Electronic Arts 2016 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

initial conversion price of approximately $31.74 per share). Upon conversion of the Convertible Notes, holders

will receive cash up to the principal amount of each Convertible Note, and any excess conversion value will be

delivered in shares of our common stock. A holder may convert any of its Convertible Notes at any time prior to

the close of business on July 13, 2016. The conversion rate is subject to customary anti-dilution adjustments (for

example, certain dividend distributions or tender or exchange offer of our common stock), but will not be

adjusted for any accrued and unpaid interest. The Convertible Notes are not redeemable prior to maturity except

for specified corporate transactions and events of default, and no sinking fund is provided for the Convertible

Notes. The Convertible Notes do not contain any financial covenants.

The carrying value of the Convertible Notes continued to be classified as a current liability and the excess of the

principal amount over the carrying value of the Convertible Notes continued to be classified in temporary equity

in the Consolidated Balance Sheets as of March 31, 2016.

Upon conversion of any Convertible Notes, we deliver cash up to the principal amount of the Convertible Notes

and any excess conversion value is delivered in shares of our common stock. During fiscal year 2016,

approximately $497 million principal value of the Convertible Notes were converted by holders thereof. During

fiscal year 2016, we repaid $470 million principal balance of the Convertible Notes and issued approximately

7.8 million shares of common stock to noteholders with a fair value of $518 million, resulting in a loss on

extinguishment of $10 million. We also received and cancelled approximately 7.8 million shares of common

stock from the exercise of the Convertible Note Hedge during fiscal year 2016. Based on the closing price of our

common stock of $65.92 at the end of the fiscal year ended March 31, 2016, the if-converted value of our

Convertible Notes outstanding in aggregate exceeded their principal amount by $175 million.

Subsequent to the fiscal year ended March 31, 2016 and through May 23, 2016, we received conversion requests

for an immaterial principal value of the Convertible Notes. During the quarter ending June 30, 2016, we expect to

settle conversion requests with $27 million in cash and a number of shares of our common stock equal in value to

the excess conversion value.

Based on the closing price of our common stock of $65.92 at the end of the fiscal year ended March 31, 2016,

approximately 0.4 million shares of our common stock would be issuable to converting holders. The actual

amount of shares issuable upon conversion will be determined based upon the market price of our common stock

during an observation period following any conversion.

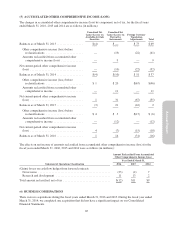

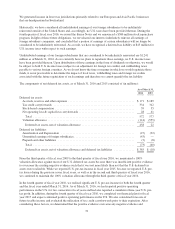

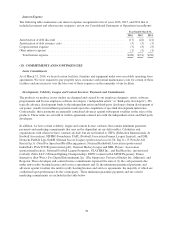

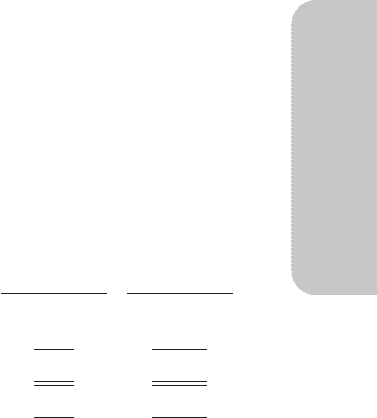

The carrying and fair values of the Convertible Notes are as follows (in millions):

As of

March 31, 2016

As of

March 31, 2015

Principal amount of Convertible Notes .................................. $163 $ 633

Unamortized debt discount of the liability component ...................... (2) (31)

Net carrying value of Convertible Notes ............................... $161 $ 602

Fair value of Convertible Notes (Level 2) ................................ $338 $1,158

As of March 31, 2016, the remaining life of the Convertible Notes is approximately 3.5 months.

Convertible Note Hedge and Warrants Issuance

In July 2011, we entered into the Convertible Note Hedge to reduce the potential dilution with respect to our

common stock upon conversion of the Convertible Notes. We paid $107 million for the Convertible Note Hedge,

which was recorded as an equity transaction. The Convertible Note Hedge, subject to customary anti-dilution

adjustments, provides us with the option to acquire, on a net settlement basis, approximately 19.9 million shares

of our common stock equal to the number of shares of our common stock that notionally underlie the Convertible

Notes at a strike price of $31.74, which corresponds to the conversion price of the Convertible Notes. As of

March 31, 2016, we received 7.8 million shares of our common stock under the Convertible Note Hedge.

75