Electronic Arts 2016 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

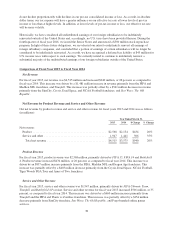

Marketing and Sales

Marketing and sales expenses for fiscal years 2015 and 2014 were as follows (in millions):

March 31,

2015

% of Net

Revenue

March 31,

2014

% of Net

Revenue $ Change % Change

$647 14% $680 19% $(33) (5)%

Marketing and sales expenses decreased by $33 million, or 5 percent, in fiscal year 2015, as compared to fiscal

year 2014. The decrease was primarily due to (1) a $9 million decrease in personnel-related costs, (2) a $10

million decrease in facility-related costs, and (3) a $9 million decrease in contracted services due to fewer

frontline title releases during fiscal year 2015 than during fiscal year 2014.

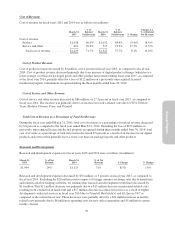

General and Administrative

General and administrative expenses for fiscal years 2015 and 2014 were as follows (in millions):

March 31,

2015

% of Net

Revenue

March 31,

2014

% of Net

Revenue $ Change % Change

$386 9% $410 11% $(24) (6)%

General and administrative expenses decreased by $24 million, or 6 percent, in fiscal year 2015, as compared to

fiscal year 2014, primarily due to a $30 million expense related to the settlement of a litigation matter during the

fiscal year ended March 31, 2014 and an $23 million decrease in costs incurred on a license, both related to our

college football franchise. This was partially offset by an $11 million increase primarily related to other litigation

matters and a $16 million increase in personnel-related costs during the fiscal year ended March 31, 2015.

Acquisition-Related Contingent Consideration

Acquisition-related contingent consideration for fiscal years 2015 and 2014 were as follows (in millions):

March 31,

2015

% of Net

Revenue

March 31,

2014

% of Net

Revenue $ Change % Change

(3) —% (35) (1)% $32 91%

During fiscal year 2015, acquisition-related contingent consideration credits decreased by $32 million, or 91

percent, as compared to fiscal year 2014, primarily resulting from changes in the fair market value of the

acquisition-related contingent consideration of our PopCap acquisition during fiscal year 2014. The PopCap

earn-out expired on December 31, 2013. No payments were made under this earn-out.

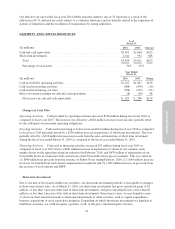

Income Taxes

Provision for (benefit from) income taxes for fiscal years 2015 and 2014 was as follows (in millions):

March 31,

2015

Effective

Tax

Rate

March 31,

2014

Effective

Tax Rate

$50 5.4% $(1) (14.3)%

Our effective tax rate for fiscal year 2015 was a tax expense of 5.4 percent. The fiscal year 2015 effective tax rate

differs from the statutory rate of 35.0 percent primarily due to the utilization of U.S. deferred tax assets, which

were subject to a valuation allowance, excess tax benefits from stock-based compensation deductions allocated

directly to contributed capital, and non- U.S. profits subject to a reduced or zero tax rates. The provision for

income taxes for fiscal year 2015 differs from the benefit from income taxes for fiscal year 2014 primarily due to

benefits related to the expiration of statutes of limitations and the resolution of examinations by taxing authorities

recorded in fiscal year 2014.

40