Electronic Arts 2016 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We are also subject to claims and litigation arising in the ordinary course of business. We do not believe that any

liability from any reasonably foreseeable disposition of such claims and litigation, individually or in the

aggregate, would have a material adverse effect on our Consolidated Financial Statements.

(14) PREFERRED STOCK

As of March 31, 2016 and 2015, we had 10,000,000 shares of preferred stock authorized but unissued. The rights,

preferences, and restrictions of the preferred stock may be designated by our Board of Directors without further

action by our stockholders.

(15) STOCK-BASED COMPENSATION AND EMPLOYEE BENEFIT PLANS

Valuation Assumptions

We estimate the fair value of stock-based awards on the date of grant. We recognize compensation costs for

stock-based awards to employees based on the grant-date fair value using a straight-line approach over the

service period for which such awards are expected to vest.

The determination of the fair value of market-based restricted stock units, stock options and ESPP is affected by

assumptions regarding subjective and complex variables. Generally, our assumptions are based on historical

information and judgment is required to determine if historical trends may be indicators of future outcomes. We

determine the fair value of our stock-based awards as follows:

•Restricted Stock Units. The fair value of restricted stock units is determined based on the quoted

market price of our common stock on the date of grant.

•Market-Based Restricted Stock Units. Market-based restricted stock units consist of grants of

performance-based restricted stock units to certain members of executive management that vest

contingent upon the achievement of pre-determined market and service conditions (referred to herein

as “market-based restricted stock units”). The fair value of our market-based restricted stock units is

determined using a Monte-Carlo simulation model. Key assumptions for the Monte-Carlo simulation

model are the risk-free interest rate, expected volatility, expected dividends and correlation coefficient.

•Stock Options and Employee Stock Purchase Plan. The fair value of stock options and stock purchase

rights granted pursuant to our equity incentive plans and our 2000 Employee Stock Purchase Plan, as

amended (“ESPP”), respectively, is determined using the Black-Scholes valuation model based on the

multiple-award valuation method. Key assumptions of the Black-Scholes valuation model are the risk-

free interest rate, expected volatility, expected term and expected dividends. The risk-free interest rate

is based on U.S. Treasury yields in effect at the time of grant for the expected term of the option.

Expected volatility is based on a combination of historical stock price volatility and implied volatility

of publicly-traded options on our common stock. Expected term is determined based on historical

exercise behavior, post-vesting termination patterns, options outstanding and future expected exercise

behavior.

There were an insignificant number of stock options granted during fiscal year 2016.

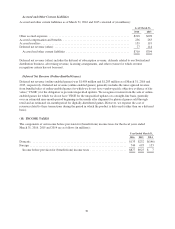

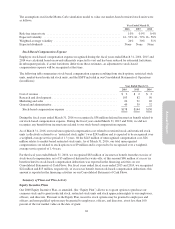

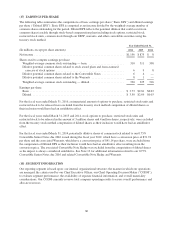

The assumptions used in the Black-Scholes valuation model to value our stock option grants and ESPP were as

follows:

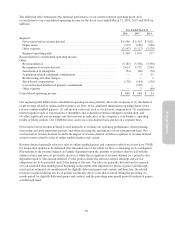

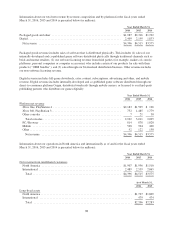

Stock Option Grants ESPP

Year Ended March 31, Year Ended March 31,

2015 2014 2016 2015 2014

Risk-free interest rate .............. 1.1-1.9% 1.6% 0.3 - 0.6% 0.04 - 0.2% 0.1%

Expected volatility ................ 36-40% 37-42% 32-36% 30-35% 36-38%

Weighted-average volatility ......... 38% 37% 33% 34% 38%

Expected term .................... 4.5years 4.5 years 6 - 12 months 6 - 12 months 6 - 12 months

Expected dividends ................ None None None None None

80