Frontier Communications 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

23

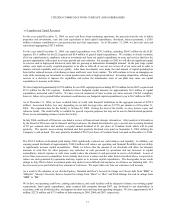

benefit and mortality. The Company reviews these assumptions for changes annually with its outside actuaries. We consider

our discount rate and expected long-term rate of return on plan assets to be our most critical assumptions.

The discount rate is used to value, on a present basis, our pension and post retirement benefit obligation as of the balance sheet

date. The same rate is also used in the interest cost component of the pension and post retirement benefit cost determination for

the following year. The measurement date used in the selection of our discount rate is the balance sheet date. Our discount rate

assumption is determined annually with assistance from our actuaries based on the interest rates for long-term high quality

corporate bonds. This rate can change from year-to-year based on market conditions that impact corporate bond yields. Our

discount rate declined from 6.25% at year-end 2003 to 6.0% at year-end 2004.

The expected long-term rate of return on plan assets is applied in the determination of periodic pension and post retirement

benefit cost as a reduction in the computation of the expense. In developing the expected long-term rate of return assumption, we

considered published surveys of expected market returns, 10 and 20 year actual returns of various major indices, and our own

historical 5-year and 10-year investment returns. The expected long-term rate of return on plan assets is based on an asset

allocation assumption of 30% to 45% in fixed income securities and 55% to 70% in equity securities. We review our asset

allocation at least annually and make changes when considered appropriate. In 2004, we did not change our expected long-term

rate of return from the 8.25% used in 2003. Our pension plan assets are valued at actual market value as of the measurement date.

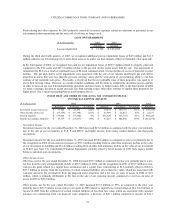

Accounting standards require that we record an additional minimum pension liability when the plan’s “accumulated benefit

obligation” exceeds the fair market value of plan assets at the pension plan measurement (balance sheet) date. In the fourth

quarter of 2003, due to strong performance in the equity markets during 2003, partially offset by a decrease in the year-end

discount rate, the Company recorded a reduction to its minimum pension liability in the amount of $35.0 million with a

corresponding increase to shareholders’ equity of $22.0 million, net of taxes of $13.0 million. In the fourth quarter of 2004,

mainly due to a decrease in the year-end discount rate, the Company recorded an additional minimum pension liability in the

amount of $17.4 million with a corresponding charge to shareholders’ equity of $10.7 million, net of taxes of $6.7 million. These

adjustments did not impact our earnings or cash flows.

Actual results that differ from our assumptions are added or subtracted to our balance of unrecognized actuarial gains and losses.

For example, if the year-end discount rate used to value the plan’s projected benefit obligation decreases from the prior year-end

then the plan’s actuarial loss will increase. If the discount rate increases from the prior year-end then the plan’s actuarial loss will

decrease. Similarly, the difference generated from the plan’s actual asset performance as compared to expected performance

would be included in the balance of unrecognized gains and losses.

The impact of the balance of accumulated actuarial gains and losses are recognized in the computation of pension cost only to the

extent this balance exceeds 10% of the greater of the plan’s projected benefit obligation or market value of plan assets. If this

occurs, that portion of gain or loss that is in excess of 10% is amortized over the estimated future service period of plan

participants as a component of pension cost. The level of amortization is affected each year by the change in actuarial gains and

losses and could potentially be eliminated if the gain/loss activity reduces the net accumulated gain/loss balance to a level below

the 10% threshold.

We expect that our pension expense for 2005 will be $5.0 million to $7.0 million (it was $3.6 million in 2004) and no

contribution will be required to be made by us to the pension plan in 2005. In October 2004, we made a voluntary contribution of

$20.0 million to the pension plan.

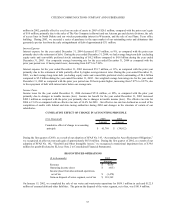

Income Taxes

Our effective tax rate has declined as a result of the completion of audits with federal and state taxing authorities during 2004

and changes in the structure of certain of our subsidiaries.

Management has discussed the development and selection of these critical accounting estimates with the audit committee of

our board of directors and our audit committee has reviewed our disclosures relating to them.