Electronic Arts 2016 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

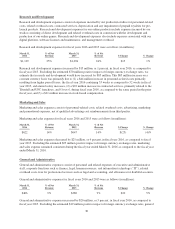

and administrative expenses would have increased by $39 million. This $39 million increase on a constant

currency basis was primarily due to (1) a $18 million increase in facilities-related expenses, (2) a $18 million

increase in personnel-related costs primarily resulting from higher payroll taxes, the fiscal year 2016 containing

53 weeks as compared to 52 weeks in fiscal year 2015, and annual salary increases, (3) a $10 million increase in

stock-based compensation. This was partially offset by a $6 million decrease in litigation matters during fiscal

year 2016 as compared to fiscal year 2015.

Income Taxes

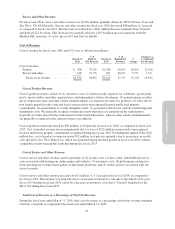

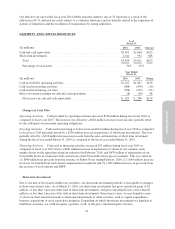

Provision for (benefit from) income taxes for fiscal years 2016 and 2015 was as follows (in millions):

March 31,

2016

Effective

Tax

Rate

March 31,

2015

Effective

Tax Rate

$(279) (31.8)% $50 5.4%

From the third quarter of fiscal year 2009 to the third quarter of fiscal year 2016, we maintained a 100%

valuation allowance against most of our U.S. deferred tax assets because there was insufficient positive evidence

to overcome the existing negative evidence such that it was not more likely than not that the U.S. deferred tax

assets were realizable. While we reported U.S. pre-tax income in fiscal year 2015, because we reported U.S. pre-

tax losses during the previous seven fiscal years, as well as in the second and third quarters of fiscal year 2016,

we continued to maintain the 100% valuation allowance through the third quarter of fiscal year 2016.

In the fourth quarter of fiscal year 2016, we realized significant U.S. pre-tax income for both the fourth quarter

and the fiscal year ended March 31, 2016. As of March 31, 2016, we had reported positive operating

performance in the U.S. for two consecutive fiscal years and had also reported a cumulative three-year U.S. pre-

tax profit. In addition, during the fourth quarter of fiscal year 2016, we completed our financial plan for fiscal

year 2017 and expect continued positive operating performance in the U.S. We also considered forecasts of

future taxable income and evaluated the utilization of tax credit carryforwards prior to their expiration. After

considering these factors, we determined that the positive evidence overcame any negative evidence and

concluded that it was more likely than not that the U.S. deferred tax assets were realizable. As a result, we

released the valuation allowance against all of the U.S. federal deferred tax assets and a portion of the U.S. state

deferred tax assets during the fourth quarter of fiscal year 2016. Accordingly, we recorded a $453 million income

tax benefit in fiscal year 2016 for the reversal of a significant portion of our deferred tax valuation allowance.

Our effective tax rate for fiscal year 2016 was a tax benefit of 31.8 percent, primarily due to the reversal of the

U.S. deferred tax valuation allowance. Excluding the impact of the reversal of the valuation allowance, our

effective tax rate for fiscal year 2016 would have been 19.8 percent, which differs from the statutory rate of 35.0

percent primarily due to non-U.S. profits subject to a reduced or zero tax rates.

Our effective tax rate for the fiscal year 2015 differs from the statutory rate of 35.0 percent as a result of the

utilization of U.S. deferred tax assets subject to a valuation allowance and tax benefits related to the expiration of

statutes of limitations and the resolution of examinations by taxing authorities.

Prior to fiscal year 2016, our effective income tax rates have been significantly affected by the U.S. valuation

allowance. As a result of the release of the valuation allowance in fiscal year 2016, we do not anticipate that our

effective income tax rates for fiscal year 2017 and future periods will be as significantly affected by changes in

our deferred tax valuation allowance as they were prior to fiscal year 2017. Our effective income tax rates for

fiscal year 2017 and future periods will continue to depend on a variety of factors, including changes in the

deferred tax valuation allowance, changes in our business such as acquisitions and intercompany transactions,

changes in our international structure, changes in the geographic location of business functions or assets, changes

in the geographic mix of income, changes in or termination of our agreements with tax authorities, applicable

accounting rules, applicable tax laws and regulations, rulings and interpretations thereof, developments in tax

audit and other matters, and variations in our annual pre-tax income or loss. We incur certain tax expenses that

37