Frontier Communications 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-22

On November 12, 2004, we called for redemption on December 13, 2004 the entire $700,000,000 of our 8.50% Notes

due 2006 at a price of 107.182% of the principal amount called, plus accrued interest, at a premium of approximately

$50,300,000.

As of December 31, 2004, EPPICS representing a total principal amount of $147,991,000 had been converted into

11,622,749 shares of Citizens common stock.

Total future minimum cash payment commitments under ELI’s long-term capital leases amounted to $10,017,000 as of

December 31, 2004.

The total outstanding principal amounts of industrial development revenue bonds were $58,140,000 and $70,440,000 at

December 31, 2004 and 2003, respectively. The earliest maturity date for these bonds is in August 2015. Holders of

certain industrial development revenue bonds may tender such bonds to us at par prior to maturity. The next tender

date is August 1, 2007 for $30,350,000 principal amount of bonds. We expect to retire all such bonds that are

tendered.

As of December 31, 2004 we had available lines of credit with financial institutions in the aggregate amount of

$250,000,000 with a maturity date of October 29, 2009. Associated facility fees vary depending on our leverage ratio

and were 0.375% as of December 31, 2004. During the term of the credit facility we may borrow, repay and re-

borrow funds. The credit facility is available for general corporate purposes but may not be used to fund dividend

payments. There are no outstanding borrowings under the facility.

During the twelve months ended December 31, 2003, we executed a series of purchases in the open market of our

outstanding debt securities. The aggregate principal amount of debt securities purchased was $94,895,000 and they

generated a pre-tax loss on the early extinguishment of debt at a premium of approximately $3,117,000 recorded in

other income (loss), net.

During December 2002, we completed a tender offer with respect to our 6.80% Debentures due 2026 (puttable at par in

2003) and ELI’s 6.05% Guaranteed Notes due 2004. As a result of the tender, $82,286,000 and $259,389,000,

respectively, of these securities were purchased and retired at a pre-tax cost of $12,800,000 (recorded in other income

(loss), net) in excess of the principal amount of the securities purchased.

For the year ended December 31, 2004, we retired an aggregate $1,362,012,000 of debt (including $147,991,000 of

EPPICS conversions), representing approximately 28% of total debt outstanding at December 31, 2003.

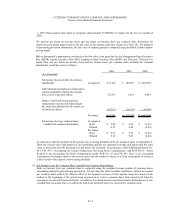

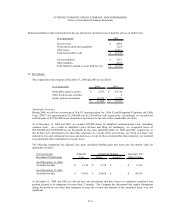

Our principal payments and capital lease payments (principal only) for the next five years are as follows:

($ in thousands)

Principal

Payments

Capital

Lease Payments

2005 $ 6,302 $ 81

2006 227,693 94

2007 37,771 110

2008 750,938 126

2009 1,000 145

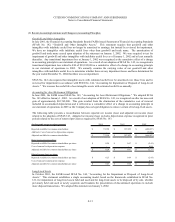

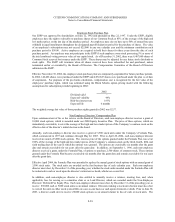

(12) Derivative Instruments and Hedging Activities:

Interest rate swap agreements are used to hedge a portion of our debt that is subject to fixed interest rates. Under our

interest rate swap agreements, we agree to pay an amount equal to a specified variable rate of interest times a notional

principal amount, and to receive in return an amount equal to a specified fixed rate of interest times the same notional

principal amount. The notional amounts of the contracts are not exchanged. No other cash payments are made unless

the agreement is terminated prior to maturity, in which case the amount paid or received in settlement is established by

agreement at the time of termination and represents the market value, at the then current rate of interest, of the remaining

obligations to exchange payments under the terms of the contracts.