Electronic Arts 2016 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

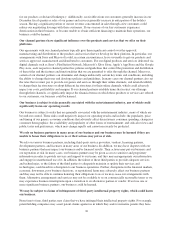

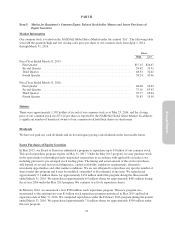

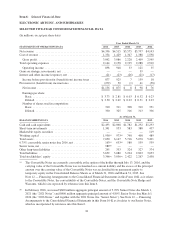

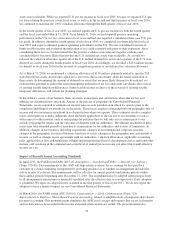

The following table summarizes the number of shares repurchased in the fourth quarter of the fiscal year ended

March 31, 2016:

Fiscal Month

Total Number

of Shares

Purchased

Average Price

Paid per Share

Total Number of

Shares Purchased as

part of Publicly

Announced Programs

Maximum Dollar

Value that May

Still Be Purchased

Under the Programs

(in millions)

January 3 — January 30, 2016 ......... 577,061 $66.52 577,061 $ 634

January 31 — February 27, 2016 ....... 1,989,912 $60.36 1,989,912 $1,013

February 28 — April 2, 2016 .......... 7,374,038 $64.38 7,374,038 $ 539

9,941,011 $63.70 9,941,011

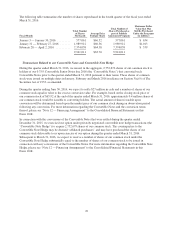

Transactions Related to our Convertible Notes and Convertible Note Hedge

During the quarter ended March 31, 2016, we issued, in the aggregate, 2,752,672 shares of our common stock to

holders of our 0.75% Convertible Senior Notes due 2016 (the “Convertible Notes”) that converted such

Convertible Notes prior to the quarter ended March 31, 2016 pursuant to their terms. These shares of common

stock were issued on multiple dates in January, February and March 2016 in reliance on Section 3(a)(9) of The

Securities Act of 1933, as amended.

During the quarter ending June 30, 2016, we expect to settle $27 million in cash and a number of shares of our

common stock equal in value to the excess conversion value. For example, based on the closing stock price of

our common stock of $65.92 at the end of the quarter ended March 31, 2016, approximately 0.4 million shares of

our common stock would be issuable to converting holders. The actual amount of shares issuable upon

conversion will be determined based upon the market price of our common stock during an observation period

following any conversion. For more information regarding the Convertible Notes and the conversion terms

thereof, please see “Note 12 — Financing Arrangement” to the Consolidated Financial Statements in this

Form 10-K.

In connection with the conversions of the Convertible Notes that were settled during the quarter ended

December 31, 2015, we exercised our option under privately negotiated convertible note hedge transactions (the

“Convertible Note Hedge”) to acquire 2,752,679 shares of our common stock. The counterparties to the

Convertible Note Hedge may be deemed “affiliated purchasers” and may have purchased the shares of our

common stock deliverable to us upon exercise of our option during the quarter ended March 31, 2016.

Subsequent to March 31, 2016, we expect to receive a number of shares of our common stock under the

Convertible Note Hedge substantially equal to the number of shares of our common stock to be issued in

connection with any conversions of the Convertible Notes. For more information regarding the Convertible Note

Hedge, please see “Note 12 — Financing Arrangement” to the Consolidated Financial Statements in this

Form 10-K.

22