Frontier Communications 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-20

As of December 31, 2003, we owned 1,333,500 shares of D & E common stock. As the result of an other than

temporary decline in D & E’s stock price, we recognized a loss of $16,400,000 on our investment for the year ended

December 31, 2002.

Marketable equity securities for 2003 include 2,305,908 common shares which represent an ownership of 19% of the

equity in HTCC a company of which our former Chairman and Chief Executive Officer was a member of the Board of

Directors. In addition, in 2003 we held 30,000 shares of non-voting convertible preferred stock, each share having a

liquidation value of $70 per share and is convertible at our option into 10 shares of common stock.

Investments in Other Entities

During 2004, we reclassified our investments accounted for under the equity method from other assets to the

investment caption in our consolidated balance sheets and conformed prior periods to the current presentation.

The Company’s investments in entities that are accounted for under the equity method of accounting consist of the

following: (1) a 33% interest in the Mohave Cellular Limited Partnership which is engaged in cellular mobile

telephone service in the Arizona area; (2) a 25% interest in the Fairmount Cellular Limited Partnership which is

engaged in cellular mobile telephone service in the Rural Service Area (RSA) designated by the FCC as Georgia

RSA No. 3; and (3) our investments in CU Capital and CU Trust with relation to our convertible preferred securities

(for 2004 only). The investments in these entities amounted to $20,726,000 and $12,787,000 at December 31, 2004

and 2003, respectively.

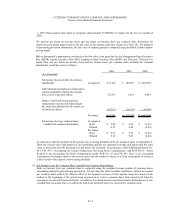

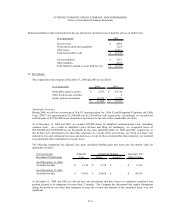

(10) Fair Value of Financial Instruments:

The following table summarizes the carrying amounts and estimated fair values for certain of our financial instruments

at December 31, 2004 and 2003. For the other financial instruments, representing cash, accounts receivables, long-term

debt due within one year, accounts payable and other accrued liabilities, the carrying amounts approximate fair value

due to the relatively short maturities of those instruments.

The fair value of the above financial instruments is based on quoted prices at the reporting date for those financial

instruments.

(1)

2004 and 2003 includes interest rate swaps of $4,466,000 and $10,601,000, respectively. 2003 excludes the $460,000,000

debt portion of the equity units. 2004 includes EPPICS of $63,765,000.

($ in thousands)

Carrying Carrying

Amount Fair Value Amount Fair Value

Investments 23,062$ 23,062$ 57,103$ 57,103$

Long-term debt

(1)

4,266,998$ 4,607,298$ 4,195,629$ 4,608,205$

Equity Providing Preferred

Income Convertible Securities (EPPICS) -$ -$ 201,250$ 205,275$

2004 2003