Frontier Communications 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

_ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2004

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ___________

Commission file number 001-11001

CITIZENS COMMUNICATIONS COMPANY

(Exact name of registrant as specified in its charter)

Delaware 06-0619596

(State or other jurisdiction of (I.R.S. Employer Identification No.)

incorporation or organization)

3 High Ridge Park

Stamford, Connecticut 06905

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (203) 614-5600

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, par value $.25 per share New York Stock Exchange

Guarantee of Convertible Preferred Securities of Citizens Utilities Trust New York Stock Exchange

Citizens Convertible Debentures N/A

Guarantee of Partnership Preferred Securities of Citizens Utilities Capital L.P. N/A

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and

will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes X No __

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2004 was approximately

$3,351,287,851 based on the closing price of $12.10 per share.

The number of shares outstanding of the registrant's Common Stock as of February 28, 2005 was 340,187,920.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the registrant's 2005 Annual Meeting of Stockholders to be held on May 26, 2005 are

incorporated by reference into Part III of this Form 10-K.

Table of contents

-

Page 1

... High Ridge Park Stamford, Connecticut (Address of principal executive offices) Registrant's telephone number, including area code: (203) 614-5600 06905 (Zip Code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock... -

Page 2

-

Page 3

...COMMUNICATIONS COMPANY AND SUBSIDIARIES TABLE OF CONTENTS Page PART I Item 1. Item 2. Item 3. Item 4. Business Properties Legal Proceedings Submission of Matters to a Vote of Security Holders 2 9 10 10 11 Executive Officers PART II Item 5. Market for Registrant's Common Equity, Related Stockholder... -

Page 4

... report. We are a communications company providing services to rural areas and small and medium-sized towns and cities as an incumbent local exchange carrier, or ILEC. We offer our ILEC services under the "Frontier" name. In addition, we provide competitive local exchange carrier, or CLEC, services... -

Page 5

... distance service through their local telephone company and receiving a single bill. Data services. We offer data services including internet access via dial up or high-speed internet access, frame relay, ethernet and asynchronous transfer mode (ATM) switching in portions of our system. Directory... -

Page 6

... Synchronous Optical Network (SONET) architecture. ELI currently provides the full range of its services in the following cities and their surrounding areas: Boise, Idaho; Portland, Oregon; Salt Lake City, Utah; Seattle, Washington; Spokane, Washington; Phoenix, Arizona; and Sacramento, California... -

Page 7

... companies. The CALLS plan addressed this requirement for interstate services. State legislatures and regulatory agencies are beginning to reduce the implicit subsidies in intrastate rates. The most common subsidies are in access rates that historically have been priced above their costs... -

Page 8

...taxation and general commercial business requirements; or whether VOIP is subject to 911, USF, and CALEA obligations. The FCC is planning on addressing these open questions in subsequent orders in its ongoing "IP-Enabled Services Proceeding," which was opened in February 2004. Internet telephony may... -

Page 9

...during 2004. We expect cable telephony competition to increase in Rochester and elsewhere during 2005. Competition from wireless companies, other long distance companies and internet service providers is increasing in all of our markets. Our ILEC business has been experiencing declining access lines... -

Page 10

... in 2004. At December 31, 2004, we had sold all of our public utilities services segments and, as a result, will have no operating results in future periods for these businesses. We have retained a potential payment obligation associated with our previous electric utility activities in the state of... -

Page 11

.... Item 2. Properties Our principal corporate offices are located in leased premises at 3 High Ridge Park, Stamford, Connecticut. An operations support office is currently located in leased premises at 180 South Clinton Avenue, Rochester, New York. In addition, our ILEC segment leases and owns space... -

Page 12

..., 2004, one of our subsidiaries, Frontier Subsidiary Telco Inc., received a "Notice of Indemnity Claim" from Citibank, N.A., that is related to a complaint pending against Citibank and others in the U.S. Bankruptcy Court for the Southern District of New York as part of the Global Crossing bankruptcy... -

Page 13

... Senior Vice President, Human Resources Executive Vice President and Chief Financial Officer Senior Vice President Sales, Marketing and Business Development Senior Vice President and Chief Accounting Officer Senior Vice President, Field Operations Senior Vice President, General Counsel and Secretary... -

Page 14

... COMPANY AND SUBSIDIARIES DANIEL J. McCARTHY has been associated with Citizens since December 1990. He is currently Senior Vice President, Field Operations. He was previously Senior Vice President Broadband Operations from January 2004 to December 2004, and President and Chief Operating Officer... -

Page 15

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES PART II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities PRICE RANGE OF COMMON STOCK Our Common Stock is traded on the New York Stock Exchange under the symbol CZN. The following ... -

Page 16

...95.1 million in 2004, 2003, 2002, 2001 and 2000, respectively. (2) Extraordinary expense represents an extraordinary after tax expense of $43.6 million related to the discontinuance of the application of Statement of Financial Accounting Standards No. 71 to our local exchange telephone operations in... -

Page 17

... lines plus high-speed internet subscribers; The effects of competition from wireless, other wireline carriers (through Unbundled Network Elements (UNE), Unbundled Network Elements Platform (UNEP), VOIP or otherwise), high speed cable modems and cable telephony; The effects of general and local... -

Page 18

.... Competition from cable companies and other high-speed internet service providers with respect to internet access is intense and increasing in many of our markets. The cable company in Rochester and other parts of our New York markets began offering a telephony product during 2004. We expect cable... -

Page 19

... while increasing our investment in certain product areas such as high-speed internet. Increasing competition, offering new services or a decision to improve the capabilities and reduce the maintenance costs of our plant may cause our capital expenditures to increase in the future. We have budgeted... -

Page 20

... debt in the open market, through tender offers or privately negotiated transactions. Interest Rate Management In order to manage our interest expense, we have entered into interest swap agreements. Under the terms of the agreements, we make semi-annual, floating rate interest payments based on six... -

Page 21

... Proceeds from the swap terminations of approximately $3.0 million and U.S. Treasury rate lock agreements of approximately $1.0 million were used to offset the call premium associated with the notes retired. Sale of Non-Strategic Investments On August 13, 2004, we sold our entire 1,333,500 shares of... -

Page 22

.... The conversion price was reduced from $13.30 to $11.46 during the third quarter of 2004 as a result of the $2.00 per share special, non-recurring dividend. The proceeds from the issuance of the Trust Convertible Preferred Securities and a Company capital contribution were used to purchase $207... -

Page 23

..., our Board of Directors approved a plan of divestiture for our public utilities services businesses, which included gas, electric and water and wastewater businesses. As of April 1, 2004, we sold all of these properties. All of the agreements relating to the sales provide that we will indemnify the... -

Page 24

... including retiree medical benefits and related liabilities are "critical accounting estimates." We sponsor a noncontributory defined benefit pension plan covering a significant number of our employees and other post retirement benefit plans that provide medical, dental, life insurance benefits and... -

Page 25

... Company reviews these assumptions for changes annually with its outside actuaries. We consider our discount rate and expected long-term rate of return on plan assets to be our most critical assumptions. The discount rate is used to value, on a present basis, our pension and post retirement benefit... -

Page 26

... No. 143 applies to fiscal years beginning after June 15, 2002, and addresses financial accounting and reporting obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. We adopted SFAS No. 143 effective January 1, 2003. The standard applies... -

Page 27

... of SFAS No. 148. In December 2004, the FASB issued SFAS No. 123 (revised 2004), "Share-Based Payment," ("SFAS No. 123R"). SFAS No. 123R requires that stock-based employee compensation be recorded as a charge to earnings for interim or annual periods beginning after June 15, 2005. Accordingly... -

Page 28

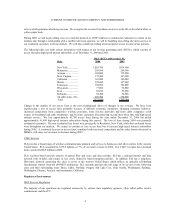

... 31, 2004. Although we have no material investments at the present time, we will evaluate the effect, if any, of EITF 03-1 when final guidance is released. (b) Results of Operations REVENUE ILEC revenue is generated primarily through the provision of local, network access, long distance and data... -

Page 29

...competitive wireline providers, from wireless providers and from cable companies (with respect to broadband and cable telephony), and by some customers disconnecting second lines when they add high-speed internet or cable modem service. We lost approximately 65,700 access lines during 2004 but added... -

Page 30

... distance minutes of use because consumers are increasingly using their wireless phones or calling cards to make long distance calls. Directory Services Directory revenue for the year ended December 31, 2004 increased $3.7 million or 3%, as compared with the prior year due to growth in yellow pages... -

Page 31

...to decreased costs in long distance access expense related to rate changes partially offset by increased circuit expense associated with additional data product sales in the ILEC sector. ELI costs have declined due to a drop in demand coupled with improved network cost efficiencies. Gas purchased We... -

Page 32

...the sales of The Gas Company in Hawaii ($11.3 million), our Arizona gas and electric divisions ($16.4 million) and Kauai Electric ($21.5 million). Expenses were negatively impacted by increased compensation expense of $1.5 million related to variable stock plans and increased pension expenses. Taxes... -

Page 33

... year due to increased marketing costs in the ILEC sector primarily related to enhanced services and high-speed internet. DEPRECIATION AND AMORTIZATION EXPENSE ($ in thousands) Depreciation expense Amortization expense Amount $ 446,190 126,520 $ 572,710 2004 $ Change $ (22,248) (318) $ (22,566... -

Page 34

... and electric sector impairments were associated with the sale of our Arizona and Hawaii gas and electric properties at prices that were less than the previous carrying values and the write-down of our remaining utility to our best estimate of net realizable sales price. Previously, we believed that... -

Page 35

... to the sales of The Gas Company in Hawaii and our Arizona gas and electric divisions, the sale of access lines in North Dakota and our wireless partnership interest in Wisconsin, and the sale of our Plano, Texas office building. During 2003, we executed a series of purchases in the open market of... -

Page 36

... business operations due to ongoing investing and funding activities, including those associated with our pension assets. Market risk refers to the potential change in fair value of a financial instrument as a result of fluctuations in interest rates and equity and commodity prices. We do not hold... -

Page 37

...proxy statement for the 2005 Annual Meeting of Stockholders to be filed with the Commission pursuant to Regulation 14A within 120 days after December 31, 2004. See "Executive Officers of the Registrant" in Part I of this Report following Item 4 for information relating to executive officers. Changes... -

Page 38

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES Item 11. Executive Compensation The information required by this Item is incorporated by reference from our definitive proxy statement for the 2005 Annual Meeting of Stockholders to be filed with the Commission pursuant to Regulation 14A within 120 ... -

Page 39

...File No. 001-11001). Convertible Preferred Securities Guarantee Agreement dated as of January 15, 1996 between Citizens Utilities Company and Chemical Bank, as guarantee trustee (incorporated by reference to Exhibit 4.200.8 to the Registrant's Form 8-K Current Report filed May 28, 1996, File No. 001... -

Page 40

... Non-Employee Directors' Deferred Fee Equity Plan dated as of May 18, 2004, (incorporated by reference to Exhibit 10.1.2 to the Registrant's Quarterly Report on Form 10-Q for the three months ended June 30, 2004, File No. 001-11001). Separation Agreement between Citizens Communications Company and... -

Page 41

...No. 001-11001). Summary of Compensation Arrangements for Named Executive Officers Outside of Employment Agreements and Summary of Non-Employee Directors' Compensation Arrangements. Split Dollar Life Insurance Agreement between Citizens Communications Company and L. Russell Mitten, effective April 28... -

Page 42

...the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. CITIZENS COMMUNICATIONS COMPANY (Registrant) By: /s/ Mary Agnes Wilderotter Mary Agnes Wilderotter President; Chief Executive Officer and Director... -

Page 43

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been...Jerry Elliott) Executive Vice President and Chief Financial Officer and Director Director (Lawton Fitt) /s/ Rudy J. Graf (Rudy J. Graf) /s/ Stanley Harfenist (... -

Page 44

-

Page 45

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES Index to Consolidated Financial Statements Item Management's Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Report of Independent Registered Public Accounting Firm Consolidated balance ... -

Page 46

...The Board of Directors and Shareholders Citizens Communications Company: The management of Citizens Communications Company and subsidiaries is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and... -

Page 47

... the degree of compliance with the policies or procedures may deteriorate. In our opinion, management's assessment that Citizens Communications Company and subsidiaries maintained effective internal control over financial reporting as of December 31, 2004, is fairly stated, in all material respects... -

Page 48

...that our audits provide a reasonable basis for our opinion. In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Citizens Communications Company and subsidiaries as of December 31, 2004 and 2003 and the results of... -

Page 49

...held for sale Total current liabilities Deferred income taxes Customer advances for construction and contributions in aid of construction Other liabilities Equity units Long-term debt Company Obligated Mandatorily Redeemable Convertible Preferred Securities* Shareholders' equity: Common stock, $0.25... -

Page 50

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2004, 2003 and 2002 ($ in thousands, except for per-share amounts) 2004 Revenue Operating expenses: Cost of services (exclusive of depreciation and amortization) Other operating ... -

Page 51

... Net income Other comprehensive income, net of tax and reclassifications adjustments Balance December 31, 2003 Stock plans Conversion of EPPICS Conversion of Equity Units Dividends on common stock of $2.50 per share Net income Tax benefit on equity forward contracts Other comprehensive loss, net of... -

Page 52

... aid of construction Long-term debt borrowings Debt issuance costs Long-term debt payments (Premium) discount to retire debt Issuance of common stock Dividends paid Net cash used by financing activities Cash provided by (used by) discontinued operations Proceeds from sale of discontinued operations... -

Page 53

... report. We are a communications company providing services to rural areas and small and medium-sized towns and cities as an incumbent local exchange carrier, or ILEC. We offer our ILEC services under the "Frontier" name. In addition, we provide competitive local exchange carrier, or CLEC, services... -

Page 54

...Notes 2 and 7). All remaining intangibles at December 31, 2004 are associated with the ILEC segment, which is the reporting unit. SFAS No. 142 also requires that intangible assets with estimated useful lives be amortized over those lives and be reviewed for impairment in accordance with SFAS No. 144... -

Page 55

...statement basis and the tax basis of assets and liabilities using tax rates to be in effect when the temporary differences are expected to reverse. (k) Employee Stock Plans: We have various employee stock-based compensation plans. Awards under these plans are granted to eligible officers, management... -

Page 56

... for changes made to the exercise price and the number of shares of a fixed stock option or award as a direct result of the special, non-recurring dividend. (l) Net Income (Loss) Per Common Share Available for Common Shareholders: Basic net income (loss) per common share is computed using the... -

Page 57

... over those lives and be reviewed for impairment in accordance with SFAS No. 144, "Accounting for Impairment or Disposal of Long-Lived Assets." We reassess the useful life of our intangible assets with estimated useful lives annually. Accounting for Asset Retirement Obligations In June 2001, the... -

Page 58

...a tender offer related to certain debt securities. Exit or Disposal Activities In June 2002, the FASB issued SFAS No. 146, "Accounting for Costs Associated with Exit or Disposal Activities," which nullified Emerging Issues Task Force (EITF) Issue No. 94-3, "Liability Recognition for Certain Employee... -

Page 59

...No. 132 (revised). Investments In March 2004, the FASB issued EITF Issue No. 03-1, "The Meaning of Other-Than-Temporary Impairment and Its Application to Certain Investments" (EITF 03-1) which provides new guidance for assessing impairment losses on debt and equity investments. Additionally, EITF 03... -

Page 60

...and historical expense data. Based on this review, the Company increased the depreciable lives of certain assets. During 2002, we recognized accelerated depreciation of $23,379,000 related to the change in useful lives of our accounting and human resource systems and our Plano, Texas office building... -

Page 61

... in Other income (loss), net: In October 2004, we sold cable assets in California, Arizona, Indiana, and Wisconsin for approximately $2,263,000 in cash. The pre-tax gain on the sale was $40,000. During the third quarter of 2004, we sold our corporate aircraft for approximately $15,298,000 in cash... -

Page 62

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements (8) Discontinued Operations and Net Assets Held for Sale: On August 24, 1999, our Board of Directors approved a plan of divestiture for our public utilities services businesses, which included our water, gas... -

Page 63

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements Summarized balance sheet information for the gas and electric operations (assets held for sale) is set forth below: ($ in thousands) Current assets Net property, plant and equipment Other assets Total assets... -

Page 64

.... The Company's investments in entities that are accounted for under the equity method of accounting consist of the following: (1) a 33% interest in the Mohave Cellular Limited Partnership which is engaged in cellular mobile telephone service in the Arizona area; (2) a 25% interest in the Fairmount... -

Page 65

... a weighted average of multiple issuances. ** In accordance with FIN 46R, the Trust holding the EPPICS and the related Citizens Utilities Capital L.P. are now deconsolidated (see Note 16). *** Includes purchases on the open market (see note 2). On January 15, 2004, we repaid at maturity the... -

Page 66

... 2002, we completed a tender offer with respect to our 6.80% Debentures due 2026 (puttable at par in 2003) and ELI's 6.05% Guaranteed Notes due 2004. As a result of the tender, $82,286,000 and $259,389,000, respectively, of these securities were purchased and retired at a pre-tax cost of $12,800,000... -

Page 67

...had completed its review of the Company's financial and strategic alternatives and on September 2, 2004 the Company paid a special, non-recurring dividend of $2 per common share and a quarterly dividend of $0.25 per common share to shareholders of record on August 18, 2004. Concurrently, Leonard Tow... -

Page 68

... represents the sales of The Gas Company in Hawaii and our Arizona gas and electric divisions, access lines in North Dakota and our wireless partnership interest in Wisconsin, and our Plano, Texas office building. Other, net for 2002 includes a $12,800,000 loss related to a tender offer completed in... -

Page 69

... 31, 2004, we have five stock based compensation plans, which are described below. We apply APB Opinion No. 25 and related interpretations in accounting for the employee stock plans resulting in the use of the intrinsic value to value the stock option. Compensation cost has not generally been... -

Page 70

... statements related to the Employee Stock Purchase Plan (ESPP) because the purchase price is 85% of the fair value. In connection with our Directors' Deferred Fee Equity Plan, compensation cost associated with the issuance of stock units was $2,222,000, $607,000 and $359,000 in 2004, 2003 and 2002... -

Page 71

...pro forma calculation, the fair value of each option grant is estimated on the date of grant using the Black Scholes option-pricing model with the following weighted average assumptions used for grants in 2003 and 2002: 2003 Dividend yield Expected volatility Risk-free interest rate Expected life 44... -

Page 72

... under our 2000 Equity Incentive Plan. The price of these options, which are immediately exercisable, is set at the average of the high and low market prices of the Company's common stock on the effective date of the director's initial election to the board. Annually, each non-employee director also... -

Page 73

... is not recorded because the options are granted at the fair market value of our common stock on the grant date. We had also maintained a Non-Employee Directors' Retirement Plan providing for the payment of specified sums annually to our non-employee directors, or their designated beneficiaries... -

Page 74

... thousands) Deferred income tax liabilities: Property, plant and equipment basis differences Intangibles Unrealized securities gain Other, net Deferred income tax assets: Minimum pension liability Tax operating loss carryforward Alternate minimum tax credit carryforward Employee benefits Other, net... -

Page 75

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES Notes to Consolidated Financial Statements The provision (benefit) for federal and state income taxes, as well as the taxes charged or credited to shareholders' equity, includes amounts both payable currently and deferred for payment in future ... -

Page 76

..." and EITF 00-23, "Issues Related to the Accounting for Stock Compensation under APB No. 25 and FIN 44", there is no accounting consequence for changes made to the exercise price and the number of shares of a fixed stock option or award as a direct result of the special, non-recurring dividend. F-32 -

Page 77

... to the $300,000,000 purchased in July, resulted in a pre-tax charge of approximately $20,080,000 during the third quarter of 2004, but will result in an annual reduction in interest expense of about $27,555,000 per year. As a result of our July dividend announcement with respect to our common... -

Page 78

... telecommunications services, principally to businesses, in competition with the ILEC. As a CLEC, we frequently obtain the "last mile" access to customers through arrangements with the applicable ILEC. ILECs and CLECs are subject to different regulatory frameworks of the Federal Communications... -

Page 79

... Assets 1 $ $ (2) (3) Consists principally of post-sale activities associated with the completion of our utility divestiture program. These costs could not be accrued as a selling cost at the time of sale. 2 Includes $110,000,000 of previously leased facilities purchased by ELI in April 2002... -

Page 80

...-tax loss on the sale was $1,087,000. In October 2004, we sold cable assets in California, Arizona, Indiana, and Wisconsin for approximately $2,263,000 in cash. The pre-tax gain on these sales was $40,000. 2003 Transactions On April 1, 2003, we completed the sale of approximately 11,000 access lines... -

Page 81

...the following: discount rates, expected long-term rate of return on plan assets, future compensation increases, employee turnover, healthcare cost trend rates, expected retirement age, optional form of benefit and mortality. The Company reviews these assumptions for changes annually with its outside... -

Page 82

... securities and 55% to 70% in equity securities. We review our asset allocation at least annually and make changes when considered appropriate. In 2004, we did not change our expected long-term rate of return from the 8.25% used in 2003. Our pension plan assets are valued at actual market value... -

Page 83

...in thousands) Change in benefit obligation Benefit obligation at beginning of year Service cost Interest cost Amendments Actuarial loss Settlement due to transfer of plan Plant closings/Reduction in force Benefits paid Benefit obligation at end of year Change in plan assets Fair value of plan assets... -

Page 84

...the Frontier acquisition, Global Crossing and we agreed to the transfer of pension liabilities and assets related to substantially all Frontier employees. The liabilities associated with the Frontier employees retained by Global Crossing were valued following the Pension Benefit Guaranty Corporation... -

Page 85

...and 2002: ($ in thousands) Change in benefit obligation Benefit obligation at beginning of year Service cost Interest cost Plan participants' contributions Actuarial (gain) loss Amendments Benefits paid Benefit obligation at end of year Change in plan assets Fair value of plan assets at beginning of... -

Page 86

... frozen from the date of sale and we have retained those liabilities. During 2003, we sold our remaining gas businesses in Hawaii and Arizona as well as our electric business in Arizona. The pension plan covering union employees for the Hawaiian gas property was transferred in its entirety to the... -

Page 87

..., 2004, one of our subsidiaries, Frontier Subsidiary Telco Inc., received a "Notice of Indemnity Claim" from Citibank, N.A., that is related to a complaint pending against Citibank and others in the U.S. Bankruptcy Court for the Southern District of New York as part of the Global Crossing bankruptcy... -

Page 88

... 31, 2004, the estimated future payments for obligations under our long distance contracts and service agreements are as follows: ($ in thousands) Year 2005 2006 2007 2008 2009 thereafter Total ILEC / ELI $ 35,831 26,363 6,796 735 165 990 $ 70,880 The Company sold all of its utility businesses as... -

Page 89

... with the State of New York (related to workers compensation claims) from Global Crossing, Inc. CNA serves as our agent with respect to general liability claims (auto, workers compensation and other insured perils of the Company). As our agent, they administer all claims and make payments for claims... -

Page 90

... and Shareholders Citizens Communications Company: Under date of March 11, 2005, we reported separately on the consolidated balance sheets of Citizens Communications Company and subsidiaries as of December 31, 2004 and 2003, and the related consolidated statements of operations, shareholders' equity... -

Page 91

Schedule II CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES Valuation and Qualifying Accounts ($ In thousands) Additions Charged to Charged to other costs and accounts expenses Revenue Accounts Allowance for doubtful accounts 2002 2003 2004 Balance at beginning of period Deductions Balance at ... -

Page 92

... each sales transaction. For information and/or an enrollment form for this Plan, please contact Illinois Stock Transfer Company. Stock Safekeeping Program The Stock Safekeeping Program is voluntary and allows shareholders to mail their stock certiï¬cates to Citizens' transfer agent, Illinois Stock... -

Page 93

...'s 2004 Form 10-K report ï¬led with the U.S. Securities and Exchange Commission and other information about the company may be requested by telephoning 402.572.4972, faxing to 203.614.4602, or emailing [email protected]. CORPORATE HEADQUARTERS Citizens Communications 3 High Ridge Park Stamford, CT... -

Page 94

(This page intentionally left blank.) -

Page 95

(This page intentionally left blank.) -

Page 96

(This page intentionally left blank.)