Frontier Communications 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

17

(a) Liquidity and Capital Resources

For the year ended December 31, 2004, we used cash flows from continuing operations, the proceeds from the sale of utility

properties and investments, cash and cash equivalents to fund capital expenditures, dividends, interest payments, a $20.0

million voluntary contribution to our pension plan and debt repayments. As of December 31, 2004, we had cash and cash

equivalents aggregating $167.5 million.

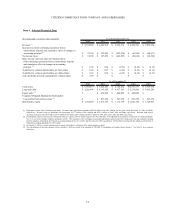

For the year ended December 31, 2004, our capital expenditures were $276.3 million, including $264.3 million for the ILEC

segment, $11.6 million for the ELI segment and $0.4 million of general capital expenditures. We continue to closely scrutinize

all of our capital projects, emphasize return on investment and focus our capital expenditures on areas and services that have the

greatest opportunities with respect to revenue growth and cost reduction. For example, in 2005 we will allocate significant capital

to services such as high-speed internet in areas that are growing or demonstrate meaningful demand. In the past, large capital

outlays were made in newly acquired properties to be able to offer all of our services across all of our areas and in order to

improve network capability and service quality. After those investments were made, the total amount of capital spending has

been further reduced because of declining revenues and lower costs from vendors. We will continue to focus on managing our

costs while increasing our investment in certain product areas such as high-speed internet. Increasing competition, offering new

services or a decision to improve the capabilities and reduce the maintenance costs of our plant may cause our capital

expenditures to increase in the future.

We have budgeted approximately $270.0 million for our 2005 capital projects including $255.0 million for the ILEC segment and

$15.0 million for the ELI segment. Included in these budgeted capital amounts are approximately $6.9 million of capital

expenditures associated with CALEA. We have received extensions of time to make our entire network CALEA compliant,

however, failure to be granted further extensions could increase our budgeted capital expenditures by up to $6.2 million in 2005.

As of December 31, 2004, we have available lines of credit with financial institutions in the aggregate amount of $250.0

million. Associated facility fees vary, depending on our debt leverage ratio, and are 0.375% per annum as of December 31,

2004. The expiration date for the facility is October 29, 2009. During the term of the facility we may borrow, repay and

reborrow funds. The credit facility is available for general corporate purposes but may not be used to fund dividend payments.

There are no outstanding advances under the facility.

In July 2004, our Board of Directors concluded a review of financial and strategic alternatives. After analysis of alternatives

by the Board of Directors and its financial and legal advisors, the Board determined to pay a special, non-recurring dividend

of $2 per common share and institute a regular annual dividend of $1 per share of Common Stock which will be paid

quarterly. The special, non-recurring dividend and first quarterly dividend were paid on September 2, 2004 utilizing the

Company’s cash on hand. The next quarterly dividend of $0.25 per share of Common Stock was paid on December 31, 2004.

The $832.8 million of dividends paid during 2004 significantly reduced our cash balances and liquidity. In addition, our

ongoing annual dividends of approximately $340.0 million will reduce our operating and financial flexibility and our ability

to significantly increase capital expenditures. While we believe that the amount of our dividends will allow for adequate

amounts of cash flow for other purposes, any reduction in cash generated by operations and any increases in capital

expenditures, interest expense or cash taxes would reduce the amount of cash generated in excess of dividends. Losses of

access lines, increases in competition, lower subsidy and access revenues and the other factors described above is expected to

reduce our cash generated by operations and may require us to increase capital expenditures. The downgrades in our credit

ratings in July 2004 to below investment grade may make it more difficult and expensive to refinance our maturing debt. We

have in recent years paid relatively low amounts of cash taxes. We expect that over time our cash taxes will increase.

As a result of the adoption of our dividend policy, Standard and Poor’s lowered its ratings on Citizens debt from “BBB” to

“BB-plus”, Moody’s Investors Service lowered its ratings from “Baa3” to “Ba3” and Fitch Ratings lowered its ratings from

“BBB” to “BB”.

We believe our operating cash flows, existing cash balances, and credit facilities will be adequate to finance our working capital

requirements, fund capital expenditures, make required debt payments through 2007, pay dividends to our shareholders in

accordance with our dividend policy, and support our short-term and long-term operating strategies. We have approximately $6.4

million, $227.8 million and $37.9 million of debt maturing in 2005, 2006 and 2007, respectively.