Electronic Arts 2016 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

We believe the counterparties to our foreign currency forward contracts are creditworthy multinational

commercial banks. While we believe the risk of counterparty nonperformance is not material, a sustained decline

in the financial stability of financial institutions as a result of disruption in the financial markets could affect our

ability to secure creditworthy counterparties for our foreign currency hedging programs.

Notwithstanding our efforts to mitigate some foreign currency exchange rate risks, there can be no assurance that

our hedging activities will adequately protect us against the risks associated with foreign currency fluctuations.

As of March 31, 2016, a hypothetical adverse foreign currency exchange rate movement of 10 percent or 20

percent would have resulted in potential declines in the fair value on our foreign currency forward contracts used

in cash flow hedging of $83 million and $167 million, respectively. As of March 31, 2016, a hypothetical adverse

foreign currency exchange rate movement of 10 percent or 20 percent would have resulted in potential losses on

our foreign currency forward contracts used in balance sheet hedging of $27 million and $53 million,

respectively. This sensitivity analysis assumes an adverse shift of all foreign currency exchange rates; however,

all foreign currency exchange rates do not always move in such manner and actual results may differ materially.

See Note 4 — Derivative Financial Instruments to the Consolidated Financial Statements in this Form 10-K as it

relates to our derivative financial instruments, which is incorporated by reference into this Item 7A.

Interest Rate Risk

Our exposure to market risk for changes in interest rates relates primarily to our short-term investment portfolio.

We manage our interest rate risk by maintaining an investment portfolio generally consisting of debt instruments

of high credit quality and relatively short maturities. However, because short-term investments mature relatively

quickly and are required to be reinvested at the then-current market rates, interest income on a portfolio

consisting of short-term investments is more subject to market fluctuations than a portfolio of longer term

investments. Additionally, the contractual terms of the investments do not permit the issuer to call, prepay or

otherwise settle the investments at prices less than the stated par value. Our investments are held for purposes

other than trading. Also, we do not use derivative financial instruments in our short-term investment portfolio.

As of March 31, 2016, our short-term investments were classified as available-for-sale securities and,

consequently, were recorded at fair value with unrealized gains or losses resulting from changes in fair value

reported as a separate component of accumulated other comprehensive income, net of tax, in stockholders’

equity.

Notwithstanding our efforts to manage interest rate risks, there can be no assurance that we will be adequately

protected against risks associated with interest rate fluctuations. At any time, a sharp change in interest rates

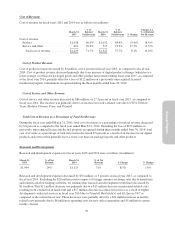

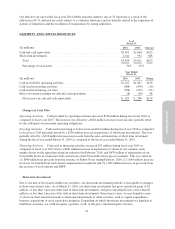

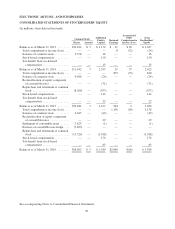

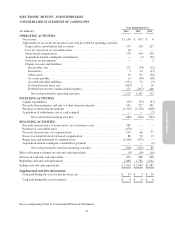

could have a significant impact on the fair value of our investment portfolio. The following table presents the

hypothetical changes in the fair value of our short-term investment portfolio as of March 31, 2016, arising from

potential changes in interest rates. The modeling technique estimates the change in fair value from immediate

hypothetical parallel shifts in the yield curve of plus or minus 50 basis points (“BPS”), 100 BPS, and 150 BPS.

Valuation of Securities

Given an Interest Rate Decrease

of X Basis Points

Fair Value

as of

March 31,

2016

Valuation of Securities Given

an Interest Rate Increase of

X Basis Points

(In millions) (150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

Corporate bonds .................... $ 744 $ 741 $ 737 $ 734 $ 730 $ 726 $ 723

U.S. Treasury securities .............. 399 395 392 390 386 383 380

U.S. agency securities ............... 171 170 169 167 167 166 165

Commercial paper .................. 50 50 50 50 50 50 50

Total short-term investments ........ $1,364 $1,356 $1,348 $1,341 $1,333 $1,325 $1,318

45