Electronic Arts 2016 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2016 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

Recurring Revenue Sources. Our business model includes revenue that we deem recurring in nature, such as

revenue from our annualized titles (such as FIFA and Madden NFL) and associated services, our ongoing mobile

business and subscription programs. We have greater confidence in our ability to forecast revenue from these

areas of our business than for new offerings. As we continue to leverage the digital transformation in our industry

and incorporate new content models and modalities of play into our games, our goal is to continue to look for

opportunities to expand the recurring portion of our business.

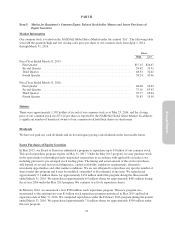

Recent Developments

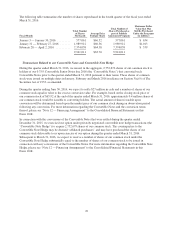

Stock Repurchase Program. In May 2015, our Board of Directors authorized a program to repurchase up to $1

billion of our common stock. This stock repurchase program expires on May 31, 2017. During the fiscal year

ended March 31, 2016, we repurchased approximately 6.9 million shares for approximately $461 million under

the May 2015 program. We continue to actively repurchase shares under this program.

On February 3, 2016, our Board of Directors authorized a new program to repurchase up to $500 million of EA’s

common stock. This program was incremental to the May 2015 program. We have completed repurchases under

the February 2016 program, repurchasing 7.8 million shares for approximately $500 million.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our Consolidated Financial Statements have been prepared in accordance with accounting principles generally

accepted in the United States (“U.S. GAAP”). The preparation of these Consolidated Financial Statements

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities,

contingent assets and liabilities, and revenue and expenses during the reporting periods. The policies discussed

below are considered by management to be critical because they are not only important to the portrayal of our

financial condition and results of operations, but also because application and interpretation of these policies

requires both management judgment and estimates of matters that are inherently uncertain and unknown. As a

result, actual results may differ materially from our estimates.

Revenue Recognition, Sales Returns and Allowances, and Bad Debt Reserves

We derive revenue principally from sales of interactive software games, and related content (e.g., micro-

transactions) and services on consoles (such as the PlayStation from Sony and the Xbox from Microsoft), PCs,

mobile phones and tablets. We evaluate revenue recognition based on the criteria set forth in FASB Accounting

Standards Codification (“ASC”) 605, Revenue Recognition and ASC 985-605, Software: Revenue Recognition.

We classify our revenue as either product revenue or service and other revenue.

Product revenue. Our product revenue includes revenue associated with the sale of software games or related

content, whether delivered via a physical disc (e.g., packaged goods) or delivered digitally (e.g., full-game

downloads, extra-content), and licensing of game software to third-parties. Product revenue also includes revenue

from mobile full-game downloads that do not require our hosting support (e.g., premium mobile games) in order

to utilize the game or related content (i.e. can be played with or without an Internet connection), and sales of

tangible products such as hardware, peripherals, or collectors’ items.

Service and other revenue. Our service revenue includes revenue recognized from time-based subscriptions

and games or related content that requires our hosting support in order to utilize the game or related content (i.e.,

can only be played with an Internet connection). This includes (1) entitlements to content that are accessed

through hosting services (e.g., micro-transactions for Internet-based, social network and free-to-download mobile

games), (2) massively multi-player online (“MMO”) games (both software game and subscription sales),

(3) subscriptions for our Battlefield Premium, EA Access, and Pogo-branded online game services, and

(4) allocated service revenue from sales of software games with an online service element (i.e., “matchmaking”

service). Our other revenue includes advertising and non-software licensing revenue.

With respect to the allocated service revenue from sales of software games with a matchmaking service

mentioned above, our allocation of proceeds between product and service revenue for presentation purposes is

27