Electronic Arts 2016 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

Unrealized gains and losses on our short-term investments are recorded as a component of accumulated other

comprehensive income (loss) in stockholders’ equity, net of tax, until either (1) the security is sold, (2) the

security has matured, or (3) we determine that the fair value of the security has declined below its adjusted cost

basis and the decline is other-than-temporary. Realized gains and losses on our short-term investments are

calculated based on the specific identification method and are reclassified from accumulated other

comprehensive income (loss) to interest and other income (expense), net, or gains on strategic investments, net.

Determining whether a decline in fair value is other-than-temporary requires management judgment based on the

specific facts and circumstances of each security. The ultimate value realized on these securities is subject to

market price volatility until they are sold.

Our short-term investments are evaluated for impairment quarterly. We consider various factors in determining

whether we should recognize an impairment charge, including the credit quality of the issuer, the duration that

the fair value has been less than the adjusted cost basis, severity of the impairment, reason for the decline in

value and potential recovery period, the financial condition and near-term prospects of the investees, our intent to

sell and ability to hold the investment for a period of time sufficient to allow for any anticipated recovery in

market value, and any contractual terms impacting the prepayment or settlement process. If we conclude that an

investment is other-than-temporarily impaired, we recognize an impairment charge at that time in our

Consolidated Statements of Operations. Based on our evaluation, we did not consider any of our investments to

be other-than-temporarily impaired as of March 31, 2016 and 2015.

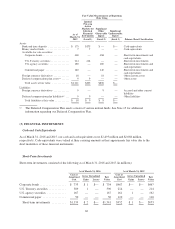

Inventories

Inventories consist of materials (including manufacturing royalties paid to console manufacturers), labor and

freight-in and are stated at the lower of cost (using the weighted average costing method) or net realizable value.

We regularly review inventory quantities on-hand. We write down inventory based on excess or obsolete

inventories determined primarily by future anticipated demand for our products. Inventory write-downs are

measured as the difference between the cost of the inventory and market value, based upon assumptions about

future demand that are inherently difficult to assess. At the point of a loss recognition, a new, lower cost basis for

that inventory is established, and subsequent changes in facts and circumstances do not result in the restoration or

increase in that newly established basis.

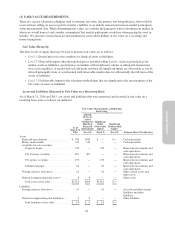

Property and Equipment, Net

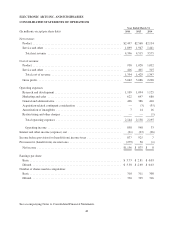

Property and equipment, net, are stated at cost. Depreciation is calculated using the straight-line method over the

following useful lives:

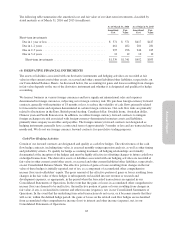

Buildings ..................................... 20to25years

Computer equipment and software ................. 3to6years

Equipment, furniture and fixtures, and other .......... 3to5years

Leasehold improvements ......................... Lesser of the lease term or the estimated useful lives

of the improvements, generally 1 to 10 years

We capitalize costs associated with internal-use software development once a project has reached the application

development stage. Such capitalized costs include external direct costs utilized in developing or obtaining the

software, and payroll and payroll-related expenses for employees who are directly associated with the

development of the software. Capitalization of such costs begins when the preliminary project stage is complete

and ceases at the point in which the project is substantially complete and is ready for its intended purpose. The

net book value of capitalized costs associated with internal-use software was $55 million and $62 million as of

March 31, 2016 and 2015, respectively. Once the internal-use software is ready for its intended use, the assets are

depreciated on a straight-line basis over each asset’s estimated useful life, which is generally three years.

53