Frontier Communications 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

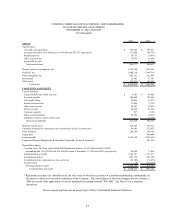

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-11

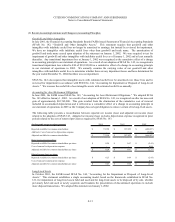

We have interest rate swap arrangements related to a portion of our fixed rate debt. These hedge strategies

satisfy the fair value hedging requirements of SFAS No. 133, as amended. As a result, the fair value of the

hedges is carried on the balance sheet in other current assets and the related underlying liabilities are also

adjusted to fair value by the same amount.

(i) Investments:

Marketable Securities

We classify our cost method investments at purchase as available-for-sale. We do not maintain a trading portfolio

or held-to-maturity securities.

Securities classified as available-for-sale are carried at estimated fair market value. These securities are held for an

indefinite period of time, but might be sold in the future as changes in market conditions or economic factors occur.

Net aggregate unrealized gains and losses related to such securities, net of taxes, are included as a separate

component of shareholders’ equity. Interest, dividends and gains and losses realized on sales of securities are

reported in Investment income.

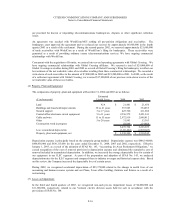

Investments in Other Entities

Investments in entities that we do not control, but where we have the ability to exercise significant influence over

operating and financial policies, are accounted for using the equity method of accounting.

We evaluate our investments periodically to determine whether any decline in fair value, below the cost basis, is

other than temporary. To determine whether an impairment is other than temporary, we consider whether we have

the ability and intent to hold the investment until a market price recovery and whether evidence indicating the cost

of the investment is recoverable outweighs evidence to the contrary. Evidence considered in this assessment

includes the reasons for the impairment, the severity and duration of the impairment, changes in value subsequent to

year-end, and forecasted performance of the investee. If we determine that a decline in fair value is other than

temporary, the cost basis of the individual investment is written down to fair value, which becomes the new cost

basis. The amount of the write-down is transferred from other comprehensive income (loss) and included in the

statement of operations as a loss.

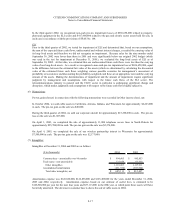

(j) Income Taxes and Deferred Income Taxes:

We file a consolidated federal income tax return. We utilize the asset and liability method of accounting for income

taxes. Under the asset and liability method, deferred income taxes are recorded for the tax effect of temporary

differences between the financial statement basis and the tax basis of assets and liabilities using tax rates to be in

effect when the temporary differences are expected to reverse.

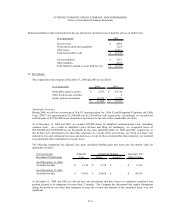

(k) Employee Stock Plans:

We have various employee stock-based compensation plans. Awards under these plans are granted to eligible

officers, management and non-management employees. Awards may be made in the form of incentive stock

options, non-qualified stock options, stock appreciation rights, restricted stock or other stock based awards. As

permitted by current accounting rules, we apply Accounting Principles Board Opinions (APB) No. 25 and related

interpretations in accounting for the employee stock plans resulting in the use of the intrinsic value to value the

stock.

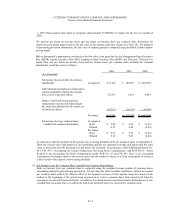

SFAS No. 123, “Accounting for Stock-Based Compensation” and SFAS No. 148, “Accounting for Stock-Based

Compensation – Transition and Disclosure, an amendment of SFAS No. 123,” established accounting and

disclosure requirements using a fair-value-based method of accounting for stock-based employee compensation

plans. As permitted by existing accounting standards, the Company has elected to continue to apply the intrinsic-

valued-based method of accounting described above, and has adopted only the disclosure requirements of SFAS

No. 123, as amended.

In December 2004, the FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment,” (“SFAS No.

123R”). SFAS 123R requires that stock-based employee compensation be recorded as a charge to earnings for

interim or annual periods beginning after June 15, 2005. Accordingly, we will adopt SFAS 123R commencing July