December 31, 2004 and 2003,

respectively.

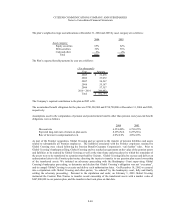

Assumptions used in the computation of pension and postretirement benefits other than pension costs/year-end benefit

obligations were as follows:

2004 2003

Discount rate 6.25/6.00% 6.75/6.25%

Expected long-term rate of return on plan assets 8.25%/N/A 8.25%/N/A

Rate of increase in compensation levels 4.0%/4.0% 4.0%/4.0%

As part of the Frontier acquisition, Global Crossing and we agreed to the transfer of pension liabilities and assets

related to substantially all Frontier employees. The liabilities associated with the Frontier employees retained by

Global Crossing were valued following the Pension Benefit Guaranty Corporation’s “safe harbor” rules. Prior to

Global Crossing’s bankruptcy filing, Global Crossing and we reached an agreement on the value of the pension assets

and liabilities to be retained by Global Crossing as well as the time frame and procedures by which the remainder of

the assets were to be transferred to a pension trust held by Citizens. Global Crossing failed to execute and deliver an

authorization letter to the Frontier plan trustee directing the trustee to transfer to our pension plan record ownership

of the transferred assets. We initiated an adversary proceeding with the Bankruptcy Court supervising Global

Crossing's bankruptcy proceeding, to determine and declare that Global Crossing’s obligation was not “executory”,

and to compel Global Crossing to execute and deliver such authorization letter. On December 18, 2002 we entered

into a stipulation with Global Crossing and other parties, “so ordered” by the bankruptcy court, fully and finally

settling the adversary proceeding. Pursuant to the stipulation and order, on February 3, 2003 Global Crossing

instructed the Frontier Plan Trustee to transfer record ownership of the transferred assets with a market value of

$447,800,000 to our pension plan, and the transfer in fact took place on that date.

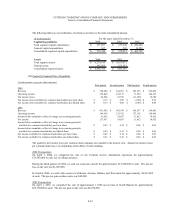

($ in thousands)

Year Amount

2005 51,878$

2006 53,072

2007 54,267

2008 55,187

2009 57,357

2010 - 2014 290,983

Total 562,744$