Electronic Arts 2016 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

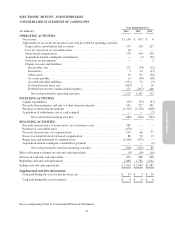

(2) FAIR VALUE MEASUREMENTS

There are various valuation techniques used to estimate fair value, the primary one being the price that would be

received from selling an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. When determining fair value, we consider the principal or most advantageous market in

which we would transact and consider assumptions that market participants would use when pricing the asset or

liability. We measure certain financial and nonfinancial assets and liabilities at fair value on a recurring and

nonrecurring basis.

Fair Value Hierarchy

The three levels of inputs that may be used to measure fair value are as follows:

•Level 1. Quoted prices in active markets for identical assets or liabilities.

•Level 2. Observable inputs other than quoted prices included within Level 1, such as quoted prices for

similar assets or liabilities, quoted prices in markets with insufficient volume or infrequent transactions

(less active markets), or model-derived valuations in which all significant inputs are observable or can be

derived principally from or corroborated with observable market data for substantially the full term of the

assets or liabilities.

•Level 3. Unobservable inputs to the valuation methodology that are significant to the measurement of the

fair value of assets or liabilities.

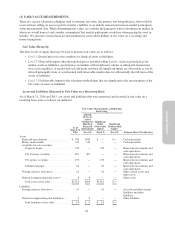

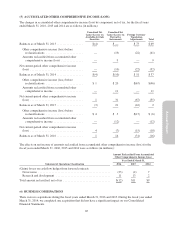

Assets and Liabilities Measured at Fair Value on a Recurring Basis

As of March 31, 2016 and 2015, our assets and liabilities that were measured and recorded at fair value on a

recurring basis were as follows (in millions):

Fair Value Measurements at Reporting

Date Using

As of

March 31,

2016

Quoted

Prices in

Active

Markets for

Identical

Financial

Instruments

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

(Level 1) (Level 2) (Level 3) Balance Sheet Classification

Assets

Bank and time deposits ................ $ 345 $345 $ — $— Cash equivalents

Money market funds .................. 143 143 — — Cash equivalents

Available-for-sale securities:

Corporate bonds .................... 745 — 745 — Short-term investments and

cash equivalents

U.S. Treasury securities .............. 407 407 — — Short-term investments and

cash equivalents

U.S. agency securities ............... 170 — 170 — Short-term investments and

cash equivalents

Commercial paper .................. 81 — 81 — Short-term investments and

cash equivalents

Foreign currency derivatives ............ 16 — 16 — Other current assets and

other assets

Deferred compensation plan assets(a) ...... 8 8 — — Other assets

Total assets at fair value .............. $1,915 $903 $1,012 $—

Liabilities

Foreign currency derivatives ............ 10 — 10 — Accrued and other current

liabilities and other

liabilities

Deferred compensation plan liabilities(a) . . . 9 9 — — Other liabilities

Total liabilities at fair value ........... $ 19 $ 9 $ 10 $—

61