Frontier Communications 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-30

all of the publicly held ELI common shares that we did not already own. These costs were partially offset by a

$2,825,000 reversal of a 2001 ELI accrual.

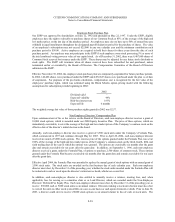

(20) Income Taxes:

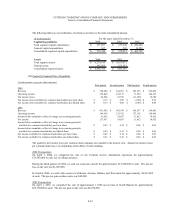

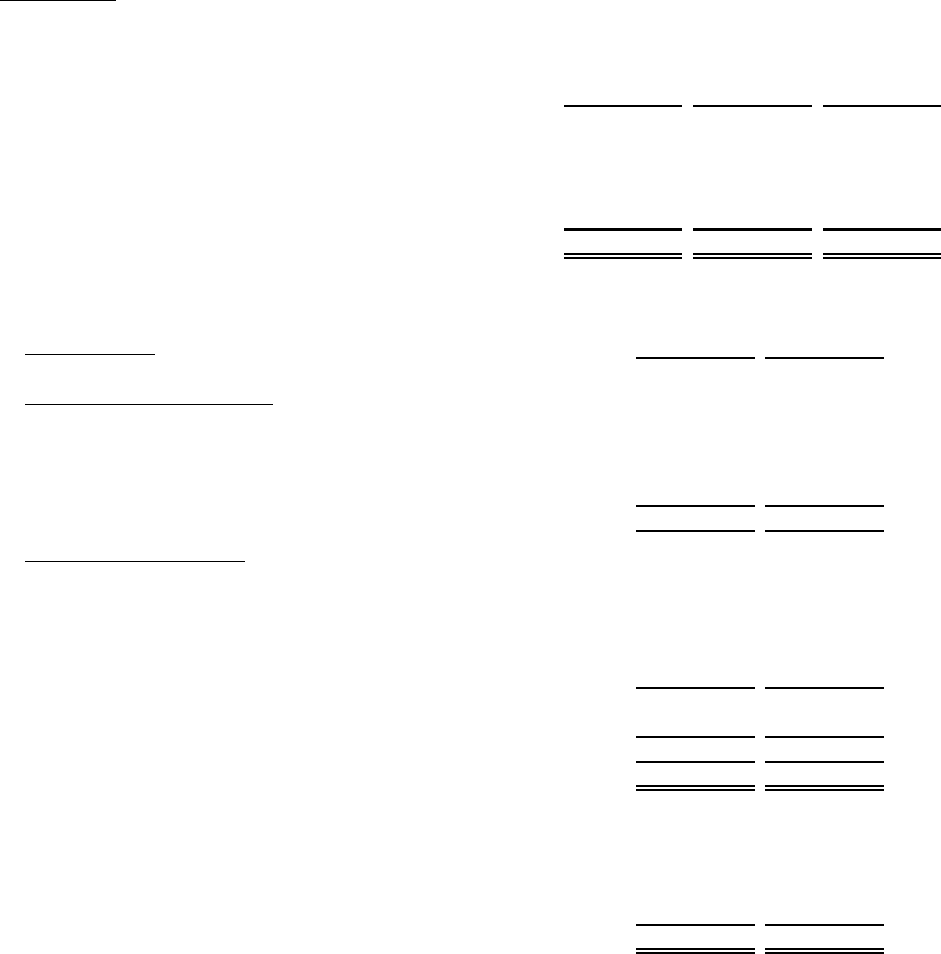

The following is a reconciliation of the provision (benefit) for income taxes for continuing operations computed at

federal statutory rates to the effective rates for the years ended December 31, 2004, 2003 and 2002:

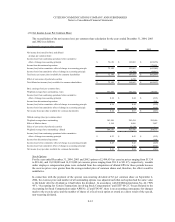

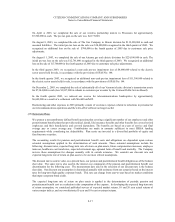

The components of the net deferred income tax liability (asset) at December 31 are as follows:

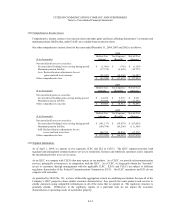

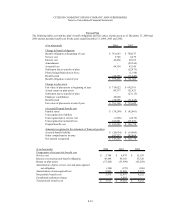

Our federal and state tax operating loss carryforwards as of December 31, 2004 are estimated at $933,722,000 and

$1,302,736,000, respectively. Our federal loss carryforward will begin to expire in the year 2020. A portion of our state

loss carryforward will begin to expire in 2005. Our alternative minimum tax credit as of December 31, 2004 can be

carried forward indefinitely to reduce future regular tax liability.

2004 2003 2002

Consolidated tax provision (benefit) at federal statutory rate 35.0 % 35.0 % (35.0)%

State income tax provisions (benefit), net of federal income tax benefit 1.7 % 6.4 % (1.3)%

Write-off of regulatory assets 0.0 % 0.0 % 2.6 %

Tax reserve adjustment (17.5)% (8.0)% 0.0 %

All other, net (3.6)% 1.0 % 0.0 %

15.6 % 34.4 % (33.7)%

($ in thousands) 2004 2003

Deferred income tax liabilities:

Property, plant and equipment basis differences 578,501$ 412,795$

Intangibles 161,955 152,226

Unrealized securities gain 458 11,432

Other, net 8,546 15,042

749,460 591,495

Deferred income tax assets:

Minimum pension liability 62,435 55,837

Tax operating loss carryforward 394,797 253,215

Alternate minimum tax credit carryforward 37,796 49,864

Employee benefits 55,566 47,856

Other, net 23,095 40,745

573,689 447,517

Less: Valuation allowance (43,503) (44,236)

Net deferred income tax asset 530,186 403,281

Net deferred income tax liabilit

y

219,274$ 188,214$

Deferred tax assets and liabilities are reflected in the following

captions on the balance sheet:

Deferred income taxes 232,766$ 198,312$

Other current assets (13,492) (10,098)

Net deferred income tax liability 219,274$ 188,214$