Electronic Arts 2016 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Acquisition-Related Intangibles and Other Long-Lived Assets

We record acquisition-related intangible assets, such as developed and core technology, in connection with

business combinations. We amortize the cost of acquisition-related intangible assets that have finite useful lives

on a straight-line basis over the lesser of their estimated useful lives or the agreement terms, typically from two

to fourteen years. We evaluate acquisition-related intangibles and other long-lived assets for impairment

whenever events or changes in circumstances indicate that the carrying amount of an asset may not be

recoverable. Recoverability of assets is measured by a comparison of the carrying amount of an asset to future

undiscounted net cash flows expected to be generated by the asset group. This includes assumptions about future

prospects for the business that the asset relates to and typically involves computations of the estimated future

cash flows to be generated by these businesses. Based on these judgments and assumptions, we determine

whether we need to take an impairment charge to reduce the value of the asset stated on our Consolidated

Balance Sheets to reflect its estimated fair value. When we consider such assets to be impaired, the amount of

impairment we recognize is measured by the amount by which the carrying amount of the asset exceeds its fair

value. There were no material impairments in fiscal years 2016, 2015, and 2014.

Goodwill

In assessing impairment on our goodwill, we first analyze qualitative factors to determine whether it is more

likely than not that the fair value of a reporting unit is less than its carrying amount as a basis for determining

whether it is necessary to perform the two-step goodwill impairment test. The qualitative factors we assess

include long-term prospects of our performance, share price trends and market capitalization, and Company

specific events. If we conclude it is more likely than not that the fair value of a reporting unit exceeds its carrying

amount, we do not need to perform the two-step impairment test. If based on that assessment, we believe it is

more likely than not that the fair value of the reporting unit is less than its carrying value, a two-step goodwill

impairment test will be performed. The first step measures for impairment by applying fair value-based tests at

the reporting unit level. The second step (if necessary) measures the amount of impairment by applying fair

value-based tests to the individual assets and liabilities within each reporting unit. Reporting units are determined

by the components of operating segments that constitute a business for which (1) discrete financial information is

available, (2) segment management regularly reviews the operating results of that component, and (3) whether

the component has dissimilar economic characteristics to other components. We determined that it was more

likely than not that the fair value of our reporting unit exceeded its carrying amount and, as such, we did not need

to perform the two-step impairment test.

During the fiscal years ended March 31, 2016, 2015 and 2014, we completed our annual goodwill impairment

testing in the fourth quarter of each year and did not recognize any impairment charges.

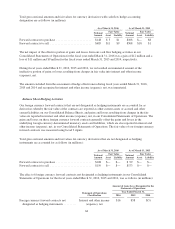

Revenue Recognition, Sales Returns and Allowances, and Bad Debt Reserves

We derive revenue principally from sales of interactive software games, and related content (e.g., micro-

transactions) and services on consoles (such as the PlayStation from Sony and the Xbox from Microsoft), PCs,

mobile phones and tablets. We evaluate revenue recognition based on the criteria set forth in FASB Accounting

Standards Codification (“ASC”) 605, Revenue Recognition and ASC 985-605, Software: Revenue Recognition.

We classify our revenue as either product revenue or service and other revenue.

Product revenue. Our product revenue includes revenue associated with the sale of software games or related

content, whether delivered via a physical disc (e.g., packaged goods) or delivered digitally (e.g., full-game

downloads, extra-content), and licensing of game software to third-parties. Product revenue also includes revenue

from mobile full game downloads that do not require our hosting support (e.g., premium mobile games) in order

to utilize the game or related content (i.e. can be played with or without an Internet connection), and sales of

tangible products such as hardware, peripherals, or collectors’ items.

Service and other revenue. Our service revenue includes revenue recognized from time-based subscriptions and

games or related content that requires our hosting support in order to utilize the game or related content (i.e., can

54