Electronic Arts 2016 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

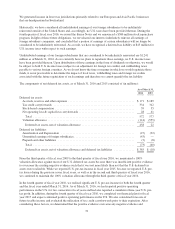

A total of 15.2 million options or 10.7 million restricted stock units were available for grant under our Equity

Plan as of March 31, 2016.

Stock Options

Options granted under the Equity Plan generally expire ten years from the date of grant and generally vest

according to one of the following schedules:

• 35 month vesting with

1

⁄

3

cliff vesting after 11, 23 and 35 months or;

• 50 month vesting with 24% of the shares cliff vesting after 12 months and the ratably over the following

38 months.

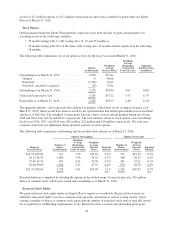

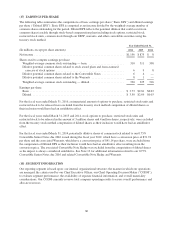

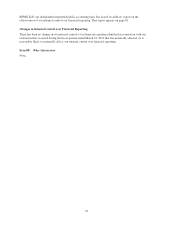

The following table summarizes our stock option activity for the fiscal year ended March 31, 2016:

Options

(in thousands)

Weighted-

Average

Exercise Prices

Weighted-

Average

Remaining

Contractual

Term (in years)

Aggregate

Intrinsic Value

(in millions)

Outstanding as of March 31, 2015 .............. 4,920 $37.44

Granted ................................. 6 66.08

Exercised ................................ (1,594) 42.43

Forfeited, cancelled or expired ............... (54) 35.61

Outstanding as of March 31, 2016 .............. 3,278 $35.09 5.61 $101

Vested and expected to vest ................... 3,163 $35.22 5.53 $ 97

Exercisable as of March 31, 2016 ............... 2,206 $36.55 4.46 $ 65

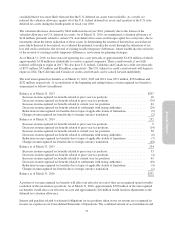

The aggregate intrinsic value represents the total pre-tax intrinsic value based on our closing stock price as of

March 31, 2016, which would have been received by the option holders had all the option holders exercised their

options as of that date. The weighted-average grant date fair values of stock options granted during fiscal years

2015 and 2014 were $12.01 and $8.61, respectively. The total intrinsic values of stock options exercised during

fiscal years 2016, 2015, and 2014 were $38 million, $22 million and $16 million, respectively. We issue new

common stock from our authorized shares upon the exercise of stock options.

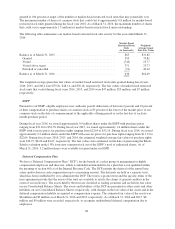

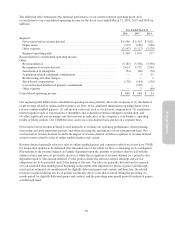

The following table summarizes outstanding and exercisable stock options as of March 31, 2016:

Options Outstanding Options Exercisable

Range of

Exercise Prices

Number of

Shares

(in thousands)

Weighted-

Average

Remaining

Contractual

Term (in years)

Weighted-

Average

Exercise

Prices

Potential

Dilution

Number of

Shares

(in thousands)

Weighted-

Average

Exercise

Prices

Potential

Dilution

$11.53-$23.83 317 3.39 $19.10 0.1% 313 $19.18 0.1%

26.25-26.25 1,000 7.58 26.25 0.3% 580 26.25 0.2%

27.49-35.70 853 8.21 35.50 0.3% 343 35.21 0.1%

36.00-59.63 1,108 2.47 47.33 0.4% 970 48.78 0.3%

$11.53-$59.63 3,278 5.61 $35.09 1.1% 2,206 $36.55 0.7%

Potential dilution is computed by dividing the options in the related range of exercise prices by 301 million

shares of common stock, which were issued and outstanding as of March 31, 2016.

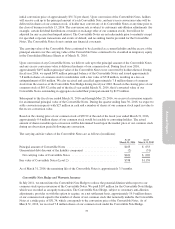

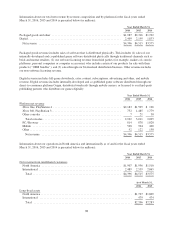

Restricted Stock Rights

We grant restricted stock rights under our Equity Plan to employees worldwide. Restricted stock units are

unfunded, unsecured rights to receive common stock upon the satisfaction of certain vesting criteria. Upon

vesting, a number of shares of common stock equivalent the number of restricted stock units is typically issued

net of required tax withholding requirements, if any. Restricted stock is issued and outstanding upon grant;

82