Electronic Arts 2016 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

granted at 100 percent of target of the number of market-based restricted stock units that may potentially vest.

The maximum number of shares of common stock that could vest is approximately 0.8 million for market-based

restricted stock units granted during the fiscal year 2016. As of March 31, 2016, the maximum number of shares

that could vest is approximately 1.3 million for market-based restricted stock units outstanding.

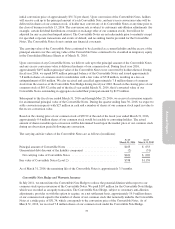

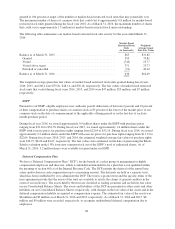

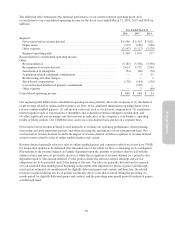

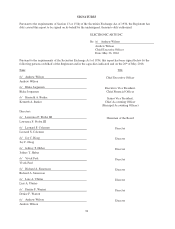

The following table summarizes our market-based restricted stock unit activity for the year ended March 31,

2016:

Market-Based

Restricted Stock

Units

(in thousands)

Weighted-

Average Grant

Date Fair Value

Balance as of March 31, 2015 ......................................... 663 $31.82

Granted ........................................................ 395 79.81

Vested ......................................................... (742) 25.77

Vested above target ............................................... 371 25.77

Forfeited or cancelled ............................................. (51) 40.10

Balance as of March 31, 2016 ......................................... 636 $64.49

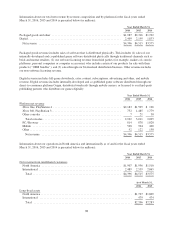

The weighted-average grant date fair values of market-based restricted stock units granted during fiscal years

2016, 2015, and 2014 were $79.81, $48.14, and $30.18, respectively. The fair values of market-based restricted

stock units that vested during fiscal years 2016, 2015, and 2014 were $47 million, $23 million, and $7 million,

respectively.

ESPP

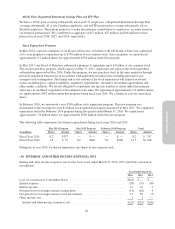

Pursuant to our ESPP, eligible employees may authorize payroll deductions of between 2 percent and 10 percent

of their compensation to purchase shares of common stock at 85 percent of the lower of the market price of our

common stock on the date of commencement of the applicable offering period or on the last day of each six-

month purchase period.

During fiscal year 2016, we issued approximately 0.9 million shares under the ESPP with purchase prices

ranging from $32.16 to $54.78. During fiscal year 2015, we issued approximately 1.4 million shares under the

ESPP with exercise prices for purchase rights ranging from $22.64 to $32.16. During fiscal year 2014, we issued

approximately 2.2 million shares under the ESPP with exercise prices for purchase rights ranging from $11.33 to

$22.64. During fiscal years 2016, 2015, and 2014, the estimated weighted-average fair values of purchase rights

were $12.97, $8.26 and $4.67, respectively. The fair values were estimated on the date of grant using the Black-

Scholes valuation model. We issue new common stock out of the ESPP’s pool of authorized shares. As of

March 31, 2016, 5.2 million shares were available for grant under our ESPP.

Deferred Compensation Plan

We have a Deferred Compensation Plan (“DCP”) for the benefit of a select group of management or highly

compensated employees and directors, which is unfunded and intended to be a plan that is not qualified within

the meaning of section 401(a) of the Internal Revenue Code. The DCP permits the deferral of the annual base

salary and/or director cash compensation up to a maximum amount. The deferrals are held in a separate trust,

which has been established by us to administer the DCP. The trust is a grantor trust and the specific terms of the

trust agreement provide that the assets of the trust are available to satisfy the claims of general creditors in the

event of our insolvency. The assets held by the trust are classified as trading securities and are held at fair value

on our Consolidated Balance Sheets. The assets and liabilities of the DCP are presented in other assets and other

liabilities on our Consolidated Balance Sheets, respectively, with changes in the fair value of the assets and in the

deferred compensation liability recognized as compensation expense. The estimated fair value of the assets was

$8 million and $9 million as of March 31, 2016 and 2015, respectively. As of March 31, 2016 and 2015, $8

million and $9 million were recorded, respectively, to recognize undistributed deferred compensation due to

employees.

84