Frontier Communications 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

F-21

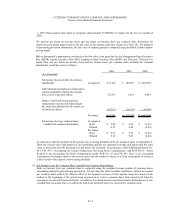

(11) Long-term Debt:

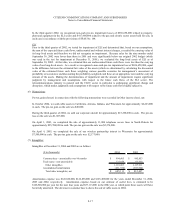

The activity in our long-term debt from December 31, 2003 to December 31, 2004 is summarized as follows:

* Interest rate includes amortization of debt issuance expenses, debt premiums or discounts. The interest rate for Rural Utilities Service Loan Contracts,

Senior Unsecured Debt, and Industrial Development Revenue Bonds represent a weighted average of multiple issuances.

** In accordance with FIN 46R, the Trust holding the EPPICS and the related Citizens Utilities Capital L.P. are now deconsolidated (see Note 16).

*** Includes purchases on the open market (see note 2).

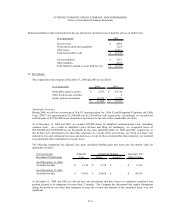

On January 15, 2004, we repaid at maturity the remaining outstanding $80,955,000 of our 7.45% Debentures.

On January 15, 2004, we redeemed at 101% the remaining outstanding $12,300,000 of our Hawaii Special Purpose

Revenue Bonds, Series 1993A and Series 1993B.

On May 17, 2004, we repaid at maturity the remaining outstanding $5,975,000 of Electric Lightwave, LLC’s 6.05%

Notes. These Notes had been guaranteed by Citizens.

On July 15, 2004, we renegotiated and prepaid with $4,954,000 of cash the entire remaining $5,524,000 Electric

Lightwave capital lease obligation to a third party.

On July 30, 2004, we purchased $300,000,000 of the 6.75% notes that were a component of our equity units at

105.075% of par, plus accrued interest, at a premium of approximately $15,225,000 recorded in investment and other

income (loss), net.

During August and September 2004, we repurchased through a series of transactions an additional $108,230,000 of the

6.75% notes due 2006 at a weighted average price of 104.486% of par, plus accrued interest, at a premium of

approximately $4,855,000 recorded in investment and other income (loss), net.

On November 8, 2004, we issued an aggregate $700,000,000 principal amount of 6.25% senior notes due January 15,

2013 through a registered underwritten public offering. Proceeds from the sale were used to redeem our outstanding

$700,000,000 of 8.50% Notes due 2006, which is discussed below.

Twelve Months Ended

Interest Interest Rate* at

December 31, Rate December 31, December 31,

($ in thousands) 2003 Borrowings Payments*** Swap Reclassification 2004 2004

Rural Utilities Service Loan Contracts $ 30,010 $ - $ (902) $ - $ - $ 29,108 6.120%

Senior Unsecured Debt 4,167,123 700,000 (780,955) (6,135) 51,770 4,131,803 7.912%

EPPICS** (reclassified as a result of

adopting FIN 46R) -

-

-

- 63,765 63,765 5.000%

Equity Units 460,000 - (408,230) - (51,770) - -

ELI Notes 5,975 - (5,975) - - - -

ELI Capital Leases 10,061 - (5,640) - - 4,421 10.363%

Industrial Development Revenue Bonds 70,440 - (12,300) - - 58,140 5.559%

Other 22 - (19) - - 3 12.990%

TOTAL LONG TERM DEBT $ 4,743,631 $ 700,000 $ (1,214,021) $ (6,135) $ 63,765 $ 4,287,240

Less: Debt Discount - (13,859)

Less: Current Portion (88,002) (6,383)

Less: Equity Units (460,000) -

$ 4,195,629

$ 4,266,998