Frontier Communications 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-17

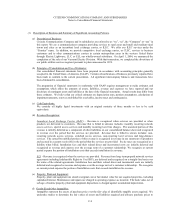

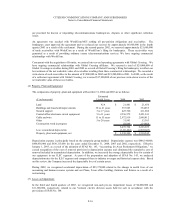

In the third quarter 2002, we recognized non-cash pre-tax impairment losses of $656,658,000 related to property,

plant and equipment in the ELI sector and $417,400,000 related to the gas and electric sector assets held for sale, in

each case in accordance with the provisions of SFAS No. 144.

ELI

Prior to the third quarter of 2002, we tested for impairment of ELI and determined that, based on our assumptions,

the sum of the expected future cash flows, undiscounted and without interest charges, exceeded the carrying value of

its long-lived assets and therefore we did not recognize an impairment. Because sales for the nine months ended

September 30, 2002 were lower than those in 2001 and were significantly below our original 2002 budget (which

was used in the test for impairment at December 31, 2001), we evaluated the long-lived assets of ELI as of

September 30, 2002. At that date, we estimated that our undiscounted future cash flows were less than the carrying

value of our long-lived assets. As a result we recognized a non-cash pre-tax impairment loss of $656,658,000, equal

to the difference between the estimated fair value of the assets (which we determined by calculating the discounted

value of the estimated future cash flows weighting various possible scenarios for management’s assessment of

probability of occurrence and discounting the probability-weighted cash flows at an appropriate rate) and the carrying

amount of the assets. Making the determinations of impairment and the amount of impairment require significant

judgment by management and assumptions with respect to the future cash flows of the ELI sector. The

telecommunications industry in general and the CLEC sector in particular is undergoing significant change and

disruption, which makes judgments and assumptions with respect to the future cash flows highly subjective.

(6) Dispositions:

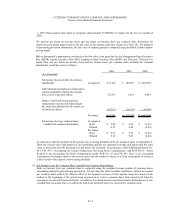

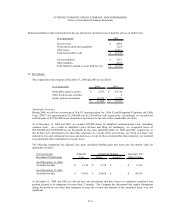

Pre-tax gains (losses) in connection with the following transactions were recorded in Other income (loss), net:

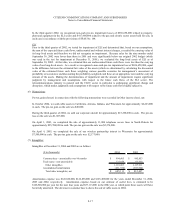

In October 2004, we sold cable assets in California, Arizona, Indiana, and Wisconsin for approximately $2,263,000

in cash. The pre-tax gain on the sale was $40,000.

During the third quarter of 2004, we sold our corporate aircraft for approximately $15,298,000 in cash. The pre-tax

loss on the sale was $1,087,000.

On April 1, 2003, we completed the sale of approximately 11,000 telephone access lines in North Dakota for

approximately $25,700,000 in cash. The pre-tax gain on the sale was $2,274,000.

On April 4, 2003, we completed the sale of our wireless partnership interest in Wisconsin for approximately

$7,500,000 in cash. The pre-tax gain on the sale was $2,173,000.

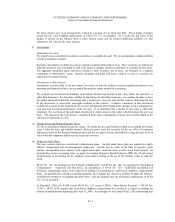

(7) Intangibles:

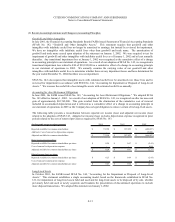

Intangibles at December 31, 2004 and 2003 are as follows:

Amortization expense was $126,520,000, $126,838,000 and $125,409,000 for the years ended December 31, 2004,

2003 and 2002, respectively. Amortization expense, based on our estimate of useful lives, is estimated to be

$126,520,000 per year for the next four years and $57,113,000 in the fifth year, at which point these assets will have

been fully amortized. The decrease in customer base is due to the sale of cable assets in 2004.

($ in thousands) 2004 2003

Customer base - amortizable over 96 months 994,605$ 995,853$

Trade name - non-amortizable 122,058 122,058

Other intangibles 1,116,663 1,117,911

Accumulated amortization (431,552) (305,504)

Total other intangibles, net 685,111$ 812,407$