Frontier Communications 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-29

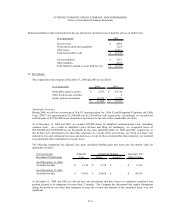

exercise price of the stock options was set at the average of the high and low market prices of the Company’s common

stock on the date of grant. The options were exercisable six months after the date of grant and had a 10-year term.

As of any date, the maximum number of shares of common stock which the Non-Employee Directors’ Deferred Fee

Equity Plan is obligated to deliver shall not be more than one percent (1%) of the total outstanding shares of the

Company’s common stock as of June 30, 2003, subject to adjustment in the event of changes in our corporate structure

affecting capital stock. There were 11 directors participating in the Directors’ Plan during all or part of 2004. In 2004,

the total options, plan units, and stock earned were 50,000, 57,226 and 0, respectively. In 2003, the total options, plan

units, and stock earned were 83,125, 46,034 and 0, respectively. In 2002, the total options, plan units, and stock earned

were 99,583, 43,031 and 1,514, respectively. At December 31, 2004, 699,979 options were exercisable at a weighted

average exercise price of $9.36.

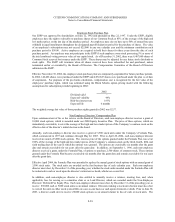

For 2004, each non-employee director received fees of $2,000 for each Board of Directors and committee meeting

attended. In addition, committee chairs (except the chairs of the Audit and Compensation Committees) received an

additional annual fee of $5,000. The chairs of the Audit and Compensation Committees were each paid an additional

annual fee of $50,000 and $30,000, respectively. In addition, the Lead Director, who heads the ad hoc committee of

non-employee directors, received an additional annual fee of $30,000. A director must elect, by December 31 of the

preceding year, to receive his meeting and other fees in cash, stock units, or a combination of both. All fees paid to the

non-employee directors are paid quarterly. If the director elects stock units, the number of units credited to the

director’s account is determined as follows: the total cash value of the fees payable to the director are divided by 85% of

the average of the high and low market prices of the Company’s common stock on the first trading day of the year the

election is in effect. Units are credited to the director’s account quarterly. The number of stock units awarded during a

given year as fees will be increased if the average of the high and low market prices of the Company’s common stock on

the last trading day of November is less than the average market price used to initially value the stock units. If an

increase in the number of units is required, the additional units are credited to the director’s account in December.

The Company accounts for the Directors’ Deferred Fee Equity Plan in accordance with APB Opinion No. 25,

“Accounting for Stock Issued to Employees” and related interpretations. Compensation expense is recorded if cash

or stock units are elected. If stock units are elected, the compensation expense is based on the market value of our

common stock at the date of grant. If the stock option election is chosen, compensation expense is not recorded

because the options are granted at the fair market value of our common stock on the grant date.

We had also maintained a Non-Employee Directors’ Retirement Plan providing for the payment of specified sums

annually to our non-employee directors, or their designated beneficiaries, starting at the director’s retirement, death or

termination of directorship. In 1999, we terminated this Plan. The vested benefit of each non-employee director, as of

May 31, 1999, was credited to the director’s account in the form of stock units. Such benefit will be payable to each

director upon retirement, death or termination of directorship. Each participant had until July 15, 1999 to elect whether

the value of the stock units awarded would be payable in the Company’s common stock (convertible on a one for one

basis) or in cash. As of December 31, 2004, the liability for such payments was $2,155,000 of which $1,411,000 will be

payable in stock (based on the July 15, 1999 stock price) and $744,000 will be payable in cash. While the number of

shares of stock payable to those directors electing to be paid in stock is fixed, the amount of cash payable to those

directors electing to be paid in cash will be based on the number of stock units awarded multiplied by the stock price on

the payment date.

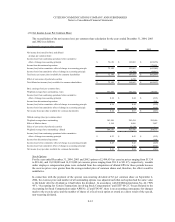

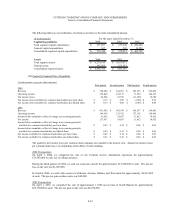

(19) Restructuring and Other Expenses:

2003

Restructuring and other expenses primarily consist of expenses related to reductions in personnel at our

telecommunications operations and the write-off of software no longer useful. We continue to review our operations,

personnel and facilities to achieve greater efficiency.

2002

Restructuring and other expenses primarily consist of expenses related to our various restructurings, $32,985,000 related

to reductions in personnel at our telecommunications operations, costs that were spent at our Plano, Texas facility and at

other locations as a result of transitioning functions and jobs, and $6,800,000 related to our tender offer in June 2002 for