Electronic Arts 2016 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

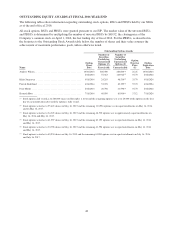

Proxy Statement

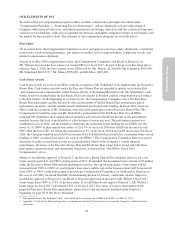

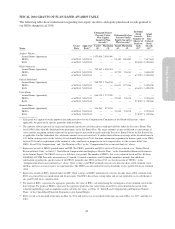

grants; however after applying the cap described above, the number of shares earned from our June 2013 PRSU

grant was reduced to 200% of target shares. If the Company’s TSR at any Vesting Opportunity is negative on an

absolute basis, the number of shares that can be earned is capped at 100% of the target regardless of the

Company’s Relative NASDAQ-100 TSR Percentile.

In addition, as an incentive to keep our executives focused on long-term TSR performance, our PRSU program

provides an opportunity for our executives to earn shares at the second and third Vesting Opportunities that were

not earned at the first and second Vesting Opportunities in an amount up to 100% of the target number of shares

unearned from the previous Vesting Opportunities. These shares are earned in the event that Company’s Relative

NASDAQ-100 TSR Percentile subsequently improves over the cumulative 24-month and/or 36-month Vesting

Measurement Periods. This feature has never been applied to PRSUs granted to our NEOs, and given our

Relative NASDAQ-100 TSR Percentile in fiscal 2016, this feature will not be applicable until, at the earliest, for

the PRSUs vesting in fiscal 2019.

For fiscal 2016, the Compensation Committee made a change to the PRSU design to remove the maximum

payout value cap of five times the stock price on the date of grant. This design feature was originally included in

the program upon its inception to reduce the accounting valuation of the awards. The Compensation Committee

determined that the cap was not a market standard provision for performance award programs. Further, in light of

the Company’s TSR performance in recent years, the removal of the cap better aligned the interest of

management with those of our stockholders.

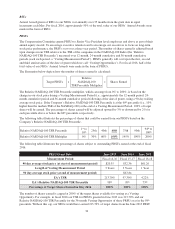

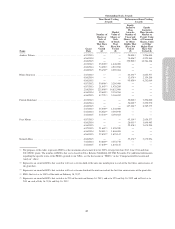

Use of Non-GAAP Financial Measures

The Company’s management team is evaluated on the basis of non-GAAP financial measures and these measures

also facilitate comparisons of the Company’s performance to prior periods. In connection with the evaluation of

management, the Company uses certain adjusted non-GAAP financial measures when establishing performance-

based bonus targets, such as non-GAAP net revenue, non-GAAP digital net revenue, non-GAAP gross profit,

non-GAAP operating income, non-GAAP net income, non-GAAP diluted earnings per share and non-GAAP

diluted shares. These non-GAAP financial measures exclude the following items (other than shares from the

convertible bond hedge, which are included) as applicable, in a given reporting period: acquisition-related

expenses, amortization of debt discount and loss on conversion of notes, change in deferred net revenue (online-

enabled games), income tax adjustments, shares from convertible bond hedge and stock-based compensation,

among others. In addition, for these purposes, we make further adjustments to our publicly disclosed non-GAAP

measures to add back bonus expense.

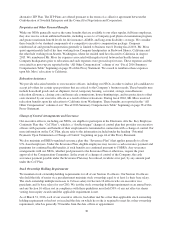

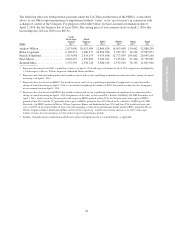

OTHER COMPENSATION INFORMATION

Benefits and Retirement Plans

We provide a wide array of significant employee benefit programs to all of our regular, full-time employees,

including our NEOs, including medical, dental, prescription drug, vision care, disability insurance, life insurance,

accidental death and dismemberment (“AD&D”) insurance, a flexible spending plan, business travel accident

insurance, an educational reimbursement program, an adoption assistance program, an employee assistance

program, an employee stock purchase plan, paid time off, and a monthly car allowance or use of a company car

for employees in certain positions and locations, including in Sweden where Mr. Söderlund resides. We also

offer a sabbatical program for regular full-time employees who commenced employment prior to October 7,

2009. If employees, including our NEOs, are unable to utilize their full sabbatical benefit within the eligibility

period, they receive a cash payout for up to 50% of their accrued, but unused, sabbatical.

We offer retirement plans to our employees based upon their country of employment. In the United States, our

employees, including our U.S.-based NEOs, are eligible to participate in a tax-qualified section 401(k) plan, with

an annual Company discretionary matching contribution of up to 6% of eligible compensation. The amount of the

matching contribution is determined each year based on the Company’s fiscal year performance. We also

maintain a nonqualified deferred compensation plan in which executive-level employees, including our NEOs

and our directors, are eligible to participate. None of our NEOs participated in the deferred compensation plan

during fiscal 2016. In Sweden, where Mr. Söderlund resides, the Company contributes to supplementary ITP

occupational pension plans (the “ITP Plans”) for eligible employees, which provide retirement, life insurance and

disability benefits. Eligible employees above certain income thresholds also may elect to participate in an

35